Real estate experts said developers and investors began planning multifamily projects two or three years ago when interest rates were at record lows. Bruce McClenny, industry principal for MRI ApartmentData, said because of this trend, he saw more apartment complexes open in 2023 and 2024 than he has in his entire career.

This spike can also be attributed to population growth and job growth, said Steve Spillette, president of real estate research and planning firm Community Development Strategies.

In a nutshell

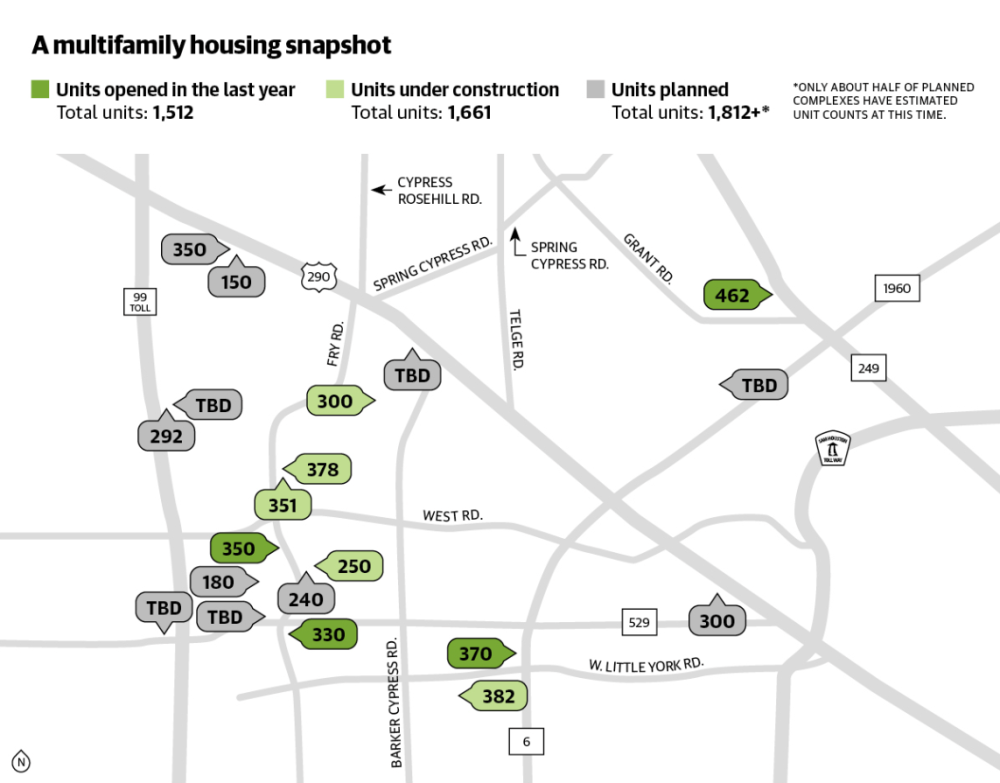

Most of Cy-Fair’s newest apartment complexes are coming to the 77433 ZIP code—south of Hwy. 290 between the Grand Parkway and Barker Cypress Road.

Boutwell Properties, a local real estate company, reports half of Cy-Fair’s single-family home sales each month are in this ZIP code, which has the highest median household income in Cy-Fair at $134,390, according to the U.S. Census Bureau’s 2022 American Community Survey 5-year estimates.

Allora Parkland and Alexan Cypress Creek opened in April with 378 and 351 units, respectively. ZRS Management oversees both properties off Fry Road in Cypress.

Paighton Hagenlocher, regional manager with ZRS Management, said she believes Cypress has a “strong demand” for multifamily options as residents look to sell their homes and downsize in an area with quality schools.

“The substantial increase in population in Cypress over the past few years demonstrates the growing desirability to live in and around Bridgeland and Towne Lake,” she said in an email.

Each community offers amenities such as outdoor living areas with pools, hammocks, grilling stations and gaming areas; fitness centers; dog parks; bicycle storage areas; electric vehicle charging stations; a biergarten; and a pickleball court.

Monthly rent at these properties range from $1,405-$2,195, not including utility costs and other fees.

The Houston Association of Realtors reported only 40% of Houston-area households could afford a median-priced single-family home in the first quarter of this year. The median mortgage payment during that time was $2,340 including taxes and insurance—about 86% higher than the average base apartment rent in Cy-Fair, which is $1,260, according to MRI ApartmentData.

Diving in deeper

Patrick Jankowski, chief economist and senior vice president of research for the Greater Houston Partnership, said in a May multifamily market update that Houston has shifted from a landlord-friendly to a tenant-friendly market because:

- Average multifamily occupancy is below 90%.

- Rental rates have fallen over the last year.

- Incentives, such as free rent, are prominent.

- Developers continue to overbuild.

Cy-Fair’s average multifamily occupancy rate dropped from 92.3% in the second quarter of 2022 to 87.5% this May, MRI ApartmentData reported.

With 19,000 apartment units under construction in the Greater Houston area and another 33,000 planned as of June 1, Jankowski said supply greatly exceeds demand.

“An industry rule of thumb holds that Houston absorbs one apartment unit for every six jobs created,” he said. “At the current pace of construction, Houston will need to create roughly 114,000 jobs to absorb what’s currently under construction. The partnership’s forecast calls for the region to create half that many jobs—57,000—this year.”

Taking a step back

Because interest rates have basically doubled in the last few years, the cost of financing new apartment projects is less sustainable for developers today, McClenny said.

“That causes a lot of problems for a lot of companies to have to ante up more capital to cover that,” he said. “The other thing that’s going on in Gulf Coast markets is insurance has really gone through the roof.”

Apartment operators are paying more than double for insurance now than they were before the COVID-19 pandemic, according to RealPage, a property management software corporation. The national average insurance cost for apartment owners was $30 per unit per month in January 2019 and $70 per unit per month five years later.

RealPage reports Houston apartment owners pay an even higher premium due to the region’s recent history of inclement weather events at $128 per unit per month. That’s about $384,000 to insure a complex with 250 units annually.

What to expect

Demographic consulting firm Population and Survey Analysts predicts multifamily housing growth in Cy-Fair ISD’s boundaries will exceed single-family housing growth for the first time in 2025-26.

“As the district builds out ... the number of multifamily units becomes a greater proportion of the ... contribution to the housing stock because it can be infill on small parcels of land in an area that’s otherwise built out,” President Stacey Tepera said at an April CFISD board meeting.

Additionally, build-to-rent housing is an emerging trend with approximately five communities in the works across Cy-Fair. PASA projects 1,345 build-to-rent units over the next decade. These single-family neighborhoods are designed specifically for renting.

“It's something that all of a sudden has gained popularity and addresses the needs of people in search of housing to rent,” McClenny said. “It's great to go into some of these neighborhoods that [residents] feel like, ‘I'm in a single-family home. I'm living the single-family life in suburbia, and I can afford it because I'm renting.’”

Jovanna Aguilar & Cassandra Jenkins contributed to this report.