Jesus Cañas, senior business economist with the Federal Reserve Bank of Dallas, said several factors lead to increased prices, including ongoing issues with the supply chain, labor shortages and the Russia-Ukraine war putting pressure on energy prices.

“All of that combined is resulting in high inflation,” Cañas said.

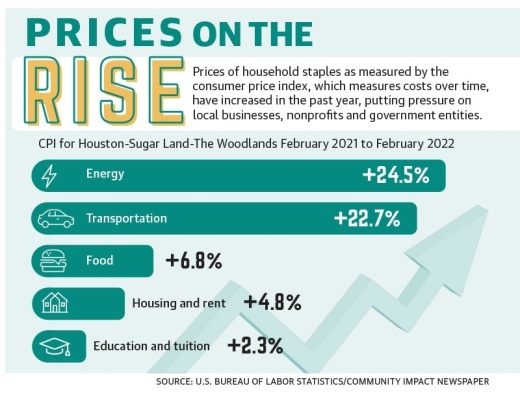

Along with food costs, Cañas said transportation and gas utility costs, which have seen 22.7% and 24.2% increases, respectively, over the past year, factor into increasing costs for consumers in the region.

However, Cañas noted the inflation distribution across Texas is not even. He said comparing the Greater Houston region to the Dallas-Fort Worthregion shows Houston-area inflation was slower in January this year based on housing data.“Prices in Houston are growing slower than DFW and the nation,” he said. “This has to do mainly with housing inflation, which includes shelter, utilities cost and rent.”

While The Woodlands area is expected to handle the increased prices better than other places due to its higher average income levels, Cañas said the effects will still be felt throughout the remainder of the year.

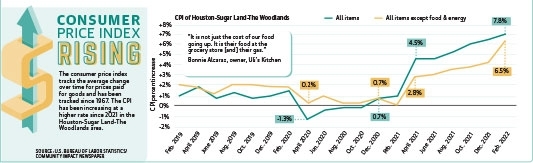

The increasing costs are affecting local business owners, such as Uli’s Kitchen owner Bonnie Alcaraz.

“[On March 23], limes hit $100 per case,” Alcaraz said. “It forced us to make some tough decisions. We do not want to compromise the quality of anything we serve, but we have to be realistic about what people can afford and what they are willing to pay.”Cañas said he believes unless there are major positive developments, such as the Russia-Ukraine war ending, prices will likely continue increasing throughout 2022.

“Inflation hits ... the low-income section of the population the hardest,” he said. “They tend to spend a higher proportion of income on food, where you see prices growing faster. If you are in a low-income sector of the population, you will be more hurt than if you are in a higher-income sector.”

Increasing local costs

According to a March 10 report by the U.S. Bureau of Labor Statistics, two sectors seeing consumer price index increases since 2021 are food and energy, which increased 6.8% and 24.5%, respectively. The CPI measures the average change over time for prices paid for goods.

Uli’s Kitchen opened in May 2021, and Alcaraz said she has always wanted to be transparent with customers. When prices increased in mid-January due to supply issues, she said customers remained largely supportive.

Alcaraz said she has tried to find small ways to cut back on costs for her business, such as serving limes with margaritas upon request.

“You would be amazed; it is one wedge of lime,” she said. “But when we serve 500 of those per day and 200 of them come back in the trash, that is a huge chunk of savings.”

Other business owners began operating when prices started to increase, including Kurt Crowley, owner of Fuhgedaboudit Bagel Co., which opened in late November.

“Some of our ingredients have risen in cost by 35%-40%,” Crowley said. “It is alarming.”

Crowley said he has seen prices increase on products such as flour, bacon and cream cheese on a near-weekly basis, so he has had to change his strategy for getting supplies.

“It takes more time for me, but I am having to cherrypick various items based off certain vendors based on pricing I get,” Crowley said.

Alcaraz said despite the struggles she and her business are facing, she remains optimistic, noting this is not the first round of inflation she has seen.Crowley said he appreciates how The Woodlands community has embraced his new business.

“We are going to do whatever we can. We know they are feeling it in their pockets as well,” he said.

Nonprofits feel pinch

Local nonprofits are also feeling the effects of inflation, including the Montgomery County Food Bank.

Kristine Marlow, president and CEO of the Montgomery County Food Bank, said food banks across the country are being hit with “the perfect storm” as a result of supply chain issues, limited resources, inflation and the ongoing effects of the coronavirus pandemic.

“Our operations costs have increased significantly. A large portion of our food is donated; however, ... we have had to purchase more and more food to fill the gaps,” Marlow said.

An email from Marlow states the Montgomery County Food Bank’s fuel costs increased 35% over in March.

Marlow added the demand for the food bank’s services have continued to increase since the start of the pandemic, and the number of people being served is higher than pre-pandemic numbers. Although the median household income in The Woodlands is $126,098, nearly twice the median income for the rest of the state, around 30% of households in The Woodlands are at or below the state median as of the U.S. Census Bureau’s 2020 five-year Annual Community Survey.

“In 2021 alone, we served over 9.6 million meals to more than 55,800 people each month,” Marlow said. “Since August, the need for food assistance has steadily increased. We are working closely with our partner agencies and are ready to help them meet the increased demand.”

An email from Missy Herndon, president and CEO of Interfaith of The Woodlands, stated inflation has affected the nonprofit’s ability to help area residents as well.

“Program costs have increased in recent months. Interfaith has raised rent assistance from $300 to $500 as fair market value for rent has increased in our area,” Herndon said. “Additionally, with the increase in gas prices, gas vouchers for our clients do not go as far.”

Herndon said Interfaith of The Woodlands’ food pantry serves around 575 individuals every month, and the increased food costs will increase the nonprofit’s budget. Around 60% of the food pantry is stocked through donations, and Herndon said there have been reduced donations in recent months.

