The overview

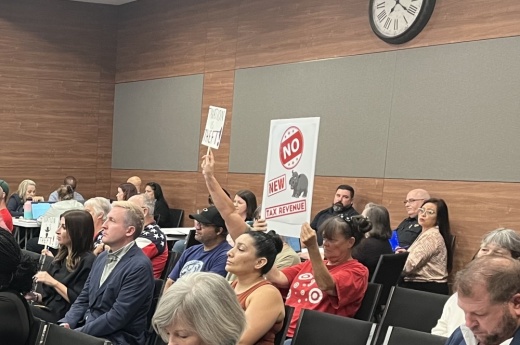

Council began its tax rate discussions in August, adopting the city’s maximum proposed rate at $0.402114 per $100 valuation—the no-new-revenue rate. At the time, council members had discussed charging property owners a street maintenance fee to help fund road improvements.

After scrapping the plan to raise funds through a street maintenance fee, council then voted to suspend Robert’s Rules of Order and repeal the previous maximum rate, raising it to $0.45 per $100 valuation. In later conversations, council members decided to increase its street maintenance budget to $1.2 million, funding it through the final tax rate, which was less than the maximum but $0.02 higher than the no-new-revenue rate.

With the new rate, owners of the average taxable value home will see an 11.6% increase in taxes, paying $1,314 in 2023.