At a May 13 City Council workshop, City Manger David Morgan said Georgetown could be facing an $80 million negative balance in the general fund by fiscal year 2027-28 if no action is taken.

“This is not what we will propose, this is not what will happen,” Morgan said during his presentation. “This is ... us making sure that we're doing our due diligence to manage our budget.”

What they’re saying

To address possible budget gaps, staff will explore short and long-term strategies including implementing new fees, calling an election for a higher tax rate, reducing city staff benefits and more.

“I think we need to look at some creative strategies in order to make sure that we're able to find the largest priorities and where the largest pressure points are,” Morgan said.

The budget model Morgan discussed at the workshop is not a proposal and has not gone through a full budget review process.

The big picture

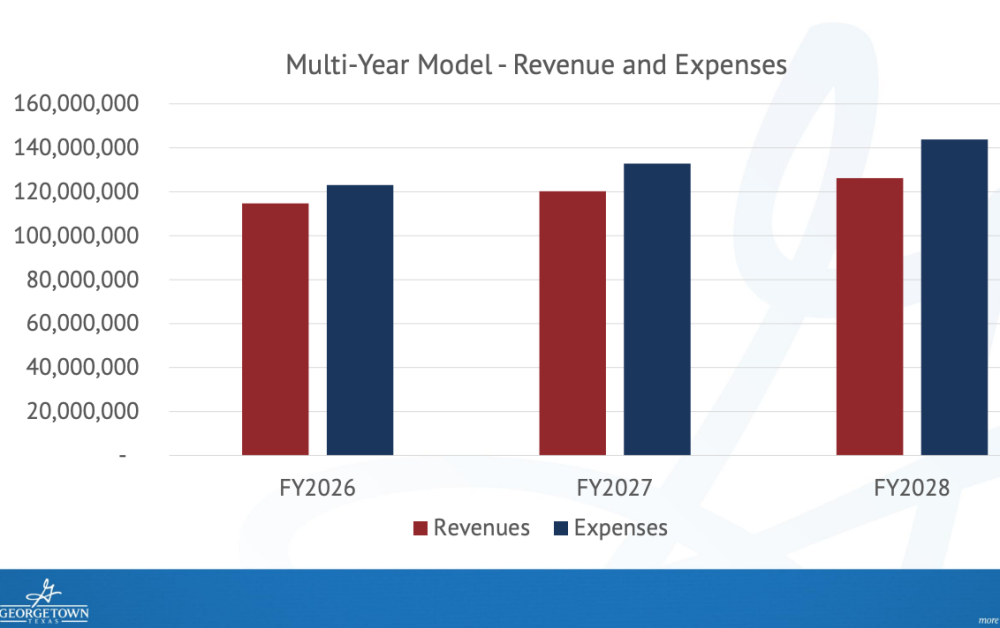

In FY 2022-23, the city of Georgetown's general fund had $1.56 million more in expenses than revenue.Heading into the FY 2025-26 budget season, Morgan said staff is facing slowing revenue growth and inflation. FY 2025-26 budget projections show expenses could be over $120 million, while revenue is just under $120 million.

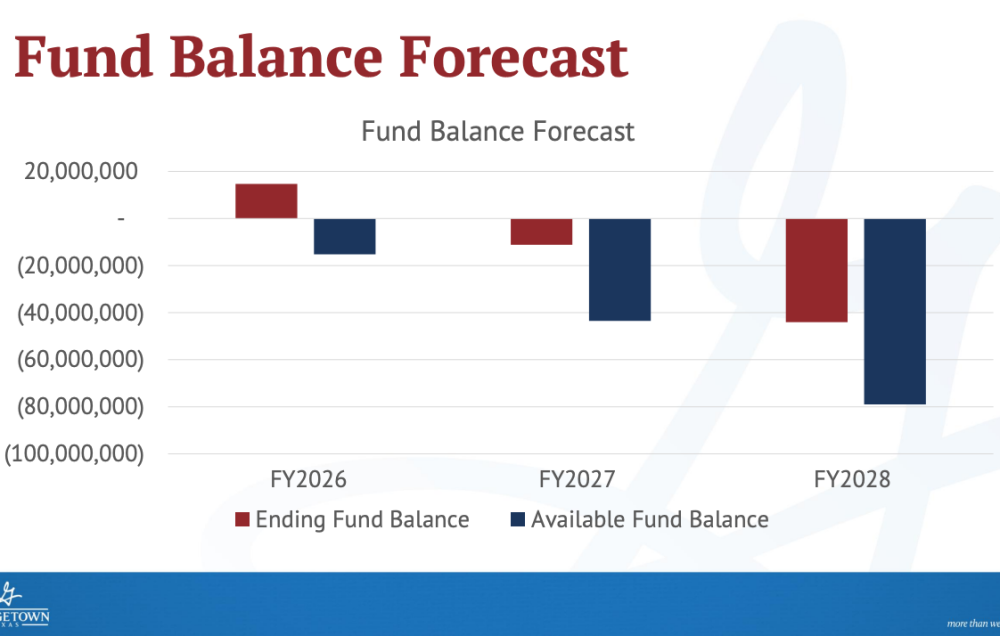

Morgan said the city currently has significant reserves in its general fund for emergencies and higher bond ratings. However, forecasts show the city “seriously” dipping into reserves in FY 2025-26, with reserves depleted by FY 2026-27, he said.

According to the fund balance forecast, the city is expected to reach nearly $20 million in net negative revenue to expenses in the FY 2025-26 general fund. Morgan said that number could grow over time, with a $40 million and $80 million negative general fund balance possible by FY 2026-27 and FY 2027-28, respectively.

The approach

Revenue generating ideas Morgan said staff are considering include:

- Increasing nonresident fees or out-of-city rates

- Evaluating the cost recovery of existing fees

- Evaluating new fees, including library fees or credit card utility billing fees

- Considering a tax rate election in future years

- Placing an ATM in city facilities such as the future downtown parking garage

- Selling advertisements and Georgetown merchandise

- Adjusting facility maintenance and lengthening the replacement cycle of equipment

- Reducing travel and training programs for city staff

- Reducing expenses at citywide events

- Reducing employee recognition and celebration activities

- Delaying capital improvement projects to avoid cost increases

- Moving to a four-day schedule for city operations to reduce building usage costs

- Reducing mowing right of way and parks

- Reducing recreation programming or hours of operation at the rec center, pools or library

- Reducing the internal cleaning of city buildings

- Reducing city staff benefits such as insurance participation

- Outsourcing operations and/or increasing contracting costs

How we got here

The three-year budget model helps city staff anticipate funding levels, plan for future needs and identify potential budget shortfalls, according to the presentation.

City staff has identified the largest expense drivers in the general fund over the next three years to go toward public safety, park improvements, and road and signal maintenance.

At a Jan. 23 Georgetown Chamber of Commerce event, Mayor Josh Schroeder said public safety is an "expensive luxury” the city is committed to funding, emphasizing how the city’s No. 1 budget item every year is either police or fire.

Keep in mind

Morgan said the finance department will submit a balanced budget later this year. A FY 2025-26 budget preview meeting is planned for July 8.

The city of Georgetown’s FY 2024-25 budget was $879.15 million, Community Impact previously reported.