Lawmakers are projected to be working with a $26.9 billion budget surplus due to high sales tax revenues statewide, which policy experts said is historic.

"We can’t count on this type of surplus happening again,” said John Hryhorchuk, senior vice president for policy and advocacy at Texas 2036, a public policy organization that focuses on statewide long-term planning. “It’s historical for a reason. We’ve never experienced anything quite like this.”

In July, Texas Comptroller Glenn Hegar released the state’s revenue estimate stating how much money lawmakers will have available in their upcoming session. Hegar’s estimate showed nearly $150 billion available to the Legislature for general-purpose spending, an increase from $112.5 billion it had in 2021.

“What we don’t want to do is create a system where we’re setting ourselves up for future fiscal cliffs,” Hryhorchuk said. “We want to make sure that this money is being spent wisely and truly invested in items that will have a long-term return on investment for the people of Texas without creating cost concerns for the future.”

Local leaders, such as J.J. Hollie, president and CEO of The Woodlands Area Chamber of Commerce, have emphasized public education initiatives as well as topics such as property taxes and infrastructure.

“People are concerned about the property tax burden both on residents and businesses,” Hollie said. “Business wants to contribute their fair share, but we want to make sure it’s done in a fair way.”

Eye on education

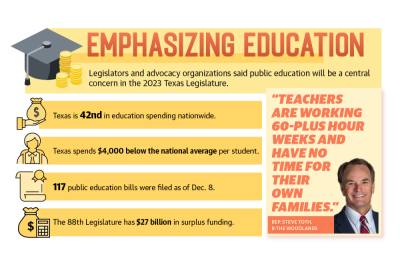

Both lawmakers and policy advocates said they would like to see changes made to the state’s public education system in response to a nationwide teacher shortage. In Texas during the 2021-22 school year, 42,839 teachers left the profession—the highest number since 2008, according to Texas Education Agency data.

State Rep. Steve Toth, R-The Woodlands, said there has been a “mass exodus” of teachers.

“When I sat down with the representatives of the Texas Classroom Teachers Association, they pointed out two big issues that we need to tackle,” Toth said. “The first problem is a quality-of-life issue. Teachers are working 60-plus hour weeks and have no time for their own families.”

The other issue, Toth said, is discipline in the classroom.

“Teachers are being assaulted by students only to see them back in the classroom the next day. Texas needs to expand its alternative education program that offers juvenile diversions to violent kids,” he said.

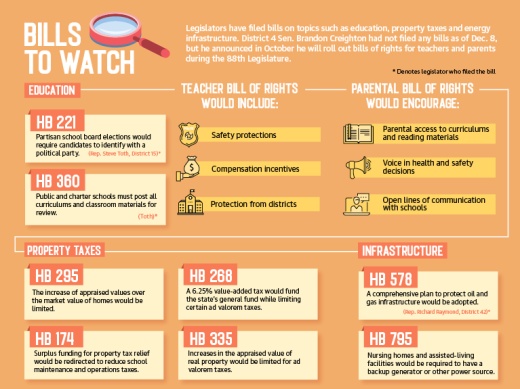

State Sen. Brandon Creighton, R-Conroe, said in a statement to Community Impact that the priority for the 88th session is getting the Legislature to adopt a Teacher Bill of Rights and a Parental Bill of Rights to address issues in education.

Creighton said the reforms in the Teacher Bill of Rights would include safety protections, compensation incentives and protection from retaliation from their districts. He said the Parental Bill of Rights would increase transparency and access and “empower parents as active participants in their children’s education.”

Creighton, who is chair of the Senate Committee on Education, said the proposals will be rolled out during the 88th session.

However, Conroe ISD spokesperson Sarah Blakelock said the district’s priority for the next session is funding.

“Conroe ISD works closely with state legislators in advocating for funding to meet our rapidly growing district’s needs,” she said. “The current funding formula is a main topic of conversation. We feel it is more reasonable to be funded on enrollment instead of daily attendance.”

Blakelock said a formula change would also allow for raises for employees.

Officials with Raise Your Hand Texas, an educational policy organization, said more funding is needed to improve per-student spending in districts— Texas is ranked 42nd in the nation for per-student funding. Senior Director of Policy Bob Popinski said the state is around $4,000 below the national average.

“With 5.5 million kids on a $70 billion system, it’s tough to maneuver a school finance bill through the legislative process,” he said. “We’ll continue to inch forward until we meet those goals of being ... at least average in per-pupil spending when it comes to our students, if not above that.”

Tackling taxes

Toth said he would like to see a portion of the budget surplus go to sustainable property tax relief for Texans. One bill he introduced, House Bill 295, would cap the increase of the appraised value from exceeding the market value of homes.

In an Oct. 17 tweet, Gov. Greg Abbott said he wants the Legislature to use much of the budget surplus to give Texas a property tax cut. Previous Community Impact reporting showed the average market property value in Montgomery County jump 29.8% from 2021 to 2022.

Creighton said at an October Greater East Montgomery County Chamber of Commerce luncheon he would like to see the cap on the annual appraised value increase for property tax purposes lowered this session.

“We need a supermajority in the Legislature to lower the appraisal cap. It’s at 10[%], but we need it somewhere down closer to 3[%],” he said.

Luis Figueroa, chief of legislative affairs for public policy advocacy group Every Texan, said rising property values do not have equal impacts on all Texans and may have disproportionate effects on renters, students and low-income individuals.

Figueroa said across-the-board property tax cuts will benefit wealthy individuals and businesses more than the lower and middle classes.

“If we want to address property taxes for the people that need it the most, there are two things that could really help,” he said. “One are homestead exemptions, particularly a homestead exemption that’s called a flat-dollar local homestead exemption. The other one is sales price disclosure, which would allow for people to know what the actual values are, particularly on the commercial side.”

A flat-dollar local homestead exemption would give residents a dollar amount for the exemption instead of a percentage. For example, The Woodlands has a $40,000 exemption for homeowners age 65 and older. The cities of Shenandoah and Oak Ridge North each have 20% homestead exemptions for residents.

“At the end of the day, we want to make sure that the policies that we enact have an impact on the people that need it the most,” Figueroa said. “How much we spend on investments like education and infrastructure and health care can make a big impact on individuals in Texas who are struggling.”

Infrastructure and workforce

State infrastructure is also a topic local leaders are watching. Hollie said the chamber is focused on water, transportation and workforce development at this year’s legislative session.

“If we have a supply of water, if we control flooding, if we have a very good solid educated available workforce and if we can transport goods and employees from point to point,” he said. “That includes roads, railroads, shipping, the airport. That includes anything and everything ... related to how goods and services get from point A to point B.”

Following Winter Storm Uri in 2021, legislators and policy advocates have also been focused on making improvements to the state’s energy infrastructure and workforce. For example, HB 578 would protect oil and gas infrastructure and HB 795 would require backup generators at certain senior facilities.

“[It] isn’t just the energy grid, but .... its challenges impacting the state workforce itself,” Hryhorchuk said.

Hryhorchuk said one way to support the workforce is to increase work-based learning in high schools through virtual learning.

“[Hopefully] there will be legislation ... that can leverage this technology ... so that more students can pursue their pathways to ... success,” he said.