The Spring ISD board of trustees trustees unanimously lowered the district’s total tax rate by about $0.07 for fiscal year 2021-22 on Oct. 12.

The new total tax rate for FY 2021-22 is $1.3128 per $100 valuation—down from last year’s tax rate of $1.3843. The district received its certified property values, which total about $16.4 billion—an increase of 6% from fiscal year 2020-21—on Aug. 20.

The total tax rate includes a maintenance and operations tax rate is $0.9028, and an interest and sinking tax rate of $0.41.

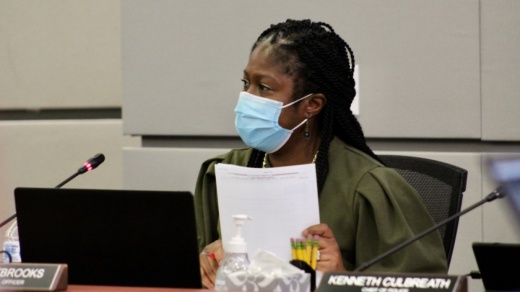

“The tax rate ... is made up of two components,” SISD Chief Financial Officer Ann Westbrooks said. “The first is the M&O portion of the tax rate, which supports the general fund budget. ... The I&S portion of the tax rate ... supports our debt service, so that's paying off our bond debt.”

Typically, school boards would hold a public hearing on a proposed tax rate before approving it. However, SISD's board was able to approve the district’s recommended rate on Oct. 12 without a hearing, because a hearing was held for a higher set of proposed tax rates in June, Westbrooks said.

While the district’s total tax rate represents a decrease from last year’s rate, the resolution trustees passed states that the rate will increase.

“Since the proposed rate is higher than [the] no new [revenue] rate, then it's considered, effectively, a tax increase,” Westbrooks said. “And so we are required by law to have that language written into the resolution and the ordinance.”

Multiple trustees expressed dislike of this requirement.

“We are required by statute to move that the property tax rate is being increased,” Board Vice President Winford Adams Jr. said. “That's disturbingly political and unfortunate.”