First-time homebuyers should know the purchasing experience goes beyond viewing properties and getting the keys.

Jo Ann Stevens, a Sugar Land-based realtor for Lane Real Estate with a 40-plus year career, got into helping first-time homebuyers as her friends’ children began buying homes.

“All of the sudden I was thrown into that first-time homebuyer market, and I enjoyed it because I was helping them find their home in their price range in the right neighborhood,” Stevens said.

Question: What should first-time homeowners expect?

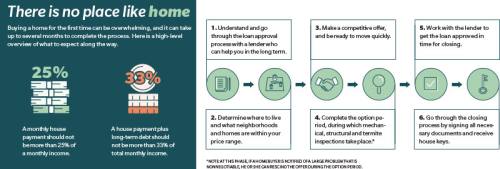

Answer: The first thing people want to do when they are ready to find a home is jump out and go look at property. There’s so much preparatory work that really should be done before that process starts. I think understanding the process, particularly for a first-time homebuyer, is so important because buying a home can be at a minimum 30-45 days and at maximum it can take several months. I try to sit down with my buyers and explain to them what the process is and how it works and all the different pieces of the process. Not only are we going to arrange for financing and the process that entails, but we are going to look at homes, we are going to negotiate price, we are going to go through an inspection process.

Q: What should new homeowners look for in a new home?

A: If you’re looking at new construction, I would do a little bit of background on builders. I would look at them to see how long they’ve been in business and what are their ratings, particularly on warranty work—things that you find after you moved into the house for the first year. Houston has the Greater Houston Home Builders Association—are [the builders] members of that? Check the Better Business Bureau. There’s a lot of builders in Houston. You want to be careful that you don’t get involved with a builder who is having financial problems and not going to be able to finish your home.

Q: What should first-time homeowners look for in an already-built home?

A: If you’re looking at resale, you can use some of the [GHHBA and BBB] information because often you can determine who built that house. I also think that with a resale, inspections that you do during the option period are so very important. I know that sometimes a first-time homebuyer can be strapped for money and if they save for their down payment they don’t have a lot of extra money, but an inspection shouldn’t run more than $300-$500, depending on the size of the home. That’s probably the best investment you’ll ever make because it could prevent you from buying a home that has a hidden problem.

Q: What should first-time homebuyers know about financing a home?

A: A great deal of that is going to depend on their monthly income, and we also have to look at long-term debt. Those are things we try to tell a prospective homebuyer from the very beginning. Having a good credit score is all about getting the best interest rate. A good rule of thumb is your house note should not be more than 25% of your total monthly income, and your house note plus your long-term debt should not be any more than 33% of your total monthly income. But, you also have taxes, insurance and homeowners association dues, so it’s understanding what the whole payment will be.

View our other Real Estate Edition coverage.