As previously reported by Community Impact Newspaper, a committee of about 70 parents, community members, employees, retired educators and business partners met five times over the course of two months in late 2021 to discuss the current and future needs of KISD. In January, representatives of the group—known as the KISD Bond Steering Committee—reported their findings to the board of trustees, recommending three possible bond package options totaling $1.1 billion, $994.4 million and $973.5 million.

Following the Jan. 11 presentation, the KISD trustees met in a special meeting Jan. 24 to discuss the long-range plan of the district, including a review of facilities and technology, as well as any potential financial impact to the community.

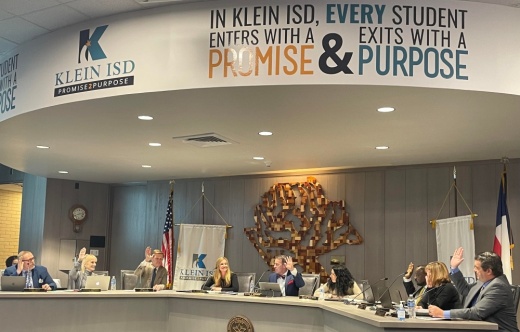

At the Feb. 15 board meeting, trustees unanimously approved an order calling for a May 7 bond election for the following four propositions:

Proposition A ($843.84 million)

- Safety and security enhancements for every school

- Address growth and capacity challenges, including construction of new Intermediate School No. 11 and classroom additions at Klein Cain and Klein Oak high schools

- Comprehensive modernization to eight aging schools (50+ years old)

- Renovate all schools

- Upgrade fine arts and athletic spaces

- Purchase new instruments, buses and career and technical education equipment

- Provide classroom technology

- New student and teacher devices

- Build district events center with indoor seating for 8,000+ for academics, fine arts, athletics, CTE programs, graduation ceremonies and large community events on existing KISD-owned property at 7500 FM 2920

- Build new districtwide stadium on existing KISD-owned land at 7500 FM 2920

- Renovate 55-year-old Klein Memorial Stadium up to current standards

"Personally—and I know our board as well—anytime we're talking about taxes, we don't take that lightly at all," Trustee Chris Todd said. "It's something that we deliberate extensively and pay very close attention to the necessity and the importance of what we're asking you."

Additionally, throughout the course of the KISD's past three bond programs, district officials noted KISD has historically been able to keep the tax rate under projected increases. In 2015, KISD voters authorized a $0.099 increase, while the rate increased by $0.04. Similarly, in 2008 KISD voters authorized a $0.26 increase and the rate, instead, rose by $0.18. In 2004, KISD voters authorized a $0.07 increase and the tax rate did not increase at all.

"Because of the district's excellent financial management, and the trust that the community can have in that financial stewardship, we have consistently come in with tax rates under what has been proposed—I think that's very significant," Board Vice President Rob Ellis said.

For more information about KISD's 2022 bond election, click here.