“All housing demand is driven by job growth and population growth,” said Matt Enzler, senior managing director for Trammell Crow Residential. “The Dallas [area] has enjoyed a pretty strong job growth market for the last decade. But that’s reversed.”

Around 13,000 residents from the Frisco area filed for unemployment in the three months since the coronavirus pandemic began, according to data from the Texas Workforce Commission. With those job losses, Enzler said demand has slowed for apartments like the ones his company plans to build in Frisco.

“There’s still plenty of demand, but it’s definitely less than it was last summer,” Enzler said.

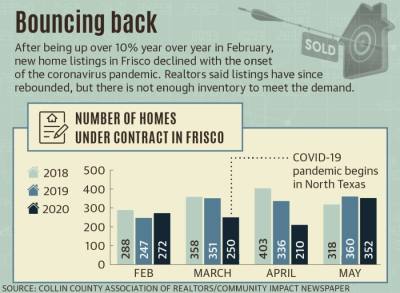

Frisco’s real estate market also saw a decrease in the numbers of new listings and available homes at the onset of the coronavirus pandemic but saw an uptick in median sales price.

David Long, president of the Collin County Association of Realtors, said listings have bounced back, but low housing inventory has been a continuing trend in Frisco.

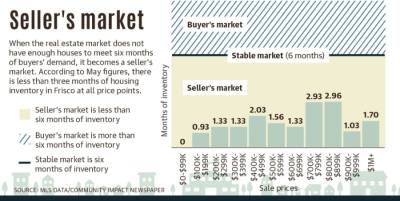

Seller’s market

When coronavirus arrived in mid-March, the housing market took a hit, much like most other local industries. Year over year, new home listings were down by nearly 29% in March and by more than 35% in April.

Long said new listings were down by a little more than 2% in May 2020 as compared to May 2019.

“As we continue into the summer, hopefully, business will continue to pick up,” Long said. “We’re going to have this inventory shortage, I think, for years here because this is such a popular area.”

Frisco Realtor Meredith Held, with RE/MAX DFW Associates, explained that there are currently just three months of inventory available, which makes the city a seller’s market.

“I think we’re back to square one on a lot of it [because of the uptick in cases in June],” Held said. “People are just a little reluctant to get out there right now.”

Realtor Adam Lile, from residential real estate firm The Cheney Group, said he has seen clients rethinking how the space in their homes is used after spending so much time there.

“We’re seeing [a] huge demand for that outdoor living space,” Lile said. “We’re definitely having our buyers put more emphasis on that.”

Apartment supply surging

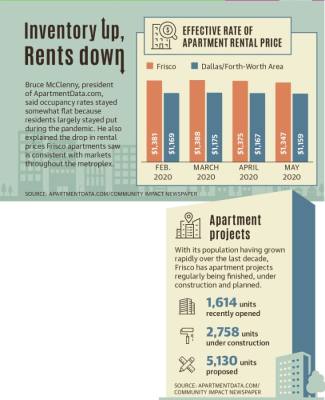

The occupancy rate for apartment complexes in the Frisco area dropped to under 85% amid the onset of the pandemic in March. That rate has rebounded in the ensuing months, but it is still less than the nearly flat 91% occupancy rate the greater Dallas-Fort Worth metroplex experienced.

“There’s always a lot of new communities coming on into the Frisco area,” said Bruce McClenny, president of ApartmentData.com, which collects monthly data on leasing activity. “The new communities coming on kind of keep that occupancy rate overall down a little bit, but it doesn’t slow the rental rate down.”

An apartment construction summary done by ApartmentData.com shows more than 1,600 apartment units recently opened in the city.

Projects both under construction and proposed are expected to add nearly another 8,000 units in the coming years, the summary showed. In addition to those, Trammell Crow is planning 2,300 apartments as part of a $1 billion development on a tract of Brinkmann Ranch.

Enzler said that project will begin next year and will be built in several phases over the next decade.

“There’s times when 1,000 units might get delivered, and there’s empty apartments for a while,” he said. “But we do not think there’s an overabundance of supply in the long term.”

Enzler said that large supply of apartments is needed throughout the region because of the area’s “unprecedented job growth and population growth.”

“Our perception is that while we are dealing with a lot of job losses [during the pandemic], the overall fundamentals of the economy in North Texas are really strong,” he said. “You’re going to continue to have companies move here and companies expand here.”

What the future holds

With COVID-19 making people work at home, Enzler said that could change the way apartments are built.

“From a size perspective, these units will likely be bigger,” he said.

Future developments could also have less shared space for tenants, he said, and more direct access to units.

“What changes in the demand [for apartments] will drive our design changes,” Enzler said. “Some people won’t care, and they’ll still rent a 600-square-foot, one-bedroom apartment.”

For single-family home buyers, Lile said sellers have not returned to the market as anticipated, so it is common for desirable houses to get multiple offers above asking price.

“We’re doing everything we can to go and try to find listings right now because there just aren’t enough homes on the market to meet the demand that we have,” he said.

Long said he believes Texas’ market will rebound from the slowdown, much like what happened after the 2008 downturn.

“We did much better than many other parts of the country,” he said. “We came out of it much stronger, so I expect we’ll see something similar.”