At a Feb. 15 meeting, the KISD board of trustees unanimously approved a recommended proposal for the bond developed in late 2021 by a committee of roughly 100 community members.

Julie Stevens, a KISD parent who served on the bond steering committee, is now spearheading a political action committee in support of the bond—dubbed Vote Yes Klein.

“I have a senior; he will never benefit from this bond. But other people in years past have said ‘yes’ to bonds, and that is why he has a [career and technical education] facility ... to do robotics at,” Stevens said. “We show up for all the students at Klein ISD because it’s important for their education, and education is important to our society and our future.”

While voters have historically supported the last 10 bond referendums KISD has placed on the ballot, officials said recent changes made to the bond process by the Texas Legislature may pose new challenges for the 2022 propositions. The bond may also result in a property tax rate increase.

Proposition breakdown

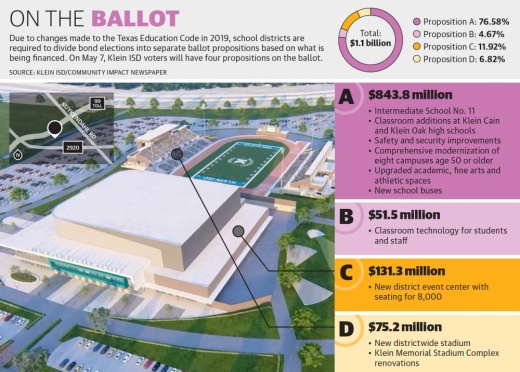

Following the conclusion of the 86th Texas Legislature in 2019, several changes were made to the Texas Education Code that affect school district bonds. Districts are now required to separate projects into general-purpose and special-purpose propositions as well as include ballot language notifying voters if property taxes will increase.

In compliance, KISD has four propositions on the ballot—one general purpose and three special purpose.

Proposition A—an $843.8 million general-purpose proposition—aims to address growth and capacity challenges with the construction of Intermediate School No. 11 and classroom additions at Klein Cain and Klein Oak high schools. Superintendent Jenny McGown noted officials are considering two district-owned sites for the campus—either near Bernhausen or Fox elementary schools.

Also included in Proposition A are safety and security improvements; the purchase of new school buses; upgraded academic, arts and athletic spaces; and the comprehensive modernization of eight aging campuses.

“One thing I’m very proud of is that the volunteer bond steering committee that put this bond proposal together really was passionate about making sure that every student in every school in every part of our district is going to benefit from all four propositions,” McGown said.

Among the special-purpose propositions, Proposition B would allocate $51.5 million for classroom technology, while Proposition C would allot $131.3 million to build a district events center. Proposition D would allot $75.2 million to build a second stadium and renovate Klein Memorial Stadium. If approved, the new district events center and stadium would be built on district-owned land adjacent to the Klein Multipurpose Center.

Fast-growth district

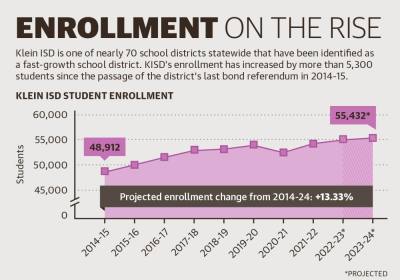

KISD is one of nearly 70 districts statewide identified as a fast-growth district—a district with enrollment growth over the last five years of at least 10%, or a net increase of 3,400 or more students, according to the Fast Growth School Coalition.

FGSC Executive Director Greg Smith said bonds are particularly important for fast-growing districts because new facilities and other capital projects can only be funded through a school district’s interest and sinking tax rate; the maintenance and operations tax rate can only be used to fund day-to-day operations, such as salaries and school supplies.

“[There] are some things you can handle within your ... maintenance and operations budget, but there are certain things you can’t handle [with that budget] if you’re a fast-growing school district,” Smith said.

Since KISD’s last bond in 2015, the district has grown by nearly 11% to more than 54,200 students in the 2021-22 school year. KISD is the 16th-largest school district in Texas.

According to Robert Robertson, KISD associate superintendent of facility and school services, through the district’s last three bond programs—which totaled $224 million in 2004, $646.9 million in 2008 and $498.1 million in 2015—KISD has built 20 new campuses, including two campus rebuilds, and four districtwide support facilities.

McGown said the district’s original long-range plan when preparing the 2015 bond was to hold another bond election in 2020.

“Of course, nobody could have imagined what the world would be like in 2020, and so, thankfully, through the collective efforts of our district and our community working in partnership, we were able to really manage the 2015 bond program so that we could extend it a bit,” McGown said. “But certainly, here we are now in 2022, and the needs that were forecasted that we would have in 2020 are here and have been here for some time.”

Dollars and cents

According to district officials, the passage of all four bond propositions could result in a tax rate increase of $0.03 per $100 of valuation. In 2021, the average KISD home was valued at $255,000, according to the Harris County Appraisal District. Based on this figure, the tax rate increase would equal about $69 more per year in property taxes for an average KISD homeowner, district officials said.

The last time KISD voters were presented with a tax rate increase in a 2018 tax ratification election, voters rejected the proposition, which would have raised the district’s property tax rate by $0.09. Spring First Church Executive Pastor David Hogan, who led the election’s opposition in 2018 through his organization It’s OK to Vote NO, Klein ISD, said he is likewise against the 2022 bond.

“We’re not opposing education; we’re opposing higher property taxes,” Hogan said. “I’m not unsympathetic to what the district says because the way the [school funding] system works in Texas is stupid. ... But their issue needs to be taken up with the state Legislature, not just put on the backs of taxpayers.”

However, officials said the projected increase would keep the KISD’s tax rate lower than it was in 2021 and $0.10 lower than in 2014.

District officials also noted KISD has historically kept the tax rate under projected increases. In 2015, KISD voters authorized a $0.099 increase, while the rate increased by $0.04. Similarly, in 2008 voters authorized a $0.26 increase, and the rate rose by $0.18. In 2004, KISD voters authorized a $0.07 increase, and the tax rate did not increase at all.

“We have been conservative in our projections on value growth, [so] if value growth does come in stronger, ... the tax rate wouldn’t have to go up as much,” Chief Financial Officer Dan Schaefer said.

Schaefer also noted low interest rates as a factor in the timing of the 2022 bond. KISD was able to save $70 million in interest through its last five refinancings, which allowed the 2015 bond to stretch beyond its original capacity.

McGown said she believes investing in school districts is vital to maintaining neighboring property values.

“I think there’s many examples of how having a quality public school system in a community helps to protect property values, and for most people, that’s their most valuable asset,” she said. “We’re really proud to be able to provide all of our students in Klein ISD an excellent education and then, connected to that, help protect property values in our district.”

For more information about KISD's 2022 bond, click here.

Maegan Kirby contributed to this report.