However, he did not expect the global supply chain climate to be so bad it made two of his biggest competitors go to him for help, he said.

Bouffard, whose tree lot at 1015 W. University Ave., Georgetown, is in its inaugural year, also owns Round Rock Honey and Good Pickle Juice. Due to the struggling global supply chain, the cost of a bundle of Christmas trees has risen to about three times as much as a typical year, Bouffard said.

“One of [my competitors] even came to our lot yesterday and asked how much for everything,” Bouffard said. “I’ve talked to three people today who want to buy all our trees because they under ordered and now they are selling out.”

Bouffard is only one example of how consumers and business owners across the country are struggling to find what they need.

In local communities, recent supply chain bottlenecks driven by inflation and labor shortages are putting business owners, suppliers and consumers in increasingly difficult positions during the busiest shopping season of the year.Experts say at its core, the issue is a simple mismatch between supply and demand that has been greatly exacerbated by the COVID-19 pandemic.

Sam Tenenbaum, director of analytics and Central Texas economist for commercial real estate information company CoStar Group, said when pandemic restrictions were first put in place last year, both the demand for and the supply of most goods decreased dramatically.

However, as restrictions continue to lift and federal stimulus measures amplify demand for goods faster than expected, suppliers are having trouble keeping up, according to Tenenbaum.

“We all kind of expected the economy to weaken considerably [because of COVID-19 and] consumer spending to go down ... but that didn’t really happen,” Tenenbaum said. “A lot of the big factory operations can’t stop on a dime and then turn around and restart operations at full capacity in a few weeks. That’s not really how everything works.”

Dealing with inflationAnother issue businesses have been affected by is inflation, which, according to Bouffard, has forced a lot of potential customers to skip Christmas tree shopping this year.

“There are different types of buyers and a lot more buyers are on pretty strict budgets,” Bouffard said. “A lot of people are on the edge and are just trying to get by. They want a Christmas tree but they are just coming by to see and smell the trees.”

Paired with inflation are spikes in material costs, Tenenbaum said.

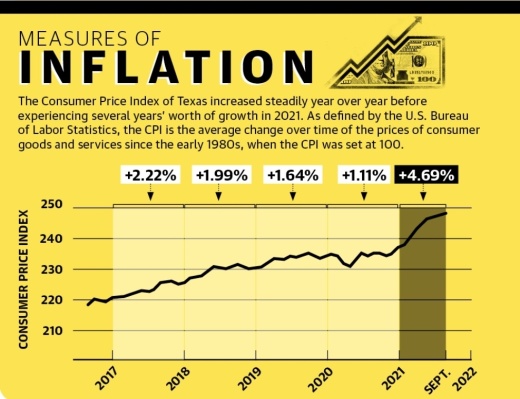

Data from the U.S. Bureau of Labor Statistics show from April 2020 to September 2021, the consumer price index, which measures the price of consumer goods, increased in Texas from 231.8 to 248, or about 6.99%. The increase is more than double the state’s average year-over-year jump in the five years prior.

Put into a real-world circumstance, archives from the U.S. Department of Agriculture show the average retail price for a gallon of conventional whole milk in Dallas in April 2020 was $2.79. By October 2021, the average price was $3.29.

Prior to the pandemic, from April 2018 to October 2019, the average price of milk dropped from $2.79 to $2.32.

Tenenbaum said COVID-19 also changed the way consumers spend their money. Prior to the pandemic, services, not goods, accounted for the majority of consumer spending, but the pandemic changed that, he said.

“COVID[-19] sort of made those closer personal interactions that are much more service-oriented certainly more dangerous,” Tenenbaum said.

He said that shift led to consumers spending more on goods than services almost overnight—an increase in demand that helped contribute to inflation.

Labor shortages

Widespread labor shortages are another factor contributing to supply chain disruptions, according to Jessica Garay, data and career awareness project coordinator for Workforce Solutions Capital Area.

Among many skilled trades vital to supply chain operations, including shipping and manufacturing, the number of vacant positions far outweighs the supply of trained workers, according to data from Workforce Solutions.

WFSCA data shows that of the 10 occupation categories most in need of workers, two are directly linked to the supply chain.

In transportation and material moving, WFSCA reported 1,213 new job postings in the Austin metro as of August and only 474 jobless trained individuals.

BLS data shows as of October, roughly 9,000 trucking industry jobs remained unfilled from pre-pandemic levels nationwide.

“Notably, there was already a shortage before COVID[-19],” Garay said. “We’re not sure whether that is because talent is not skilled for these positions in transportation, warehouse and manufacturing, or if it’s something else.”

However, some business owners have not been affected by the dry labor market. Cody Hirt, co-owner of Golden Rule and Mesquite Creek Outfitters in Georgetown, has been able to maintain many of his original employees, he said. Mesquite Creek Outfitters opened Nov. 16, 2016 and Golden Rule opened June 23, 2020 a month after the pandemic started in the United States.

“At Mesquite Creek Outfitters 8 of our 14 original employees have stayed with us since the beginning,” Hirt said. “The Golden Rule is a little bit different. We’ve had a great group of servers stay with us who come and go seasonally, have maintained three of our four managers, and have kept every single person in our kitchen staff.”

A consistent number of staff and his decision to source his goods locally has kept him afloat, he said. In order to demonstrate the power of what local suppliers are able to achieve together, Hirt sources all of his goods for both businesses from local suppliers throughout Texas. Golden Rule’s desserts are made in Georgetown at Lulu’s Pies and the restaurant’s meat comes from Colinas Foods. Additionally, Mesquite Creek Outfitters has become a grocery supply company by partnering with Colinas Foods.

Moving forwardHirt has seen a steady increase in the cost of his goods but has refused to pass that increase on to his customers, he said

“Just because we are getting our supplies from locals, it doesn’t mean [our suppliers] are getting their supplies locally,” Hirt said. “We’re still having to deal with their increased cost. But if everyone keeps increasing their prices due to inflation then the economy just isn’t going to work anymore and there is going to be a crash.”

Tenenbaum said he expects manufacturers to make a few changes in response to global supply chain issues so they are more prepared to deal with future disruptions.

The most notable change Tenenbaum predicts is the reduction of overseas manufacturing in favor of local manufacturing to reduce reliance on the global supply chain.

“Now that we sort of understand the struggles of a global supply chain, I think what we’ll see is onshoring or nearshoring, where we either bring the manufacturing process back to the United States or we keep more inventory of that item,” Tenenbaum said.

Some customers are understanding about the rise in prices for goods but others believe the issue is arbitrary, Bouffard said.

“This problem is not something that local businesses are creating and then reacting to,” Bouffard said. “The global economy is affecting small local businesses to increase prices, take away profits, increase operating costs and more.