After marking it as a top priority this legislative session, Texas lawmakers in March filed several bills focused on overhauling the state’s school finance system.

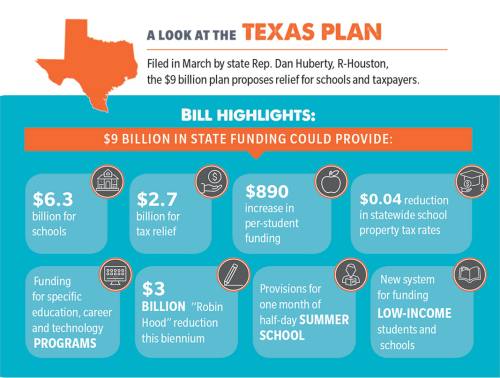

One of the reform packages, House Bill 3, was filed in March by state Rep. Dan Huberty, R-Houston, and is highlighted by a $9 billion plan to rework the state’s education funding and district property taxes. With

$6.3 billion directed toward schools and $2.7 billion for tax relief, HB 3, or the “Texas Plan,” proposes a nearly $900 increase in per-student funding; a $0.04 reduction in statewide school property tax rates; raises for teachers; and funding for specific education, career and technology programs.

“This is transformative. This is going to make a difference,” Huberty said in a statement.

Other features of the Texas Plan include providing for one month of half-day summer school, a simplification of transportation funding, and establishing a new system for funding low-income students and schools.

A $3 billion reduction in the state’s “Robin Hood” recapture system—which distributes surplus property tax revenues from wealthier districts to those with less valuable property—and an increase to earnings on enrichment pennies—tax revenue levied above a district’s compressed tax rate—are also proposed.

Conroe ISD Chief Financial Officer Darrin Rice said the district has analyzed the proposal, but remains uncertain of its financial effects as the bill’s content could change before a final version is passed.

“They are putting more money in the system. They are providing tax reform. They’re making changes, [an] overall overhaul of the school funding formula, and then attempt to make it simpler and easier to understand,” Rice said. “But with those changes, we still have questions on how that’s all going to shake out when we start working the formula model.”

After review by the House Public Education Committee in March, The Texas Tribune reported that HB 3 was revised to remove language concerning increased pay for highly rated teachers. That concept was swapped for a teacher incentive program encouraging educators to work at schools with a higher need, in rural locations or with a teacher shortage.

The language concerning teacher pay is at odds with a proposal in the Senate mandating standardized raises for Texas teachers. Senate Bill 3, filed earlier this session by Sen. Jane Nelson, R-Flower Mound, calls for $5,000 raises for all full-time teachers and librarians in the state. That bill passed through the Senate in March, and will likely face opposition in the House from lawmakers favoring district control of educator salaries

Rice said although the district is not opposed to faculty raises, CISD favors a system that would allow it to manage its own salary increases.

“I think the district believes [in] local control, instead of the state mandating what a raise should be,” he said.

In addition to revising teacher pay, the Senate also considered its own broader school finance package in SB 4, filed by Sen. Larry Taylor, R-Friendswood, in early March. That bill outline included some deviations from the HB 3 plan and was not introduced in a completed form. SB 4 was referred to the Senate Education Committee on March 11, where it remained by early April.

Despite the differences in the language and goals of the two main reform bills, state lawmakers and local school officials said they are optimistic that a major reform bill will be passed in some form by the Legislature following its high-profile push for progress on the issue.

While a final solution is still not on the table, Rice said he expects reform to pass through later this spring.

“I do believe that the House and the Senate will come together with a new school funding bill,” he said.

The House prepared HB 3 for an April 3 vote, after approving the plan’s $9 billion scope in its 2020-21 budget plan contained in House Bill 1. Per The Texas Tribune, the Senate budget committee also moved toward accepting that $9 billion figure in late March for its own education strategy, including $4 billion for educator pay, $2.7 billion for property tax relief and $2.3 billion for adjustments to

school finance.

While the funding breakdown was included in the Senate’s budget plan, SB 1, the language of SB 4 still lacked firm strategy details similar to the Texas Plan. Taylor told The Texas Tribune in late March that SB 4 would likely stall, with budgeting and strategy compromise between the two chambers centering on HB 3.