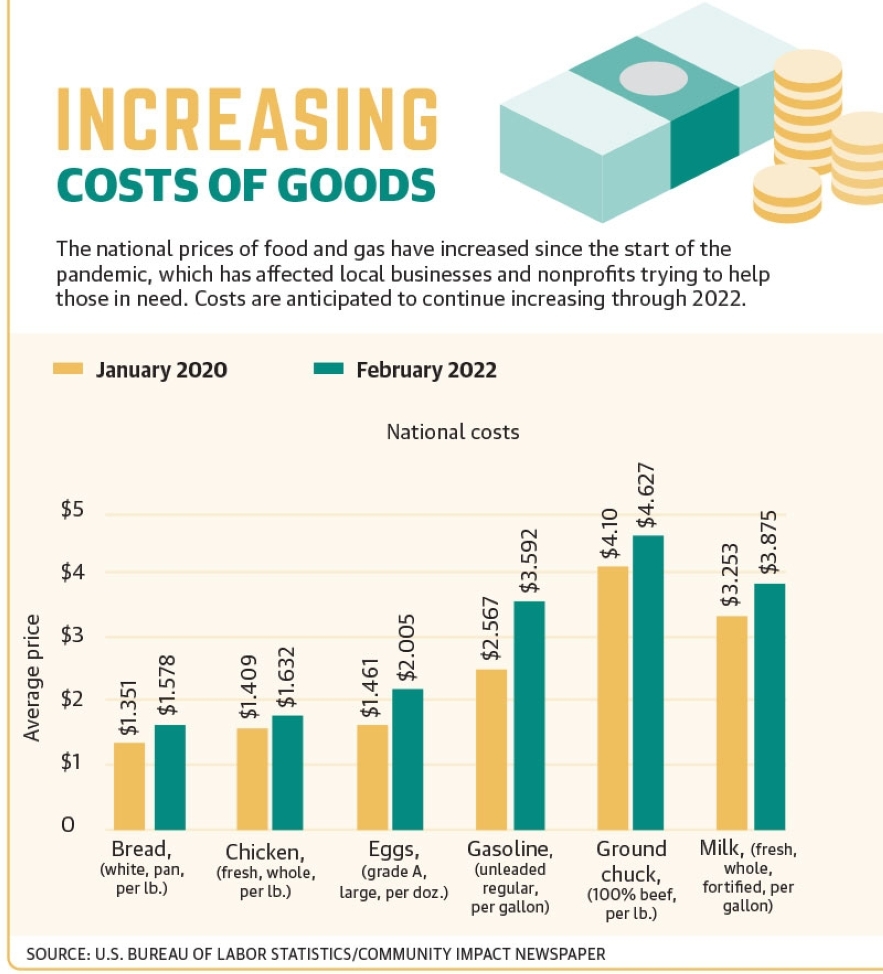

According to information from the U.S. Bureau of Labor Statistics, the national costs of many staples have increased over the past year. Comparing February data from 2020 to 2022, the cost of bread has increased by 22.7 cents per pound; chicken has increased by 22.3 cents per pound; eggs have increased by 54.4 cents per dozen; ground beef has increased by 52.7 cents per pound; and whole milk has increased by 62.2 cents per gallon.

Information from the U.S. Department of Agriculture indicates the price of wheat increased over 30% throughout 2021 as well.

Marlow noted due to increasing costs for families in the area, there have been struggles with receiving monetary and food donations, causing the food bank to make more purchases with its available funding.

“A majority of our COVID[-19] relief funding, dedicated specifically to food purchases, has already been expended,” Marlow said. “So we are having to funnel other donated funds in order to purchase much-needed and harder-to-get items, such as meat and peanut butter.”

Municipalities strategize

Local governing bodies have also been feeling the effects of inflation and are looking at ways to ensure services continue.

Chris Nunes, assistant general manager for The Woodlands Township, said the levels of inflation are something local governments have not dealt with in many years. He said the most noticeable effects of inflation have come from goods that are required for resident services.

“Many of our services are sourced with contractors, and prices are set for multiple years,” Nunes said. “For those contracts that have expired, we have started to rebid these agreements.”Nunes noted there have “been a handful” of contracts that had gone through renewal periods as of March 28, and contractors are making more expensive requests due to labor, fuel and material costs.

In the neighboring city of Shenandoah, the City Council approved increasing city staff pay in a 3-2 vote March 23 to both help staff members with inflation and to increase retention. The changes to pay were varied depending on whether the position was hourly or salaried.

“We looked at the numbers. [City staff] had done a market survey of other cities of similar sizes. ... We were below market,” Shenandoah Mayor Ritch Wheeler said during the meeting. “We were unable to fill staff positions.”Shenandoah Finance Director Lisa Wasner said inflation was a factor for the pay increases along with cost-of-living adjustments.“Everybody is being hit with the same inflation,” Wasner said.

As of late March, The Woodlands Township was in the process of selecting a consultant to conduct a compensation study to understand the impacts of inflation and other factors that impact staff compensation, Nunes said.

Looking ahead to preparing the township’s budget, Nunes said there are some uncertainties about the future.

“The Woodlands Township has always taken a conservative approach to budgeting revenue and expenditures,” he said. “Inflation does create some uncertainty, ... and it’s closely being monitored by township staff at this time.”

Area municipalities are beginning to plan for their upcoming budgets, which generally reset for the fiscal year in September. As of March, Oak Ridge North had not discussed inflation in its meetings this year.

Cañas said many factors will determine when inflation rates decline, including the Russia-Ukraine war and future coronavirus infections.

“It is really hard right now to have an idea for what will happen for the remainder of the year with the uncertainty levels we are experiencing,” Cañas said.