To help guide these individuals, Community Impact Newspaper spoke with Ben Gonzalez, a spokesperson with the Texas Department of Insurance, to learn more about the importance of health insurance and what options are available.

According to Gonzalez, the TDI is the state agency that regulates the insurance industry in Texas, which includes all lines of insurance and any insurance companies that are licensed to sell insurance in Texas. In addition, the agency also provides consumer education. This interview has been edited for length and clarity.

Is increasing unemployment causing more Texans to become medically uninsured?

We understand that's happening anecdotally. We all know somebody who's unemployed right now that wasn't a few months ago. Texas has a large population that's uninsured to begin with, before all the pandemic stuff, and about half of those people that did have coverage were getting it at work, so we know that this is happening.

What options are available for people who have lost their medical insurance with their job?

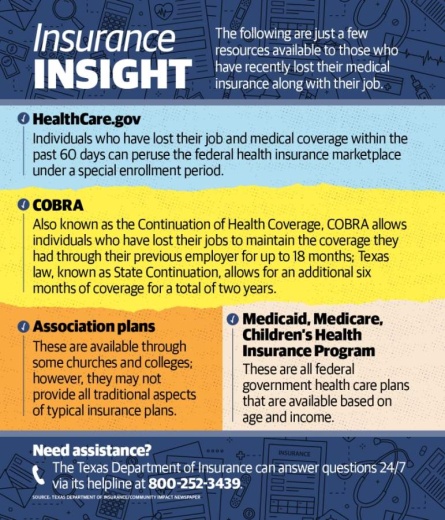

One of the options that is available that isn't usually available this time of year is healthcare.gov. People may know it as Obamacare or the Federal Exchange; it goes by lots of different names, but it's the health marketplace that was set up by the federal government, and typically it's only available in the fall for a short enrollment period that starts in, I think November, but if you had coverage at your job and you lost that job and subsequently the insurance coverage that went along with it, that qualifies as a special enrollment period, which means you can go to healthcare.gov as long as that job loss and that coverage loss is in the last 60 days. That qualifies as a special enrollment period, which means you can shop healthcare.gov right now; there doesn't have to be any kind of special opening; it's a special enrollment period for that individual.

Is the healthcare.gov special enrollment period a new initiative by the federal government, or has it always been in place?

It's always been in place to kind of assist people in maintaining health coverage over time because you don't want it to lapse, especially if you have pre-existing conditions that you need to care for on a daily basis—cardiac issues or diabetes, those kinds of things—so that was put into place to give people an option outside of the regular enrollment periods in order to give them an opportunity to get insurance on their own. But again, if you were getting it at work, it was likely subsidized or paid for fully by the employer; this means you'll have to shop for a plan that fits your budget.

How does the cost compare between getting insurance through an employer and getting insurance through healthcare.gov?

It depends on the job and how good the benefits were where you were getting it, but for many people it was either a very low cost or no cost at their job; here there will be some cost, but there's also subsidies built into the federal program, so it is based on your income. Maybe there's two people at your home who were working and one of them loses a job; that means there is some income, so you'll have to pay some there, but if you've lost your job there's likely going to be subsidies to help you get a plan. You'll have to choose from different levels of coverage and match those up with what your needs are medically. And if you were already getting your insurance through healthcare.gov and if you've recently had a drop in your income, then you can go back to them and say, 'Hey, my income has changed,' and they can readjust that subsidy.

Aside from healthcare.gov, what other options are available for those without medical insurance?

You can certainly contact any insurance company directly on your own. They usually have offices that you can call directly and ask them about individual plans or plans for your family, and those are available at any time of the year. But again, that's a plan that you'll have to see if it fits your budget.

If it's critical that you maintain the coverage that you already had, there's COBRA, which is another federal law that allows you to keep the coverage that you had with your previous employer for up to a year and a half. But again, the cost is going to be substantial because with the plan that you got through your employer, it was likely being subsidized in part by that employer as a benefit to you, so if you have to go on COBRA, you'll have to pay the entire premium, and that can be quite a shock to some people if they haven't seen or paid attention to how much their employer was actually covering the expenses. But if that's the only way that you can get the treatments that you need or the medicine that you need, COBRA is available to you by law. So that's 18 months, and Texas law has something that's called State Continuation, which adds another six months to that so you can get up to two years of maintaining that same plan that you had at your previous job. But again, all that cost comes out of your pocket, so that may be difficult to do if you don't have a job, but if you have savings, that can be an option. If you want to do COBRA, you're going to talk to your HR department at that former employer and ask them to help you set up that paperwork.

There's also things called association plans that may be an option, and these are generally through an employer organization or church; sometimes schools like colleges can offer plans, but we just want to caution everyone that these may not have all the traditional aspects of an insurance plan that you would get from an insurance company, so just be aware that you want to make sure what that plan covers and whether it works for you. But those are some options that you can check on and see if your church or school offers anything.

Also, depending on your age you could get on a parent's plan. That's one of those things we don't always think about once we get into the workplace on our own, but if you're under the age of 26 you can get on your parent's plan. You don't have to be living with them; you don't have to be going to school—I think in the old days you might have had to be a full-time student to maintain that coverage, but with changes in the federal laws, now you just have to be under 26, and then you can be on your parent's plan for the time being. You can be married, have other jobs—as long as you're of that age group you can get on your parent's plan.

If one person in the family like your spouse still has coverage through an employer, you can definitely try to get on with that company's plan; again there's usually an increase in the premium you'll have to pay, but that's another option for you.

Medicaid, Medicare and the CHIP program—those are also federal government plans out there, especially if you've never considered them in the past, if your health care bridges is an immediate need, you may want to look into those.

Is there any advice you would give to someone who has lost their medical insurance with their job?

We don't push any kind of products [because] we are a state regulator. But certainly, health insurance is the best way to get medical coverage; you don't want to be completely bare without any kind of coverage because then your options become more limited. You're left with community clinics—which are great options and available to people—and of course the emergency room, but that's an expensive way to take care of health needs. Health coverage is a great way to think about preventative care and doing what you can to not become very sick; it's a lot cheaper to go the preventative route than to go the emergency route.

TDI is a state agency; we are a regulator; we don't sell things, so you can always come to us for information on the website, and we also have a helpline which is 1-800-252-3439, and we have people there all the time to answer questions about the different options that may be available to you; they're not going to be selling you anything; they'll just be providing you information, and they can help you understand things. So we're here as a resource for all of Texas.

One other thing: We have a coronavirus banner on our website, and if you click on that, you can see what other companies have done as far as health plans in terms of waiving costs for coronavirus testing and also for things like telemedicine instead of going to the doctor—so we have links to each of those companies that have told us they're doing things like that, so that's another resource out there.