In January and February meetings, city staff presented plans to Pearland City Council to address a $10.3 million deficit alongside a roadmap for how the city will assess its financial needs in the coming months. The city aims to approach its deliberations for the next fiscal year’s budget with all of the correct information it needs to set accurate tax rates and balance a potentially tight budget. The council has also hired third party Strategic Government Resources, or SGR, to audit the city’s tax collection process.

“Now, I’m not going to say this was a fatal blow, but we had to go through triage,” Mayor Kevin Cole said at a State of the City event Feb. 9 in reference to the November financial crisis.

Discovery and initial response

City staff discovered a problem with a 2022 property tax evaluation worksheet in November when evaluating a potential tax increment reinvestment zone. The value of some Pearland properties in Harris County were recorded as $1.3 billion versus the actual value of about $30 million, according to city staff.

City staff said the error occurred between the Brazoria County Tax Office and the Harris Central Appraisal District, which is the office that provided Brazoria County the values. However, a statement from HCAD released to Community Impact by Chief Communications Officer Jack Barnett claimed the information HCAD provided was correct.

“HCAD provides value information to all—over 600—the taxing jurisdictions in the county, and that information is required by the tax code and done in accordance with state law,” the statement reads. “However, the [calculation] the jurisdictions must do is very complex.”

District 11 state Sen. Mayes Middleton, R-Wallisville, previously acknowledged the complexity of the calculation process that led to the city’s financial troubles.

“One of the good news in all of this is ... the city adopted a tax rate below the no-new-revenue rate, which is a really good thing,” Middleton said. “That means it actually was a tax cut, ... but at the same time, we need to make sure that those calculations are done correctly.”

The incorrect worksheet was discovered in early November after the city had already passed its annual budget in September, and the largely overvalued properties forced the city to reconcile with a $10.3 million deficit and incorrect tax rates. On Nov. 22, City Council fired City Manager Clay Pearson in an effort to bring the city staff a change in leadership and seek accountability, promoting Deputy City Manager Trent Epperson to the role in the interim.

The city has since passed a variety of refinancing moves, such as adjusting spending and refinancing debt to cover the unexpected debt. A job posting for the open city manager position went live in mid-February on the website for SGR, the consultant group that will assist the city’s audit of its tax calculation process.

“We’re going to be hiring a consulting group to help us understand even more clearly what happened,” Cole said. “But also, more importantly, how could we have caught it? And what are our best practices moving forward?”

Road to recovery

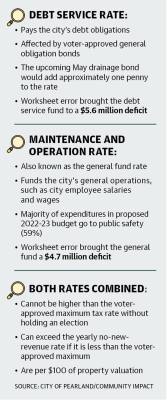

City staff gave a presentation at a Feb. 20 City Council meeting that announced a new plan to manage the city’s debt service tax rate in future years after the worksheet error caused an artificial drop in the property tax rate.

City staff announced in the presentation that the city acquired a corrected version of the tax worksheet from the Brazoria County Tax Assessor-Collector. The corrected sheet will allow staff to more accurately project the city’s future budgets and tax rates.

“We’ve removed one of the big unknowns in our planning moving forward,” Epperson said.

During the presentation, city staff and financial adviser John Robuck proposed a plan that would transfer reimbursements from the Shadow Creek Ranch TIRZ to the city’s debt service fund.

They said this would allow the city to reduce its outstanding debt over the coming years, allowing for a lower tax rate rebound than previously expected.

According to the presentation, the new highest estimated debt service tax rate is an increase from $0.3388 to $0.365, rather than the previous estimation of $0.395 per $100 of property valuation. These projected rates both assumed the passage of the upcoming $181 million drainage bond package coming to ballots on May 6.

Pearland’s Budget Officer Eric Roche said during the presentation that current tax projections are not indicative of what individual residents’ property tax bills will be next year.

“We don’t have that information yet,” Roche said. “We don’t know what your home or property may be worth next year.”

Council Member Alex Kamkar protested the plan, saying the way to keep the city’s property tax rate low is to reduce city spending. He said the general fund budget is “much larger” than the city’s tax base can afford.

“While I am glad to hear we are finding solutions by rolling over debt, we need to take a harder look at reducing general fund spending instead of depending on financial wizardry to solve our long-term spending issues,” Kamkar said.

At a Feb. 13 meeting, the council approved a $36,750 contract with SGR for a two-phase 24-day audit process: first, gathering information through interviews and document reviews, then followed by final recommendations to the council.

City Council has sought an audit of its tax calculation process since Nov. 21, when it passed an agenda item to select a third party to review and prepare a forensic audit of the parties and processes involved with the 2023 budget process.

“We wanted to get this done sooner,” Cole said. “The hard part was finding independence and finding a group that really hadn’t worked for the city, hadn’t worked for Harris County, hadn’t worked for Brazoria County or any of the other entities—and that really was the hang-up for getting there.”

City manager search

After Pearson’s removal Nov. 22, the search for a new city manager opened up to the public in February, with a closure date of March 19, according to the job posting. Pearson had served as the city manager since March 2014.

“Nobody wants to go through [firing a city manager] because there’s a human side,” Cole said. “But at the end of the day, council felt it necessary that we needed to change the direction.”

The posting calls for a candidate with at least 10 years of local government experience. It describes the responsibilities of the city manager as providing executive leadership for Pearland and all its operations, and the role is the “go-between for the elected policy body, the City Council, the community and the city organization.”

Epperson said he is considering applying for the open role at a Feb. 20 meeting. Kamkar said the city has received 18 applications for the position as of March 6.

“We’re searching wide and hard,” Cole said. “We want to make sure that we have the best person for the 130,000 people that call Pearland home to run the everyday operation of our city.”