Alvin Lankford, chief appraiser for the Williamson Central Appraisal District, said these increases—which could be higher than 40% in some neighborhoods—are directly tied to the housing market. Appraisals from both WCAD and the Travis Central Appraisal District will be mailed to all residents in mid-April and aim to show a home’s value as of Jan. 1.

“What people don’t realize is that we are a mere reflection of the market sales transactions that happen,” Lankford said. “Our job is to appraise at the market level that we are seeing.”

Real estate professionals said these property value increases are not surprising given current real estate conditions—low inventory coupled with a high demand for houses have continued to drive prices up.

“The concern we have as Realtors is if we continue to have a low number of new active listings, but also increasing demand, then we are going to see steep increases again in valuations,” said Realtor Drew Griffin, who works primarily in Northwest Austin and surrounding communities.

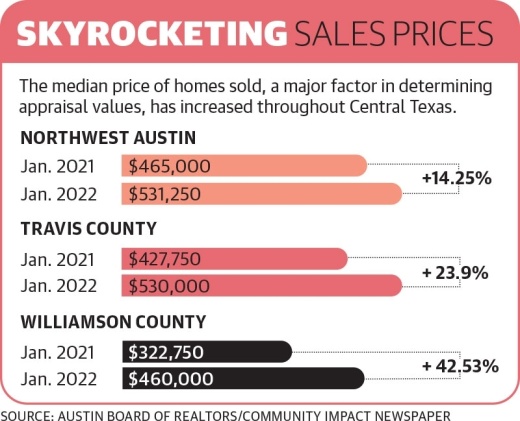

In January, the median price of a home sold in Northwest Austin was $531,250, up 14.25% from the median sales price in January 2021, according to data from the Austin Board of Realtors.

Meanwhile, Travis County as a whole saw median home prices rise 23.9% to $530,000 in January. Neighboring Williamson County saw even larger increases, with median sales prices increasing 42.53% to $460,000.

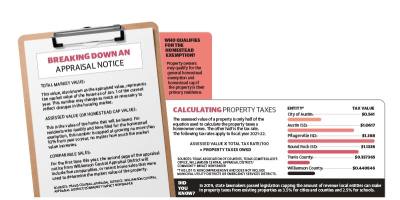

These steep increases in home sales prices and, subsequently, property values could affect homeowners’ property taxes for the coming year. However, experts said the increase in what a person owes in property taxes is unlikely to be proportional to the increase in home value due to the homestead exemption and caps on how much revenue a taxing entity can make from property taxes in a year.

Residential ramifications

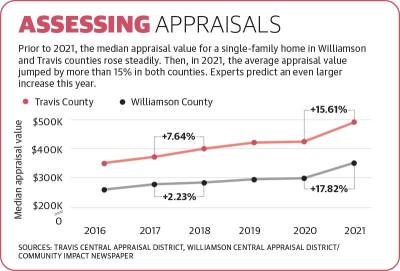

Last year, property valuations increased more than 15% in both Travis and Williamson counties, according to data from the appraisal districts.

Prior to that, both Travis and Williamson County residents saw appraisals increase on average between 1%-8% each of the last five years.

Despite the expected increases in property tax appraisals, the homestead exemption caps the amount a property’s taxable value can increase in a year at 10%. To qualify for the homestead exemption, the property must be a person’s primary place of residency, according to the Texas comptroller.

Additionally, property values are only one factor in the tax formula. The other is property tax rates, which are set by taxing entities, including school districts, cities and counties, during their annual budgeting process.

A 2019 Texas law capped the revenue counties and cities can make from property tax increases to 3.5% on existing properties without needing voter approval, according to the Texas Association of Counties. A 2.5% cap was also implemented for school districts.

Therefore, Lankford said if the taxable value of homes in a jurisdiction increases by 10%, the property tax rate will have to decrease so that total revenue does not exceed these limits.

“Even though property owners will see their market values go up substantially, there are numerous protections in place so that they will not feel that complete impact in their taxes,” TCAD Chief Appraiser Marya Crigler said.

Despite these caps, Griffin said 10% increases in the taxable value of a property adds up over time.

“If you do a tax increase of 10% every year for five years ... the taxes that [someone is] going to pay this year are going to be significantly higher than maybe five or especially 10 years ago,” Griffin said. “It could potentially impact affordability in the near future for a lot of people.”

As home values go up, Crigler said the number of protests filed with TCAD has historically increased. However, she encouraged residents to understand the appraisal district only sets the market value for the home, not the amount of property taxes a resident owes.

ABoR President Cord Shiflet said tax rates and potential property tax bill payments are something buyers are taking into account when deciding where and whether they are able to purchase a home.

“Added expenses of property taxes can price someone out of an area,” Shiflet said in an email. “It is important to work with a Realtor that can help you understand that your housing payment isn’t just principle and interest; it’s those things plus insurance, taxes, potentially mortgage insurance, any [homeowners’ association] fees and more.”

Rapid real estate growth

Crigler said the rising home prices are a simple side effect of supply and demand.

The Northwest Austin area has seen an influx of technology jobs, with Apple planning to move a first phase of employees into its new $1 billion campus in 2022 and continued growth near The Domain.

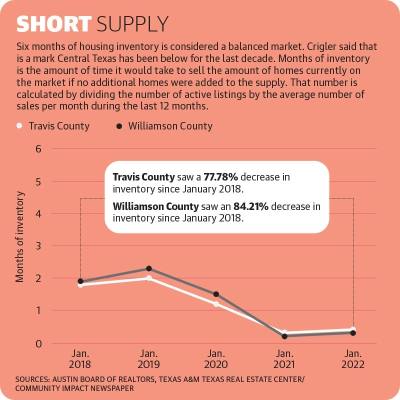

Additionally, housing inventory levels have also been at record lows. In January, Travis County had 0.4 months of housing inventory and Williamson County had 0.3 months, according to ABoR data.

Months of housing inventory is determined by dividing the number of active listings in an area by by the average number of sales per month during the prior 12 months. According to the Texas A&M Real Estate Research Center, six months of inventory is considered a balanced housing market, in which supply and demand are stable.

“We are at a point now where we are not measuring [housing supply] in terms of months; we’re not measuring it in terms of weeks; we’re measuring it in terms of days,” Crigler said. “So there’s a real supply shortage but still high demand.”

As prices in Austin reach record highs, Kiersty Lombar, a Realtor with Keller Williams Realty in Williamson County, said more people are being driven out of the city’s center into the outskirts and surrounding suburbs.

“The location is terrific being that Austin is right next to Williamson County and it has been such an epicenter of growth over the last decade,” Lombar said.

Similarly, Todd LaRue, a managing director for RCLCO Real Estate Consulting, said developers are pursuing more housing projects in Williamson County, despite rising costs on their end.

“Williamson County is a pro-business, pro-growth county,” LaRue said. “There is quite a bit of high-quality community development in the pipeline.”

To help homeowners understand why property valuations are increasing dramatically year over year, WCAD is providing comparables—other homes in the area that have recently sold—alongside the appraisal notice. Lankford said WCAD is the first appraisal district in Texas to do this.

Crigler said TCAD does not offer this because the data it uses is confidential.

With each home that sells above asking price, Griffin said another comp is created that drives home values up. Barring any major economic downturns, Griffin said he expects the median price point for homes to increase for at least the next three to five years.

“This is not just a crazy snapshot of the market, but it will be better soon,” Griffin said. “No, this is going to change the real estate dynamic in Austin and the surrounding areas for a decade or more. It will change it forever, and this is only the beginning.”