Eric Bramlett has been a real estate agent in Central Texas for 18 years, and said since the end of the 2008 economic recession, the local housing market has been consistently strong, following consistent seasonal patterns and holding relatively steady in total sales and price.

But something happened around the middle of 2020 that led the market to take off, according to realtors and economists.

Due to the increase in telework brought on by the COVID-19 pandemic, they said, many newly remote workers moved in from other, more expensive, cities, no longer tied to their commutes. Locally, employees using their homes as office space thought differently about their needs. While unemployment levels reached the double-digits nationwide, those who did keep their jobs built up disposable income.

"We were the hottest market, and we essentially dumped gasoline on it," Bramlett said.

Before July 2020, the monthly median home sales price in the Austin-Round Rock metropolitan area had never reached $350,000. It surpassed $400,000 in March 2021, then reached $465,000 in May, according to data available from the Austin Board of Realtors. That is a 27.4% increase from January.

Those incredibly rapid price increases are creating an affordability challenge, said James Gaines, a research economist with Texas A&M University's Texas Real Estate Center.

"You don't have to have a Ph.D in economics to understand that if prices go up faster than incomes, and home affordability is based on the relationship between income and price, then [home ownership] becoming less affordable," Gaines said.

That breakneck pace of price increases cannot last forever, said Susan Horton, president of ABoR. Eventually, she said she expects the price to return to some level of normalcy, although that could take years as supply catches up with demand.

"The builders can't build [homes] fast enough to get us where we need to be to accommodate the growth into the metropolitan area," Horton said.

A seller’s market

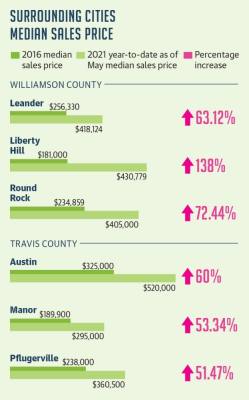

As housing prices rise in Travis County, buyers have turned to outside of Austin for homes, raising prices in Williamson County.

In January 2020, the median sales price in Williamson County was just under $280,000, according to ABoR’S market report. As of May 2021, the median sales price reached $435,000.

The report also shows houses spending less time on the market, going from selling in an average of 63 days in January 2020 to 10 days as of May 2021.

Renee Fox, broker and owner of Fox Realty, said in the approximately nine years she’s lived in Central Texas, residential real estate has been a market that benefits sellers over buyers.

However, she said she has not seen a seller’s market come close to the current trend.

During the beginning of the COVID-19 pandemic, Fox said typical real estate trends including moving and downsizing were put on pause.

Usually new homes are a popular option for homebuyers trying to avoid competition. Now there are waitlists for new builds along with supply shortages causing extended construction timelines.

Fox said she and her team look for houses an hour and a half in any direction from the center of Austin. Where before homebuyers with a budget of around $250,000 could afford to live in their ideal home in Williamson County, now Fox said she has had to show those same buyers homes outside the area, including Burnet County, or even much further south, near San Antonio.

Alternatives to single family

Adrianne Craft, a real estate broker who is licensed with Keller Williams Realty, agreed buyers are having a truly difficult time finding homes.

“A year ago, I would say that buyers could be a little bit pickier as far as the condition of a home goes,” Craft said. “A buyer may choose a house over another house because it doesn’t have carpet, or it has white cabinets. ... Whereas now, buyers are having to just concede on everything.”

Craft added that every deal she has brokered this year has seen multiple offers for which homes are typically selling for 10%-20% over asking price. This is a situation that frequently disfavors first-time buyers, especially those seeking single-family homes, which account for the vast majority of homes on the market at any given time, she said.

One solution officials in cities throughout the greater Austin metro area have been examining over the last several years involves diversification of home types.

Dan Parolek, CEO of Opticos Design, a California firm that helps collaborate on housing and community issues, has given many presentations to city officials throughout Central Texas, from New Braunfels to Austin.

Parolek’s presentations center on a concept called missing middle housing.This involves homes such as duplexes and townhouses to buildings with eight units.They are usually walkable, meaning they are located near business or city centers that have popular amenities.

These options, Parolek said, offer more affordability for people including first-time buyers who cannot make cash offers in order to become homeowners.

“Every market, regardless of how big the city, has been impacted pretty dramatically by the increase in costs,” Parolek said. “It’s become harder for ... sort of entry-level households to purchase homes.”

While Parolek agrees that single-family homes are the most abundant option for homebuyers, he said his research has shown that they are not necessarily the most popular option. He added that 60% of all housing will need to be missing middle housing by 2040 in order to keep up with demand.

“I think there will continue to be a demand for single-family detached [homes], but I think more and more, there is a growing demand that is not being met for these missing middle housing types,” he said. “I’m not saying there is not a demand for single-family, but historically that is all we’ve been delivering, and the industry is having a hard time sort of adjusting and shifting quickly enough to meet the demand.”

Smaller cities see big growth

When Robin Sheppard sold her Austin home of 35 years in December, she did not anticipate that she would still be searching for a house more than six months later.

Increasing tax rates, heavy traffic and rapid growth within Austin played a key role in Sheppard’s decision to leave the capital and move to San Marcos. She would still be close enough to visit friends but in a less crowded city, she said.

“I had lived in Houston for many years and I left there to come to Austin because Austin was a lot smaller and had a wonderful feel to it,” Sheppard said. “This is not the Austin I came to.”

Within two and a half days of listing her home, Sheppard received seven bids and accepted an offer that was $50,000 over asking and included a contingency that allowed her to live in her home rent-free for thirty days after closing.

“I just thought, ‘Wow this is great, now I can go and buy myself a house and have extra left over to travel,’ ... but that wasn't the way it was,” Sheppard said.

By June, Sheppard had placed bids on more than six properties that met her requirement for an accessory dwelling unit she plans to rent for a low cost to an elderly friend. Despite offering $42,000 over asking on one property, she has been outbid every time.

Many who plan to move farther from the city core to one of the smaller cities along the I-35 corridor expect to find more availability at a lower price point than in larger metro areas, said Patricia Fernandez, 2021 board president for Four Rivers Association of Realtors, which covers the suburban corridor between San Antonio and Austin.

“You can pick any town in this corridor and it’s the same story,” Fernandez said. “That whole middle market [is] just now getting wiped out of the playing field.”

She added that buyers who qualified at one point for a house worth $350,000, for example, may have to place bids for homes listed in the high $200,000 range with the expectation of paying significantly more.

The same goes for buyers trying to find a home north of Austin.

She said houses were going for $300,000-$400,000 and, with her budget of $260,000, she knew she could not afford the area where she was looking. Even finding a house in Burnet County was difficult, as properties were selling well above asking price, she said.

Besides location, Rodriguez said she had to compromise on her commute—living in Burnet County, she will be 30 minutes away from her job and her family. However, she said the distance is better than having to wait a year, save money and hope the market will change.

For first-time homebuyers last year, $250,000-$300,000 was a normal budget within Williamson County, Fox said. Now those same homes in that range are selling for $375,000-$400,000.

Comparing it to the housing market in California, Fox said she predicts real estate in Central Texas will eventually level off, but added she is doubtful prices will decrease.

“I expect it to be this way for the rest of the year, and I think it’s going to be dependent on the builders being able to open up lots and start selling homes regularly again instead of having huge waitlists,” she said. “Once they are able to sell a whole lot of homes, then that opens up more inventory.”