In Round Rock ISD, the district is paying for a higher cost of instruction while having to contend with its rising state recapture payment.

“The biggest challenge was trying to balance our needs to the expected revenue with a tax rate that could help with the rising cost of living [and] inflation in the area. Trying to balance all three of those is what made the budget so complex,” RRISD Chief Financial Officer Dennis Covington said.

As taxing entities in Round Rock work to keep up with growing populations, their budgets and tax rates reflect their priorities and the challenges they face.

“Our No. 1 objective was to take care of our staff. If you look at the budget, we increased the budget by over $18 million for compensation to ease some of the burden that is being put on our staff and families in this area due to the rising cost to live here," Covington said.

Money out

Round Rock ISD is expecting to pay nearly five times more to the state through recapture. In fiscal year 2021-22, the district paid $14.5 million and anticipates paying around $72.5 million for FY 2022-23.

Trustees also approved a 5% pay increase for district teachers and librarians, and a 4% increase for administrative and operational support roles. Other positions saw a 3% pay increase for FY 2022-23. Key takeaway

Salaries accounted for 55.58% of the district’s general fund, which is used for daily expenses, in FY 2021-22 but only 50.2% in FY 2022-23.

Year over year, expenditures increased by 11.47% from $467 million to $521 million.

Expenditures by function Money in

The district is expecting to see an increase of $66.27 million in property tax revenue for fiscal year 2022-23. While the budget itself is balanced, the district decided to absorb increased health care costs without passing them on to employees, creating a $3 million deficit from revenues to expenditures.

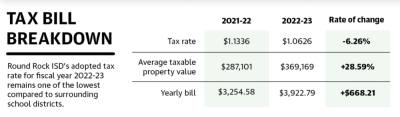

Property taxes are the biggest revenue generator, and home values in the district continue to increase due to growth in population and a competitive housing market, according to district officials.

Property tax revenue grew over 17% from $388.6 million in FY 2021-22 to $454.87 million in FY 2022-23.

Year over year, the district's revenues grew by 16.54% from $444.5 million to $518 million.

Revenue by source To see the city of Round Rock's budget, click here.