The city of Round Rock has allocated significant funds for road construction and water projects among other capital improvements.

“People expect value for their tax dollars, and that is what we are about: high-value services,” Round Rock City Manager Laurie Hadley said. “It is also important to note that our funding mechanisms are quite complex, and we work hard to not only keep property taxes low but also to provide great water, wastewater and garbage rates in a world that has significant upward pressure on costs.”

As taxing entities in Round Rock work to keep up with growing populations, their budgets and tax rates reflect their priorities and the challenges they face.

“Having a long-range focus and many checks and balances in how we fund our regular operations has allowed us to continually hit high marks for services while having some of the best rates in the area,” Hadley said.

City of Round Rock's budget

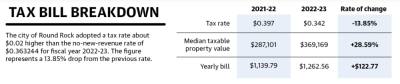

For fiscal year 2022-23, the city of Round Rock adopted a tax rate about $0.02 higher than the no-new-revenue rate of $0.363244. This represents a 13.85% drop from the previous rate. Based on median home values, which rose over 28% from last year, the median tax bill will increase by $122.77 per year.

Money out

The city's biggest expense for FY 2022-23 is its community investment program, or CIP. The program encompasses a number of transportation and utility projects included in the city’s five-year plan. The CIP is used for long-term capital projects, such as land purchases, improvements to buildings, road construction and water and wastewater projects. Year over year, the city saw its expenses increase by 5.73% from $525.4 million in FY 2021-22 to $555.5 million in FY 2022-23.

“I truly believe that our employees are what make our services special, and our biennial survey shows that our citizens agree. When you call on the city of Round Rock to handle a waterline break or a heart attack, you can be sure we are sending folks that are well-trained and care about handling issues quickly and professionally," Round Rock City Manager Laurie Hadley said.

Money in

The city of Round Rock has a diverse revenue pool that includes property taxes, which account for 13.48%. Although total revenues are lower than expenditures, the city funds a significant portion of its infrastructure needs from excess sales tax and other taxes and revenues that have accumulated from prior years.

Biggest increase in revenue: The city saw increases in revenue largely came from sales tax receipts and property taxes with $4.8 million in additional property tax revenue, or a 6.8% increase, including $1.45 million from new property. Year over year, the city revenues increased by 0.41% from $412.66 million to $414.36 million.

To read about Round Rock ISD's budget, click here.