Do they raise tax rates to get ahead of future budget holes and build funding that can be used for future coronavirus relief programs, or do they lower taxes to provide relief to homeowners amid the pandemic?

In Harris County, the debate is still underway, and the decision could mean the difference in millions of dollars. Jersey Village officials are waiting to learn how home values have changed since last year before setting a tax rate, but officials plan to keep homestead exemptions flat, citing the uncertainties of what the future may hold.

Some call for tax cuts in Harris County as discussions play out

The tax rate conversation is still underway in Harris County and is likely to be taken up the next meeting of the commissioners court Sept. 15. Officials are considering calls to provide taxpayer relief amid the coronavirus pandemic alongside efforts to follow through on policy goals in 2021 and the potential costs of continuing to support residents in need.County leaders have called for increased investments over the last two years in areas such as early education and criminal justice reform. Following the spate of protest marches in June, commissioners set a number of criminal justice studies in motion that could turn into budget items next year, including the potential development of teams that would provide alternative responses to certain criminal justice calls.

Officials have effectively ruled out the “voter approval” rate, or the highest possible rate which can be set before a jurisdiction is required to get approval from voters through an election.

Instead, commissioners were considering a tax rate that would raise 3.5% in additional revenue, a rate that would keep the property tax burden on residents the same as last year, or somewhere in between. Keeping the tax burden the same, also known as the “no new revenue” tax rate, could result in a $10 million budget shortfall for the county, but would likely not require staff cuts or endanger pensions, according to comments made by Budget Director David Barry at an Aug. 6 meeting. However, as of Sept. 12, there is no official indication of how the county's budget will be affected nor what could be cut if a shortfall is seen.

One element of the conversation is the need to strike a balance between funding the county’s many budget priorities and providing relief to taxpayers who are hurting from the COVID-19 pandemic, which has led many businesses to shut down and unemployment to soar across almost all sectors of the economy.

The county embarked on a number of criminal justice studies in June that could turn into budget items down the road, including one study that involves looking into alternative responses to criminal justice when it comes to calls related to homelessness, poverty, substance abuse and mental health situations.

The study was proposed by Precinct 1 Commissioner Rodney Ellis, who said he wanted his fellow commissioners to remain open to funding the priority. Ellis expressed his personal willingness to commit at least $25 million to developing alternatives to criminal justice responses related to homelessness, poverty and substance abuse.

In a Sept. 2 email statement Ellis reiterated his desire to see the county "invest in effective public safety strategies that connect people to the resources they need, not punish them for being in need."

Jennifer Bourgeois, a professor with the Lone Star College-CyFair Criminal Justice Department and a fellow in the Houston-based Center for Justice Research at Texas Southern University, said the effort could go far in addressing the flaws in the existing system.

“Often times what we see is a lot of pomp but no action,” she said. “[Providing funding] would actually build trust in the community.

At an Aug. 6 meeting, Precinct 4 Commissioner Jack Cagle said he believes the court should keep homeowners in mind who may be suffering economically as a result of the pandemic. He said he plans to support the “no new revenue” tax rate.

“This is not the time to be increasing taxes on our constituents,” he said.

In conservative approach, Jersey Village to keep tax rate homestead exemptions flat

In Jersey Village, officials are waiting to propose a tax rate until they receive information from the Harris County Appraisal District on how home values have changed from last year. However, in July budget talks, city council members indicated they would not increase homestead exemptions, citing uncertainties posed by the pandemic.

Jersey Village has historically kept its tax rate flat, but City Council members approved a homestead exemption increase in 2019 from 8% to 14%. The bump meant the owner of a $200,000 home paid about $89 less in property taxes last year.

A homestead exemption is set each year by elected officials and determines how much homeowners within a jurisdiction can reduce the value of their homes when calculating the amount of property taxes they owe. In Jersey Village, the bump to 14% meant the owner of a $200,000 home paid about $89 less in property taxes last year.

When the exemption was raised in 2019, several council members and Mayor Andrew Mitcham said they would consider raising it again in 2020. However, with the coronavirus pandemic and economic fallout still playing out in Houston, council members agreed it would be better to hold off this year.

“I think the more responsible course is to regroup next May and see where we stand, and hopefully by then there is a vaccine and we’ve got this well behind us and we’re churning back along like we were before this pandemic began,” said Council Member Bobby Warren, who campaigned on raising homestead exemptions.

The coronavirus pandemic also prompted city officials to reassess plans for capital improvement projects. In a preliminary budget—one that City Manager Austin Bless said should see few changes before adoption Sept. 21—about $8 million was earmarked for capital improvement projects, some of which were carried over from the previous fiscal year.

A potentially $5 million project to build a new convention center at the Jersey Meadow Golf Course has been paused, and Mitcham, in a July budget workshop, said the city is not likely to take any action on the item this year. However, he said the city remains committed to the project

“We do want to make sure that we’re not forgetting about this project,” Mitcham said at the July meeting. “It’s proven that if we invest in the golf course ... that benefits citizens as a whole.”

The city still intends to move forward with a project to construct a new City Hall, Bleess said. The building will be built south of Hwy. 290 within a future development that has been dubbed the Village Center, which will feature a mixture of retail, restaurant, office, hotel and greenspace at build out.

Bleess said the city still hopes to see ground broken on the Village Center later this year. Collaborate Architects, which is developing the project, estimates that it could open around 2023-24.

“Everything still is moving forward, but a little slower because of COVID,” Bleess said.

Plans move forward for expansion of Cy-Fair Fire Department

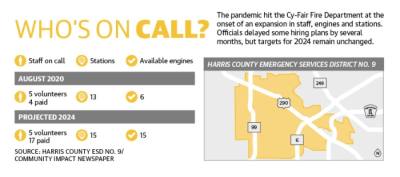

The coronavirus pandemic hit Harris County Emergency Services District No. 9 and the Cy-Fair Fire Department just as the two entities were embarking on a new chapter in their existence—one that involved making significant financial commitments to hiring more paid staff, building new stations and increasing the number of engines.

At an Aug. 20 meeting, commissioners opted to lower the tax rate, but the district is expected to raise $26.1 million in property tax revenue this year—about $1.5 million more than last year—due to increases in local home values. Annual taxes paid by the average homeowner will increase by $4.52, from $109.81 to $114.33.

Tommy Balez, the president of the board of commissioners, said the increase in revenue will help fund land purchases, station construction and hiring efforts.

“At some point we plan to hopefully reach a spot where we’re not building so much, but we’re years away from that,” he said.

In plans presented in July 2019, district officials said they were seeking to increase the number of paid staff on call at any given time from five to 17 by 2023. Over that same time, plans called for increasing the number of stations from 13 to 15 and the number of available fire engines at any given time from six to 15, one for each station.

Cy-Fair fire Chief Amy Ramon said the department hired its first round of 14 full-time firefighters in November and planned to do another round of hiring this summer, but that second round of hiring has since be delayed.

“We’ll start that process toward end of the year with the first quarter of next year in mind, which is when our new Station 5 opens up,” Ramon said, referring to a new station slated to open on French Road in Houston. “Our trucks are still fully staffed. We’re not having problems filling any shifts at all.”

Balez said the district should be able stick to its 2023 goals due to stronger-than-expected sales tax revenue and having a reserve fund in excess of $63 million. The district has plans for the upcoming fiscal year to start construction on a new Station 1 on Fairbanks North Houston Road and a new Station 6 off West Little York Road. Officials also hope to purchase land for a Station 10 rebuild, Balez said.

“If any curveballs were to come, we might delay some [capital] projects, but we’re still plowing ahead,” Balez said.