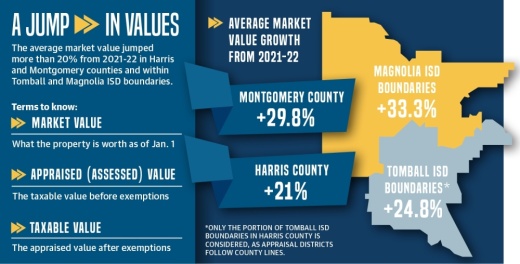

From 2021-22, the average market value of properties increased 21% and 29.8%, respectively, in Harris and Montgomery counties, according to data from the counties. In comparison, the average market value for properties has risen no more than 15.4% year over year within Harris County and no more than 11.2% in Montgomery County in the years prior since 2010.

Jack Barnett, communications officer for the Harris County Appraisal District, said all property is appraised at its full market value and determined by Jan. 1. Notices are sent to homeowners in the spring with a market value and appraised value. The market value is what the home is worth, whereas the appraised value is the taxable value before property tax exemptions.

In years prior, the market and appraised values have been similar, Barnett said. However, most homeowners may notice a discrepancy this year between values due to the state’s 10% cap on appraised value increases while home values surge.

As local taxing entities begin budget discussions for the upcoming fiscal year, Tammy McRae, Montgomery County’s chief tax assessor-collector, said at an April 21 tax workshop she believes lower tax rates are needed to compensate.

“When values go high, tax rates need to go down,” McRae said. “You need to pay attention to that because this year more than ever, most tax rates need to be coming down.”

Local legislators have pitched solutions to provide further taxpayer relief.

“I’ve filed a bill in each legislative session that I’ve been in ... that would cap all appraised property values at a 5% increase just to protect Texans from what we’re seeing right now,” state Rep. Cecil Bell, R-Magnolia, said in an interview.

Appraised values rise

The increase in appraised values is a result of several factors. Montgomery County Chief Appraiser Tony Belinoski said there is a large demand for homes in Texas but a low inventory of homes to purchase.

The appraisers consider market transactions from home sales, and since so many homes have been sold above the asking price, this drives the market value up, according to Dick Lavine, senior fiscal analyst with Every Texan, an Austin-based public policy center.

“People really want to move into a new home; they are paying above the asking price in order to get the home. This is contributing to the increase in values,” Barnett said.

According to a May 3 news release from the Houston Association of Realtors, the median price of a single-family home in the Greater Houston area has increased nearly $80,000 in the last two years.

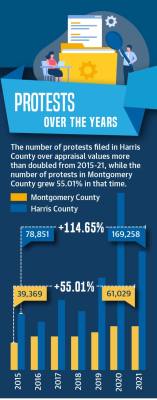

Homeowners can protest appraised values if they feel they are inaccurate and receive an informal hearing with the Appraisal Review Board, which may decide to lower the appraised value. The protest deadline for property owners was May 15.

Despite no guarantee of getting appraised values reduced, Belinoski said in an email he encourages property owners to protest, especially if they believe the market value is inaccurate and can provide information to warrant an adjustment. County data shows the number of protests filed has increased about 55% in Montgomery County and 114% in Harris County from 2015-21.

“Most of the time [the ARB and homeowners] come to an agreement,” Belinoski said. Unsustainable increase

The year-over-year percent increase in average market value was in the single digits for five of the last six years in Harris County and all six years in Montgomery County, according to data from the appraisal districts.

As such, Belinoski said he was “shocked” by 2022 appraisal values.

Locally, the average market value for properties within Tomball ISD boundaries in Harris County rose 24.8% from 2021-22—following a 29% increase overall from 2017-21—and 33.3% within Magnolia ISD boundaries, following a total increase of 17.7% from 2017-21, according to data from the appraisal districts.

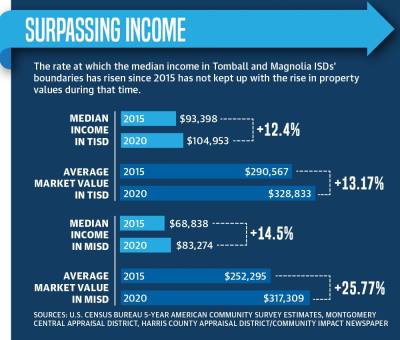

Property values are increasing faster than the median income across Harris and Montgomery counties, leaving people worried their taxes will increase so much they will be forced out of their homes, Bell said.

The TISD area’s median income increased 12.4% from 2015-20, according to American Community Survey five-year estimates from the U.S. Census Bureau, while county data shows the average market value of properties in the Harris County portion of TISD rose 13.17% during that time. The MISD area’s median income increased 14.5% from 2015-20, while the average market value increased 25.77% during that time, according to Montgomery County data.

As such, some homeowners said they are worried about how high their taxes will be this fall.

Jon Matlack, a Magnolia-area resident who lives within TISD’s boundaries north of Spring Creek, said his home’s valuation increased 45%. He said his school and county taxes increased $2,649 from 2021.

“My mortgage has increased by $220.75 a month to cover this increase,” he said in an email.

Adam Perdue, a research economist at the Texas Real Estate Research Center, said the center is expecting the housing market to slow over the next year and prices to decrease. In the Houston area between 2020-21, there was a 21% increase in home prices when typically there is a 5% increase over a two-year span, according to Perdue. ••“We expect to see [prices] fall back much closer to that 5% or even fall below it. We are expecting to continue to see it be a positive [increase] but slower than what we have seen over the past two years,” he said.

Although property values increased, taxing entities are limited to how much they can raise their property tax revenue. Counties and cities are limited to a 3.5% increase and schools to 2.5%, Perdue said.

“Taxing jurisdictions look at that [appraisal valuation], and they figure out what their rate will be, and that [tax] rate almost has to fall. [Taxing jurisdictions] don’t necessarily need more revenue because the valuation increased,” Perdue said.

Seeking relief

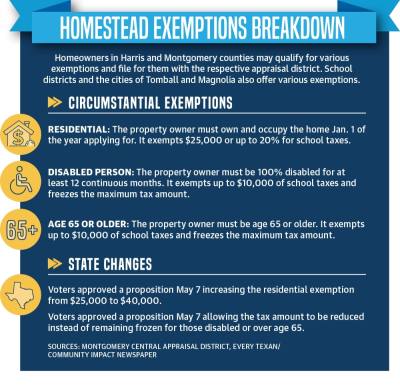

Homeowners may see relief from homestead exemptions and two statewide propositions approved by voters May 7.

Lavine said Proposition 1 amended the exemption for those who are disabled or over age 65, allowing school taxes to decrease for these homeowners instead of being frozen at age 65 so as not to increase the amount. Proposition 2 increased the homestead exemption for school taxes from $25,000 to $40,000 off of the appraised value.

State Rep. Steve Toth, R-Woodlands, said while homestead exemption changes will help, he believes they are not enough. He is advocating for doing away with appraisal districts and using a price-paid valuation, which he said 40% of states use in property tax calculations. Homeowners’ taxes would be based on the amount the home was purchased for instead of an ever-changing value.

Toth said he has introduced a bill advocating for such in previous legislative sessions and is anticipating a hearing on it in the 2023 session, which will begin Jan. 10.

In addition, Bell said he believes the chief appraiser of each county needs to be an elected position. He said he has drafted a bill for it that is gaining traction this year.

"When you have that much authority, you should be responsible and accountable to the people,” Bell said.

Jishnu Nair contributed to this report.