“I could probably sell [my house] now for double what I purchased it for,” Smith said.

The overview

Smith is among thousands of Spring-area residents facing property tax spikes due to rising home values as more than 95% of homeowners countywide saw sizable property value increases in recent years, averaging 23.3% in 2022 and 17.3% in 2023, according to Harris Central Appraisal District data.

But relief is on the way as Texas lawmakers approved an $18 billion plan during special legislative sessions this summer that Lt. Gov. Dan Patrick said would save the average homeowner $1,250-$1,450 on their 2023 tax bill.

What you need to know

Despite entities such as Spring and Klein ISDs lowering property tax rates in recent years, property appraisal increases have resulted in higher tax bills for local homeowners.

State legislators approved a plan to address property tax increases in mid-July, closing out the second special session of the year.

“If passed by voters this fall, Texas homestead exemptions [for school district taxes] will rise to $100,000, senior homeowners will be protected from being priced out of their home, the small-business exemption for the franchise tax will double, and Texas small businesses will be protected from excessive appraisal increases,” Gov. Greg Abbott said in an Aug. 9 news release after signing off on the plan.

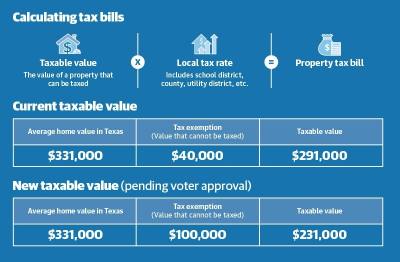

The $18 billion package includes two bills—Senate Bills 2 and 3—and a constitutional amendment. For the tax cuts to show up on this year’s tax bill, Texans must approve the constitutional amendment, Proposition 4, in November. Homeowners would also need to apply to receive the homestead exemption.

This tax relief comes after back-to-back years of what Harris Central Appraisal District officials called “unprecedented” property value increases. The average homeowner saw 23.3% and 17.3% market value increases in 2022 and 2023, respectively, following 8.9% and 10.4% increases in 2020 and 2021, respectively.

What else?

If Proposition 4 passes, the homestead exemption will be raised, and homeowners will pay reduced taxes to their local school districts.

- ISD tax rates will decrease by 10.7 cents.

- The state will distribute $12.7 billion to schools.

- For a $300,000 home, decreasing the school district tax rate by 10.7 cents would cut an average tax bill by $321.

- The value of a property worth $5 million or less cannot increase by more than 20% year over year.

- This applies to all nonhomestead property, such as second homes and commercial property.

- Approximately 13 million properties will qualify.

- Businesses that make less than $2.47 million annually will no longer have to pay the tax.

- Roughly 67,000 small and midsize businesses will be exempt from the tax.

- Collectively, qualifying business owners will save around $300,000 each year.

Why it matters

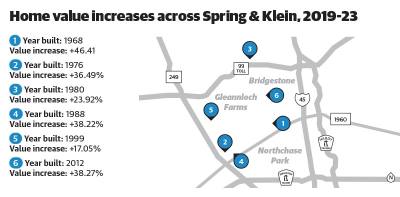

Property values increasing has been a trend across homes in the Spring and Klein area.

Per Houston Association of Realtors data, property values have increased by at least 17% since 2019 across each of the six ZIP codes that comprise Community Impact’s Spring and Klein coverage area.

A random sampling of homes on the market in August built between 1968-2015 and located in neighborhoods such as Bammel Forest, Champions Park and Sanctuary Veritas all experienced double-digit value increases over the past five years.

What they’re saying

- “We must balance the needs of government with the limits of a taxpayer’s wallet.” —State Sen. Lois Kolkhorst, R-Brenham

- “The signing of this Texas-sized tax cut, the biggest property tax cut in history, is a massive victory for all 5.7 million Texas homeowners.” —Lt. Gov. Dan Patrick

- “Forty percent of [Texans] rent. ... They often live month to month on their salaries. ... We are specifically leaving out 40% of this state.” —State Rep. Gene Wu, D-Houston

After the legislation was approved, three Democratic state representatives, including Ron Reynolds, D-Missouri City, of the Houston area, released a statement condemning Republicans for providing more tax relief to certain groups.

“Texas Democrats fought hard for the millions of Texans who rent, who are teachers or who send their children to public schools, but they were entirely neglected in the process by Republican leadership,” the statement says.

While school districts will receive state funds to offset lower property tax revenue, overall school funding will not change. Lawmakers are expected to return to the Capitol this fall to discuss school funding, Lt. Gov. Dan Patrick said.