In The Woodlands Township, officials were still collecting data in late July on growth projections in preparation for the Aug. 22 budget workshops. President and CEO Monique Sharp said in an email July 29 that preliminary projections were not yet available, but known factors include sales tax growth in 2022 as well as several new expenses.

“While I anticipate sales tax revenues ... will continue to grow, I believe economic pressures ... will slow that rate of growth,” Sharp said in the email. “I have not yet determined what growth factor will be used to project 2023 revenues.”

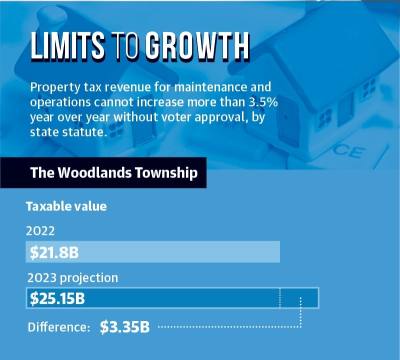

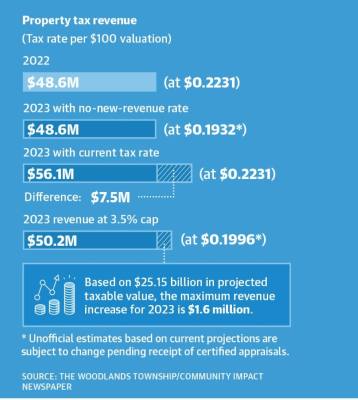

At the township’s current tax rate, $0.2231 per $100 valuation, revenue from property tax for maintenance and operations is limited to 3.5% growth without voter approval, or $1.6 million, from FY 2022 to FY 2023. Township fiscal years run from January to December.

However, a lower tax rate could be adopted for FY 2023, which would result in no additional revenue from property tax. In this scenario, higher property assessments would be balanced by a lower tax rate, at least for the township’s portion, according to officials. According to preliminary numbers, rate of $0.1996 would generate close to the maximum $1.6 million in additional revenue if the tax base grows by $3.35 billion as expected, according to calculations by Community Impact Newspaper.

Sales tax revenue also appears to be increasing. As of the July financial report, the first six months of the year resulted in sales tax revenue $5.8 million higher than budgeted with gains in every category, Sharp said, including internet sales tax. Operating expenditures were also about $3 million below projections for the year to date. However, these gains are balanced by inflation and unknown factors with regard to tax appraisal protests.

“The township certainly isn’t immune to the inflationary pressures being experienced in the markets right now,” Sharp said. “We are factoring in higher prices for many of our goods and services.”

New costs being assumed by the township in FY 2023 include maintenance of The Woodlands Waterway, which will amount to about $600,000 in the FY 2023 budget, she said. The township is also adding a new fire department company with 15 personnel and related equipment, she said.

Montgomery County

A public hearing on a proposed Montgomery County tax rate of $0.3764 per $100 of taxable property will be held Aug. 26, when the budget will also be adopted, according to a decision at an Aug. 9 Commissioners Court session.

The four commissioners present approved the tax rate. The county’s tax rate has decreased annually since 2019, according to the county website. The 2022 values were calculated using a certified property value of $73.3 billion, according to county Tax Assessor-Collector Tammy McRae.

According to Budget Officer Amanda Clark, increases to law enforcement personnel under the Montgomery County Sheriff’s Office as well as a 5% countywide raise contributed to the rate exceeding the no-new-revenue rate of $0.3312.

Carter also cited lower revenues than the previous year as another reason for the tax rate, with county courts still facing backlogs. Montgomery County has adopted tax rates either equal to or lower than the effective rate for each year since 2019.