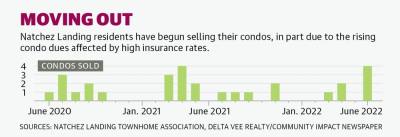

Natchez Landing, a 108-unit condo complex at 3535 NASA Parkway, Seabrook, and The Meridian, a group of 14 townhomes in Nassau Bay at 329 Lakeside Lane, each saw their buildings’ windstorm insurance rates double from 2021 to 2022, increasing by thousands of dollars.

Residents and property managers said the skyrocketing costs are unsustainable.

“When this news [of this increase] came down, I was just sick,” said Debra Doss, a Natchez Landing resident and former president of the property’s condo association.

Now, residents and managers are working with politicians to change state laws to reduce rates.

“People are struggling,” Natchez Landing resident Cortney McKenzie said. “We’re going to price people out of their homes.”

Skyrocketing costs

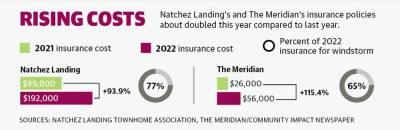

Natchez Landing’s insurance—including windstorm, which insures properties along the coast that may be affected by heavy gulf storms—cost $99,000 in 2021. This was spread out among unit owners in the form of condo dues they had to pay.

In 2022, the amount shot up 93.9% to $192,000. Windstorm accounts for $148,000 of the total, Property Manager Zar Wade-Gledhill said.

“The reality was worse than anybody expected,” he said, noting typical annual increases are about 10%.

The Meridian saw similar increases. Its insurance rose from $26,000 in 2021 to $56,000 this year, and windstorm accounts for nearly two-thirds of that, Property Manager Leon Pennel said.

“We just didn’t have a choice,” Pennel said of taking the expensive insurance, noting at least one townhouse association board member is moving out because of the increase.

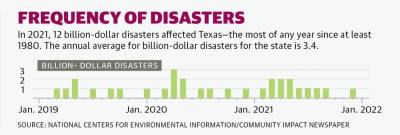

Wade-Gledhill said several factors are affecting insurance rates, including increasing construction costs to rising property values. Not only are windstorm insurance rates increasing, but it is harder to find insurers who want waterfront properties’ business, residents and managers said.

Due to its “undesirable” location, Natchez Landing was denied by over 30 insurers before the association found an insurer for 2022, Doss said. The Meridian had over 15 denials, Pennel said.

“We have to have insurance, and we can’t hardly find it,” Doss said. “It’s stressful.”

To cover the major increase, Natchez Landing first raised its condo dues by 3%, then had to increase them again mid-year another 8%. The association is pulling from savings and halting some projects, such as landscaping, to cover the remainder of the cost, but that is a temporary fix, Doss said.

“We’re more and more feeling like this is not an anomaly and this is the way things are going to stay,” Wade-Gledhill said.

Searching for solutions

McKenzie and Pennel said underinsuring is not really an option. For Natchez Landing, doing so would make lenders not want to loan money to buyers of the properties, crashing units’ selling prices, McKenzie said.

“It would be a very complicated procedure for us to not buy insurance,” she said.

Therefore, residents and managers are working on a few ways to reduce insurance costs.

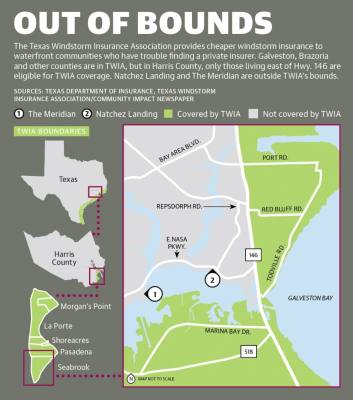

One option would be the Texas Windstorm Insurance Association. Established in the 1970s by the Texas Legislature, the TWIA exists to provide private insurance subsidized by the government to areas of the state where it is difficult to find available insurance due to proximity to the coast.

Every Texas county along the Gulf of Mexico and Galveston Bay is fully within TWIA boundaries, meaning residents are eligible for TWIA insurance. The only exception is Harris County, only a sliver of which is in TWIA bounds. This covered section includes parts of Seabrook, Pasadena and other cities east of Hwy. 146.

Despite also being in Seabrook and right against the water, Natchez Landing is not in TWIA boundaries because it is west of Hwy. 146. The Meridian, also adjacent to Clear Lake, is also outside TWIA bounds.

“By law, TWIA is an insurer of last resort, meaning that TWIA coverage is only available for property owners in a specific geographic area who have been declined coverage in the private insurance market,” Aaron Taylor, senior legislative and extern affairs specialist for TWIA, said in an email.

The Texas Legislature, which will meet in January, has the power to adjust TWIA boundaries, or residents can petition to alter them. Doss began this process before hearing from state Rep. Dennis Paul, R-Houston, who said there may be another option.

Another program is the Texas Fair Plan Association, which provides insurance for eligible policyholders when no one else will. The TFPA does not apply to condos or townhomes, so Paul is looking into changing that, Doss said.

In the meantime, these communities are stuck with high insurance rates, and their petition is on hold, though it may resurface if other avenues do not pan out, Doss said.

“For the future, we don’t know,” she said. “We’re really hoping that Rep. Paul will come up with something for us.”