Rising property tax values across the state—including Richmond and Fort Bend County—over the past few years have put a strain on area property owners. The issue has prompted leaders in Texas government to explore ways to alleviate the growing burden.

Between 2005 and 2016, the Fort Bend County property tax rate has dropped from 0.4933 to 0.4580, a decrease of 7 percent, according to data from the Fort Bend County tax assessor-collector’s office. However, the average assessed property value in the county has jumped more than 35 percent since 2012 and more than 20 percent in the last two years alone.

Between 2005 and 2016, the Fort Bend County property tax rate has dropped from 0.4933 to 0.4580, a decrease of 7 percent, according to data from the Fort Bend County tax assessor-collector’s office. However, the average assessed property value in the county has jumped more than 35 percent since 2012 and more than 20 percent in the last two years alone.

In contrast, from 2012 to 2015, the median household income in the county increased only 10.5 percent in Fort Bend County, according to the U.S. Census Bureau.

“If the citizens want better infrastructure, police protection and parks and recreation areas, they have to pay for it. Fort Bend County has been growing by leaps and bounds for well over 10 years. It is very hard to stay up with all the demands this increasing population requires,” said Patsy Schultz, Fort Bend County tax assessor-collector, in an emailed statement.

“This is not an anti-government crusade; it’s a crusade for reality.”

—Texas Sen. Paul Bettencourt, R-Houston

Schultz said the county had 241,157 properties on the tax roll in 2005 and 328,787 properties in 2015, an increase of more than 36 percent. As the number of properties grows and the assessed property values in the county rise, tax bills continue to rise despite the 7 percent decrease in the county’s tax rate.

Houston-area lawmakers say the rate of increase is unsustainable. At an Oct. 26 presentation to the Texas Senate Finance Committee, legislators presented the findings of a Senate Select Committee for Property Tax Reform and Relief. The committee found Texas has one of the highest tax burdens in the U.S., and city and county tax levies in the state have risen more than 70 and 80 percent, respectively, compared to a 29 percent increase in household income since 2005.

“This is not an anti-government crusade; it’s a crusade for reality,” said state Sen. Paul Bettencourt, R-Houston. “My taxpayers’ realistic ability to pay has to come into the equation.”

Bettencourt chairs the Property Tax Committee that presented the findings. Established by Lt. Gov. Dan Patrick, the committee has been tasked with finding ways to alleviate the property tax burden in the 2017 legislative session.

Bettencourt chairs the Property Tax Committee that presented the findings. Established by Lt. Gov. Dan Patrick, the committee has been tasked with finding ways to alleviate the property tax burden in the 2017 legislative session.

At a town hall meeting hosted by Bettencourt’s committee at the University of Houston in May, Harris County Tax Assessor-Collector Mike Sullivan acknowledged the challenges county taxpayers face.

“Whatever the economic drivers are that drive those values up, the fact is that a lot of people are faced with appraisals they just can’t afford,” he said.

Appraisers with the Fort Bend County Central Appraisal District determine the assessed value of a property using a formula that takes multiple factors into account. They include home sale prices, median prices and sales volume, appraisal officials said.

“We are required by law to appraise property at its market value,” said Glen Whitehead, FBCAD chief assessor.

Whitehead said the state comptroller does a ratio study every other year to evaluate the county’s appraisals and make sure the county’s assessments match the state’s property value estimates.

“One [approach used in assessing property values] is the cost approach, and the other is the market approach,” Whitehead said. “We collect information from various sources—people bring us closing statements, we send out closing confirmations and we have sources where we get sales information.”

Whitehead said the county’s assessments must be within 95 to 105 percent of the state’s calculation of value. In 2014, Fort Bend County underestimated market values and had to be studied twice.

“We failed with Katy, Lamar, Needville and Fort Bend ISDs in 2014,” Whitehead said. “The following year we had to do corrections to our values. We failed to do time adjustment, which ended up understating our values. Not by much, but we were off by a couple of percentage points because the market was rising quicker than we anticipated. We have since fixed that.”

