In the Northeast San Antonio Metrocom, the lowest average home sales price among the five zip codes that make up the area was reported at $253,253 as of June, which is an estimated 52.06% increase from the 2017 lowest average home sales price of $166,548, according to data provided by the San Antonio Board of Realtors.

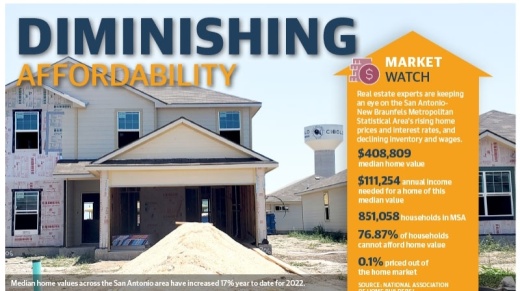

In the most recent data available, the SABOR reported in May the San Antonio area saw a 2% decrease in home sales compared to May 2021, and the median home prices have increased around 24%, which experts attribute to supply chain issues, inflation and housing demand.

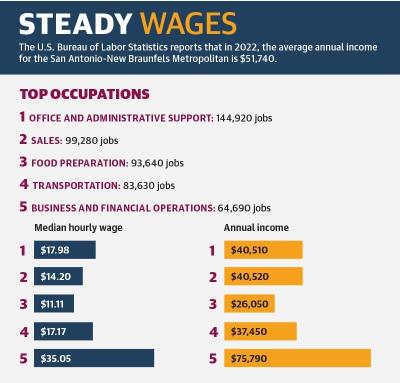

Clare Losey, assistant research economist for the Texas A&M University Texas Real Estate Research, said housing prices are outpacing increases in income, making it unlikely that the average income of $51,740 for the San Antonio-New Braunfels Metropolitan Statistical Area is enough to afford the average closed values of homes in the area.

“Affordability has certainly diminished,” Losey said. “It is largely because the increase in home prices has pretty significantly outpaced the increase in incomes. It is very unlikely that affordability is going to improve, at least significantly, over the next couple of years.”

San Antonio and the surrounding areas face issues similar to other cities across the nation, including lack of inventory, rising costs and supply chain issues, SABOR CEO Gilbert Gonzalez said.

“With all that demand, our [average] days on the market was 30 days, and our inventory is 1.4 months [in June], so it is still a little better than other communities,” Gonzalez said. “Since 2017, we have seen a 38% increase in the median price per square foot, and it has absolutely made it a competitive market just like everywhere else.”

Losey said the number of days a house sits on the market and how many months supply of inventory, or MSI, are available are two key indicators of the health of a market.

A strong housing market

Gonzalez said the housing market in the San Antonio area remains strong.

“There is a reason people come to San Antonio, and we feel like the most popular reason is you can still find a house and have the opportunities to buy a home at many different price points,” Gonzalez said. “It is not easy by any chance, the market is just as demanding here, but it is still much more affordable than other parts of the country.” ••While San Antonio has lower housing prices than other parts of the country, Tim Brown, owner of the RE/MAX Corridor in Schertz, said the housing market is changing at a rapid rate that Realtors have not seen before.

“We have seen some extremes, but we have never seen anything go so quickly as this,” Brown said. “Everybody knew interest rates were going to rise and whatnot, but the inflation just took such a strong hold, and it has made buyers very reluctant right now.”

Mortgage interest rates at the beginning of March were around 3% and have increased to nearly 6% in June, Brown said.

Brown said he anticipates more competition and believes the market will cool to a point where people can receive and use loans more reliably.••“We will see more people that are coming in with our conventional [Federal Housing Administration] and [Veterans Affairs] loans actually have a chance to compete in the market again,” Brown said. “People still need to buy homes, and people still need a roof over their heads. Even though homes are expensive, they are still a good investment, because in 10 years, that $350,000 home will be worth $400,000.”••Rents on the rise

As San Antonio-New Braunfels MSA median home prices have increased 17% from $249,500 in 2021 to $292,600 in 2022, median single-family rental rates have also increased 13% year over year, according to Brown.

“When housing values go up, the taxable value goes up, and unfortunately, the people who own rental properties do not get any homestead exemptions,” he said.

