Hebert said her home’s value has increased since she purchased it for $47,500 in 1995. She said the house was originally in disarray, saying she intended to fix up the house and gradually improve its condition over time as she was able to afford improvements.

The property was initially valued at $65,010 in 1995. The latest 2023 appraised value was $222,340, or 242% higher. Hebert said the rapidly rising values did not reflect the condition of the house, which still needs some major renovations, but her attempts to protest were denied.

“When I went with all of these pictures and showed everything, I was told, verbatim quote: ‘It’s not our fault you don’t maintain your property,’” she said.

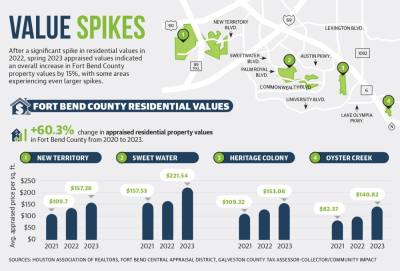

Residential property values in Fort Bend County have risen since the pandemic began in 2020. Since then, an average home value with no homestead exemption could have seen a 60.3% increase, according to Fort Bend Central Appraisal District annual appraisal data.

To address this problem of rapidly rising taxable values for homes, the state House and Senate each introduced separate bills in the 88th Legislature to reduce property taxes. As of press time, the two chambers have not agreed on a compromise bill to send to the governor’s desk for a signature.

Houston Association of Realtors Chair Cathy Treviño said the current market and economic situation is causing pressure on homeowners, buyers and sellers alike.

“Prices [and] inflation and things like that ... are all going up, and salaries aren’t unfortunately going up as quickly,” she said.

Upward trends

Home values are rising due to an unprecedented combination of pressures on the economy, including federal officials’ move to raise interest rates, which has added increased mortgage payments, Treviño said.

According to HAR data, several subdivisions in Sugar Land and Missouri City are at the highest average price per square foot on record, including the New Territory, Sweet Water, Heritage Colony and Oyster Creek subdivisions.

In an unscientific web survey conducted from June 15-22 by Community Impact, Sugar Land residents in the survey indicated having to make spending adjustments to account for rising home values. They reported having less disposable income and spending less on food and medicine.

Hebert, who describes herself as a single person who bought a “fixer-upper,” said her taxes have risen to the point where she fears she will be priced out of her home and be unable to pass the property down to her children.

"For people who are lower middle class, or even lower, it’s a pretty big life changing event to inherit property,” she said. “Well, my two children will not be inheriting anything.”

Missouri City resident Jim White said in an email that high property taxes are pricing him and his family out of his home. He said hikes in his home’s value are making it increasingly difficult to support his son’s medical expenses.

“We don’t have money for meat of any kind so we eat cheaper vegetables,” he said. “If meds are over 10 bucks we don’t take them.”

Legislative efforts

The state House and Senate each introduced bills in late June with different methods for reducing property tax bills. An agreement has not been reached between chambers as of press time.

Lawmakers filed House Bill 1 in the legislative session to cap appraisal increases at 5% annually and reduce school district tax rates by 16.2 cents for two years, which are typically the highest-taxing entity for many Houston-area taxpayers.

Meanwhile, Senate Bill 1 proposed a 10-cent reduction in school district tax rates. Additionally, senators proposed raising the homestead exemption to $100,000. Both chambers also proposed resolutions allowing Texans to vote on the tax cuts in November.

“Taxpayers are waiting for their tax cut, and the clock is ticking,” said Lt. Gov. Dan Patrick, who leads the Senate, about the Senate proposals.

For the first special session that ran May 29-June 27, Gov. Greg Abbott directed both chambers to come up with a property tax relief plan that will reduce the school district tax rate—since that was the only thing both chambers originally proposed. The second special session began June 27.

Fort Bend ISD Deputy Superintendent Steven Bassett said both proposed bills reducing school district property tax rates and making up the funding difference with state funds could affect FBISD’s debt service fund. This is the fund the district uses to pay its debt obligations, including bond payments.

FBISD voters passed a $1.26 billion bond in November, which came with projections on how the district predicted property tax collections may grow based on its current rate. If legislation lowers tax rates, Bassett said the district may need to raise the rate to be able to be able to pay its obligations.

Bassett said he believes the state is capable of using its budget surplus to provide property tax relief and needed financial support to schools.

“We’d love to see a property tax decrease, and I think there will be one,” Bassett said. “But I do believe that maybe you don’t need $17 billion to go into property tax relief—maybe $12 billion, and then that other $5 [billion] can ... be allocated for school districts.”

Resources for residents

Residents seeking relief from rising appraisals could utilize a homestead exemption to set a cap on the amount their primary home increases in taxable value year over year.

Properties with a homestead exemption have a 10% cap on the increase in their taxable value year over year, and homestead exemptions withhold some value from being taxed by certain entities. Homestead exemptions withhold $40,000 in value from being taxed by school districts.

“The homestead exemption remains the easiest way a homeowner can reduce their property taxes by as much as 20%,” FBCAD Chief Appraiser Jordan Wise said in a release.

Residents seeking relief can find more information on exemptions on the FBCAD online exemptions portal.

Dave Manning contributed to •this report.