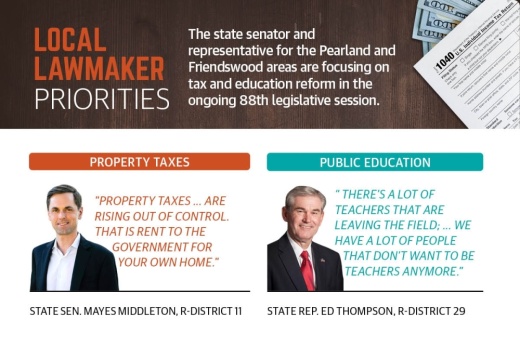

State lawmakers for the Pearland and Friendswood areas—Rep. Ed Thompson, R-Pearland, and Sen. Mayes Middleton, R-Wallisville—both signaled an interest in reforming how school districts receive funding from the state to combat property taxes and an ongoing teacher shortage. These needs were also expressed by city and school district officials in Pearland and Friendswood.

While local lawmakers have not filed bills directly pertaining to these topics, other lawmakers in the state House and Senate have, and the deadline for filing bills will occur 60 calendar days after the start of the session, or March 10.

At Texas Gov. Greg Abbott’s Jan. 17 inauguration speech, he indicated the 88th Texas legislative session will come with a $32.7 billion state surplus.

“[We] will use that budget surplus to provide the largest property tax cut in the history of the state,” he said.

Middleton is the senator of District 11, which encompasses Brazoria and Galveston counties and part of Harris County. He said the surplus could be used to relieve local taxpayers by “buying down” the rate, or paying a lump sum of money to districts to allow them to reduce their property tax rates.

Three state House representatives so far have filed bills this session that relate to allocating the surplus state revenue to the property tax relief fund to reduce district maintenance and operations property taxes.

“We’ve wanted that for a long time ... because it provides real relief to local property taxpayers; their bill goes down a lot,” Middleton said.

Education reform

Legislators are expressing an interest in major education reform this session, with many bills being filed relating to a slew of topics from public school funding to electronic cigarettes.

Thompson said the state needs to continue to work with public schools on funding, which has shifted from being predominantly state-funded to mostly locally funded over the span of several years.

House Bill 3 from the 86th Texas Legislature in 2019 was the last time the basic per-student allotment of funds was increased from $5,140 to $6,160, and some local school districts said inflation and the COVID-19 pandemic brought an urgent need for change. The state gives schools $6,160 per student who meets the average daily attendance threshold, or the sum of attendance counts in a school year divided by the number of days schools are open.

Sen. Nathan Johnson, D-Dallas, filed Senate Bill 88 this legislative session, which would increase this allotment to $7,075.

“There’s a lot of issues [with school funding] that we can do to help,” Thompson said. “We’ve had some great meetings with both Alvin ISD and Pearland ISD, some great ideas that we’re going to take up and work on.”

Pearland ISD Superintendent Larry Berger said one of the topics he discussed with Thompson was the unfunded state mandate of full-day pre-K from the 2019 Texas Legislature, which requires full-day prekindergarten to be provided for all eligible 4-year-old students.

Exemptions to the mandate could be provided to districts that would have to construct facilities to host pre-K classes or if implementing the mandate would result in fewer eligible children being enrolled in pre-K.

“We’re only funded at half-time pre-K. ... We are providing 100% of the education that the state asks us to do, but they’re only giving us 50% of the funding,” Berger said.

Berger said the pre-K mandate is an example of some of the funding gaps in the school financing system that led to budgetary concerns for Pearland ISD, including a projected $15 million deficit for the fiscal year 2023-24 budget. He said the district’s drop in average daily attendance during the pandemic also contributed.

Thompson also expressed interest in establishing a cost of living allowance for retired teachers, as well as a pathway for them to return to work without penalty.

“There’s a lot of teachers that are leaving the field; ... we have a lot of people that don’t want to be teachers anymore,” Thompson said.

Berger echoed concerns for teacher retention, hoping to see adjustments to teacher compensation and benefits from the legislative session.

Tax reform

Pearland Mayor Kevin Cole said school funding is directly tied to a problem of high property taxes in the state, saying the biggest property tax that residents pay is from school districts. He said the state’s surplus could be used to address the issue.

“[As] you got teachers and others whose livelihood comes through those property taxes, what system are they going to set up in place?” he said.

Cole also said he hopes for changes to the law in regards to tax calculation worksheets that cities depend on for determining property values. The city of Pearland received an incorrectly calculated worksheet last summer when developing the FY 2022-23 budget, leading to the city to adopt a lower tax rate and face a $10 million deficit.

The worksheet assessed property values in the areas of Pearland in Harris County. The city is working to try to receive a corrected worksheet from the Harris Central Appraisal District to have accurate figures to work with for developing future budgets.

“We want to make sure that not just us, but any city, county, whatever that comes after us, if there’s an error, there’s a very clear path on what you have to do,” Cole said.

Middleton expressed a variety of concerns regarding taxes in the state, saying property taxes are “rising out of control,” calling it “rent to the government for your own home.” He said he seeks to limit the amount that property values increase to further limit taxes.

“Property tax relief is a great way to let people keep their own money in their own pocket and help small businesses,” he said. “It gets people to move here.”