With the continued spread of the virus affecting the economy alongside an international conflict over oil prices, several forecasters agreed the Greater Houston area’s economic future remains unclear.

“We’re having the double whammy of having both a natural disaster in the form of coronavirus shutting down the national economy and the oil market being severely depressed as a result of ... the price war between Saudi [Arabia and] Russia,” said Jesse Thompson, a senior business economist with the Federal Reserve Bank of Dallas, Houston Branch.

Gil Staley, president and chief executive officer of The Woodlands Area Economic Development Partnership, said the organization is constantly monitoring the energy market and oil price swings that could affect employment at local energy companies such as Occidental Petroleum Corp., which acquired The Woodlands’ Anadarko Petroleum Corp. in a $55 billion deal in 2019.

“We’ve been lucky over the years,” Staley said. “We have seen steady growth since ... 1974. ... It’s going to be very painful but we will come back because of that very strong foundation.”

Energy market responses

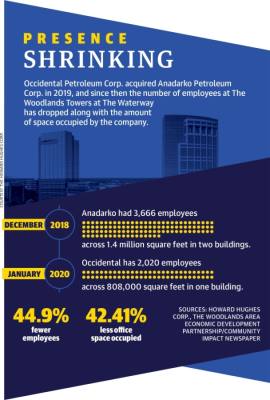

Since its 2019 acquisition of Anadarko, one of The Woodlands area’s largest employers, Occidental has retained the company’s presence in one of the two former Anadarko towers now owned by the Howard Hughes Corp. However, it has reduced the number of employees at that location.

The Woodlands Area EDP reported Anadarko had 3,666 employees in December 2018 and Occidental had 2,020 as of January 2020, but Gordy Bunch, the chair of The Woodlands Township board of directors, said that was expected to drop to 1,500 by the end of the year.

After oil prices plunged in March, Occidental said in a March 25 statement it planned to cut its capital spending from between $5.2 billion and $5.4 billion to between $2.5 billion and $2.7 billion this year.

Occidental President and CEO Vicki Hollub said March 25 the reductions were planned to reduce the company’s debt and strengthen its financial position due to the recent steep drop in commodity prices worldwide.

The company also announced it will cut its planned 2020 operating and corporate costs by at least $600 million, including salary reductions for its employees.

Officials with ExxonMobil, which headquarters several of its business operations at its Springwoods Village campus south of The Woodlands and has offices in Hughes Landing, also said they were evaluating cuts to capital and operating expenses in a March 16 statement. •Alisa Lukash, a senior analyst for Rystad Energy, which has offices in Houston, said in early March that oil prices of $30 to $40 per barrel were not considered as damaging for companies with a low breakeven price—the price needed for a firm to profitably drill a new well—such as Occidental and ExxonMobil.

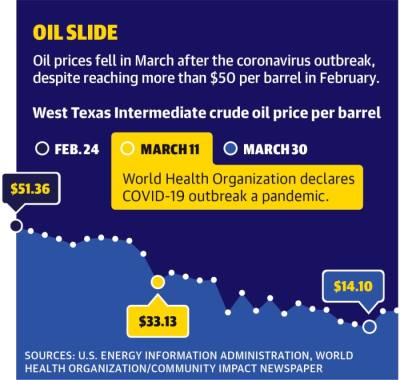

However, in late March prices dipped below the $30 mark. According to the U.S. Energy Information Administration, benchmark West Texas Intermediate crude oil prices reached a yearly low of $14.10 per barrel March 30. The WTI market price had peaked at $63.27 in early January.

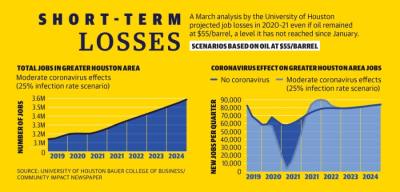

“Put these together—COVID-19 and oil—and it is not a good situation for Houston or the broad Houston economy,” said Bill Gilmer, director of the University of Houston’s Bauer Institute for Regional Forecasting. “Even a meaningful U.S. slowdown would wipe out most of the 49,000 jobs that I was forecasting for this year. This is one of those times you have to hope for the best and plan for the worst.”

Regional job effects

Patrick Jankowski, senior vice president of research for the Greater Houston Partnership, said the hazy time frame and societal effects of the coronavirus outbreak could lead to hesitance by consumers and businesses to get back to work as the worst of the outbreak subsides. The crisis is expected to bring tens of thousands of job losses across the region in 2020, Jankowski said.•“I’m fairly comfortable saying that we will probably lose ... over 150,000 [jobs] but less than 400,000,” he said.

A March 22 report written by Gilmer also showed the region’s economy could be heading for a downturn.

“As the virus progresses, the loss of workers and caretakers to illness would subtract a steady [10,000]-20,000 workers from payrolls. Then labor force shortages, social distancing, supply disruptions, and public health policy will simply pile on an unknown number of additional job cuts. These losses come on top of the effects of a national recession that would be underway,” Gilmer wrote of the projections.

Thompson said the region’s reliance on the oil market has become more balanced due to growth in other fields in recent years, but the U.S. economy’s overall downturn leaves Houston in an uncertain place in 2020.

“The economy of Houston sells into the broader economy of the United States, and so we have that backdrop of diversification to help weather the storm of the 2015-2016 oil bust. Because of uncertainties with the coronavirus, it’s not clear to what extent the broader economy of the United States is going to provide any sort of stabilization against the forces of this recent collapse in oil prices,” he said.

Danica Smithwick contributed to this report.