“Generally speaking, homebuying has eroded as prices and mortgage rates have increased,” said Clare Losey, an assistant research economist with Texas A&M's Texas Real Estate Research Center, during a Nov. 30 interview.

A study from the real estate center published on Nov. 4 compared data from 2011 through the third quarter of 2022. The study, completed by Reece Neathery, Harold Hunt and Losey, found several key factors in determining housing affordability have risen dramatically over the past decade, including the 30-year fixed mortgage rate.

According to the study, first-time homebuyers must factor in a monthly mortgage payment that is nearly three times as high as it was a decade ago. In 2011, the average mortgage interest rate of 5.62% equated to a monthly payment of $865. First-time homebuyers in 2022 pay an average of $2,379 per month for that same interest rate. Moreover, the actual mortgage rate has increased considerably over the past year.

According to the study, mortgage rates have increased from 3.82% in the first quarter of 2021 to 5.27% in the second quarter, before settling at the existing rate of 5.62%.

The increase in mortgage rates is the result of a set of variables, including a reproachful lending market that continues to eye the Federal Reserve System, according to the report. As of Nov. 30, the federal interest rate lies between 3.75% and 4% after three straight 0.75% increases in a row, including one on Nov. 2. The federal interest rate has risen dramatically as the Fed attempts to curtail inflation, which reached its peak at nearly 9% in July.

Affordability

The number of people within the Houston-The Woodlands-Sugar Land market area that could qualify for a 5.62% mortgage rate in 2022 is 24.8%, a figure that is down more than 30% from 2011. According to the affordability study, the required household income to obtain a 5.62% fixed mortgage rate for repeat buyers—a group that Losey said typically enjoys more latitude when applying for a loan due to proven lending history—is around $107,000.

Moreover, the percent of homebuyers who can afford the median sales price of an actual home within that same market area was 45.7%, a decline of more than 25% since 2011.

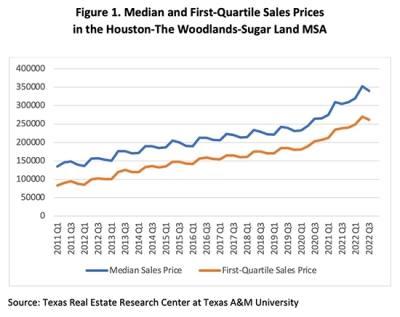

The study points out that the median home price within the area has increased from $148,500 in the third quarter of 2011 to $340,000 in the third quarter of 2022.

Home price acceleration has decreased over 2020-21, which saw a rise in home prices of 15.5%, but still remains high at 11.5% from 2021 to 2022. Losey points out that while the median family income has increased 34.18% from $52,800 in 2011 to $70,850 in 2022, gains are offset by rising mortgage rates and a skittish lending market.

“While the rise in median family income outpaced the growth in median home price, the substantial uptick in mortgage rates essentially offset the effect of higher median family income,” the study reads.

Wary lending

Two key factors for determining affordability are the debt-to-income ratio and the loan-to-value ratio. According to Losey, the loan-to-value ratio is “simply a measure of the loan amount to the value of the home,” and is inversely proportional to the down payment on a house.

In other words, the more you pay as a down payment, the lower the loan-to-value ratio, Losey said. This is critical for determining loan eligibility—if loan-to-value ratios are higher on average, that means fewer people can afford the down payments required of an elevated housing market.

A higher loan-to-value ratio means a larger mortgage loan and often a higher interest rate. For homebuyers, this often equates to an increase in mortgage insurance premiums as lenders attempt to protect their investments. It also means mortgage credit standards are tighter as lenders remain wary of higher investments. For those with substandard credit or without a nest egg in place, purchasing a home can simply be an impossible ask.

Similarly, the debt-to-income ratio is affected by the size of homebuyers’ mortgages. The affordability study assumes a 30% debt-to-income, which Losey explains as being composed of student loan debt, credit card debt, car loan debt and monthly mortgage payments.

Data for the study was extrapolated from the U.S. Census Bureau, the Bureau of Labor Statistics and the Texas Real Estate Research Center at Texas A&M University.

The full report may be read here.