The existing system often yields an assessed value that does not correlate with what is actually happening in the market, said Mike Olivares, chief operating officer of O’Connor and Associates, a Houston-based property tax consulting firm.

“When the county goes in and assesses the entire market, you have to ascribe values to property that hasn’t sold,” he said. “These past few years were the perfect example of the increases in value seeming to surpass what the market was actually doing.”

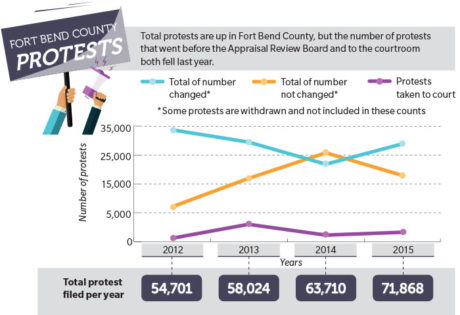

Addressing the problem involves educating people on protesting their appraisal values, Olivares said.

“In the state of Texas, we actually have some of the more favorable laws in place enabling property owners to protest,” he said. “Either they’re not aware or they’re intimidated by the process.”

Calculating the problem

Fort Bend County’s tax rate has decreased slightly over the past decade, as has the tax rate in the city of Richmond. However, the market value of property in the county and the city have greatly increased, according to FBCAD data and city records, resulting in more property tax revenue for the county and the city.

Fort Bend County’s tax rate has decreased slightly over the past decade, as has the tax rate in the city of Richmond. However, the market value of property in the county and the city have greatly increased, according to FBCAD data and city records, resulting in more property tax revenue for the county and the city.

Governing bodies outside the county—such as the city of Richmond, school districts and municipal utility districts—also set tax rates that homeowners pay in addition to county tax. These entities use the county’s assessments as the basis for their tax rates.

“The assessor calculates two rates for governing bodies—they calculate what’s called the effective rate and the rollback rate,” Whitehead said.

The assessor calculates those two rates and turns them over to the governing body, and that body chooses to adopt the effective rate, they can adopt a flat 3 percent tax rate, or they can adopt up to an 8 percent increase under the rollback rate.

To Bettencourt and other reform advocates, the problem can be summarized by how much faster assessed values have risen compared to median household income.

“What we’re seeing is a constant pattern of property taxes increasing 2 1/2 to three times faster than Texans’ paychecks,” Bettencourt said. “For homes below the statewide median average, those budgets are very stretched to begin with. That’s health care money, education money.”

Olivares said two demographics tend to feel the squeeze of increased property taxes more than others: individuals in lower-income brackets and seniors living on fixed incomes.

“The citizens of Fort Bend County are just like all Americans. We all have a budget and have to work to stay within that budget,” Schultz said.

Legislative priorities

The Texas Legislature passed several bills aimed at property tax reform in the 2015 legislative session. Senate Joint Resolution 1, passed by voters in November 2015, increased the homestead exemption for school districts from $15,000 to $25,000, saving residents an average of $115 on their tax bills every year.

The Texas Legislature passed several bills aimed at property tax reform in the 2015 legislative session. Senate Joint Resolution 1, passed by voters in November 2015, increased the homestead exemption for school districts from $15,000 to $25,000, saving residents an average of $115 on their tax bills every year.

Bettencourt also attempted to pass a bill that would have cut the rollback rate from 8 percent to 4 percent, meaning any tax rate increase that results in at least 4 percent total revenue growth would have to be approved by local taxpayers in an election. That bill did not pass, but the property tax discussion is expected to resurface in the 2017 legislative session.

One method of reform that will be up for discussion revolves around implementing a measure that causes tax rates to go down automatically as assessed values rise, Bettencourt said.

Improving transparency within appraisal districts and appraisal review boards has also been proposed, according to the Senate Committee on Property Tax Reform.

“Most of the telephone calls we get from taxpayers are concerning what exemptions they are entitled to and how they are calculated,” Schultz said. “I would encourage all citizens to be proactive, get involved, attend the public hearings on tax rate adoption and voice their opinions.”