Despite these increases, the average rental rate increase in San Antonio is lower than cities, such as New York, Miami and Phoenix as well as other areas in Texas, said Celine Williams, interim executive director for the San Antonio Apartment Association, a nonprofit trade association representing multifamily and rental housing.

Williams said in 2022, Austin, Dallas and El Paso had average apartment rental increases of 19.2%, 17.4% and 16.4%, respectively.

With increases in San Antonio being lower than other cities, it draws in population growth, and the city is expected to see an increase of 80,000 households by 2026, Williams said.

Williams said the community must work together to make San Antonio a place where rental housing providers can operate cost-efficiently, meet their increased overhead expenses and have enough left over in profits to invest in new apartment communities.

“We know there are many people struggling to find housing they can afford, which is why we need our elected officials to challenge anyone who tries to postpone new, viable and affordable housing projects,” she said.

Affordability

Losey said homebuyers are facing multiple effects that put pressure and increases on the housing market including price appreciation, inventory of homes, population growth and a rise in mortgage interest rates.

The rise in interest rates has put pressure on homebuyers, especially those buying a home for the first time, causing a decline in the number of home sales and an increase in inventory, Losey said. In the San Antonio area, inventory was at 1.4 months as of June, which is a slight increase from the 1.2 months inventory available early this year.

“It is important to understand, when we say low inventory, we are not being dramatic,” she said. “In many markets, inventory is less than one month. Essentially, in a balanced market, you want to see about 6.5 months of inventory.”

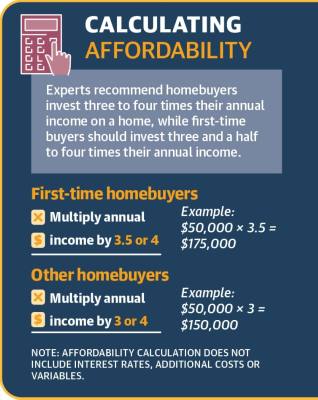

Real estate experts recommend buyers purchase a home priced at three to four times their annual salary. First-time buyers should invest in a home priced at three and a half to four times their salary, meaning a first-time buyer making $50,000 annually can afford a $175,000-$200,000 home, Losey said.

In the Northeast San Antonio metrocom this year, the lowest average home sales price across the five ZIP codes—78266, 78148, 78233, 78154 and 78108—is $253,253, which, according to the affordability formula, would require a first-time homebuyer to have a minimum annual income of $63,313.

Of those zip codes, 78233 was the only one that does not have a median income that meets the requirement for the lowest average home value of $253,253, according to the 2020 Census.

Only two zip codes, 78108 and 78266, have median incomes that enable a buyer to afford a higher priced home of $346,588, which is the average home value in 78154.

“At this point, not only would home price appreciation have to revert ... to its average, it would also have to have nominal price declines in order to return to affordability, prepandemic,” Losey said. “That is because income growth has not kept pace with growth in home prices.”

The market’s future

Gonzalez said the SABOR anticipates the market will be more balanced toward the end of this year and the start of 2023.

“It is absolutely a seller’s market, and we expect it to level itself out and reflect the needs of both buyers and sellers together, and it is going to become very stable,” he said. “Nationally, home sales are expected to be down 9%, and San Antonio is down 2%.” ••With strong population growth and demand in Texas and San Antonio, it is unlikely that home prices will experience any nominal decline, Losey said.

“We will probably see it decrease a little bit from its double digit highs, but over the long run, it should revert to its average,” she said.

There are benefits to buying in this market, and it could be beneficial in locking in interest rates before they increase more, Losey said.

“We know that mortgage interest rates are only going to continue to rise, because the federal reserve is going to continue to increase the federal funds rate, and that is going to push up the cost of borrowing across the board,” she said.

On the other hand, Losey said, waiting could prove beneficial as sellers may have to mark down home prices due to the increase of rates.

Whatever homebuyers decide, Losey recommends paying cash, if possible, or paying a higher down payment to reduce the loan repayment and working with real estate experts to find a home.

“It is really important that homebuyers take all these factors into consideration,” she said. “But it is really important for Texas cities to supply new homes, and given affordability constraints, costs of construction and cost of land, it is going to be important for us to consider different types of housing.”