As a result, the concept of needing to buy flood insurance was a foreign idea, Martin said, especially when that flood insurance policy cost the couple $2,600 a year.

While the Martins’ home did not flood in the Memorial Day and Tax Day floods of 2015 and 2016, respectively, Hurricane Harvey in August 2017 brought close to a foot of water from Brays Bayou inside their house and caused at least $100,000 in damages.

“It was a train wreck,” Martin said. “We didn’t think we’d flood, frankly. I figured we’d be good because we survived Tax Day and Memorial Day.”

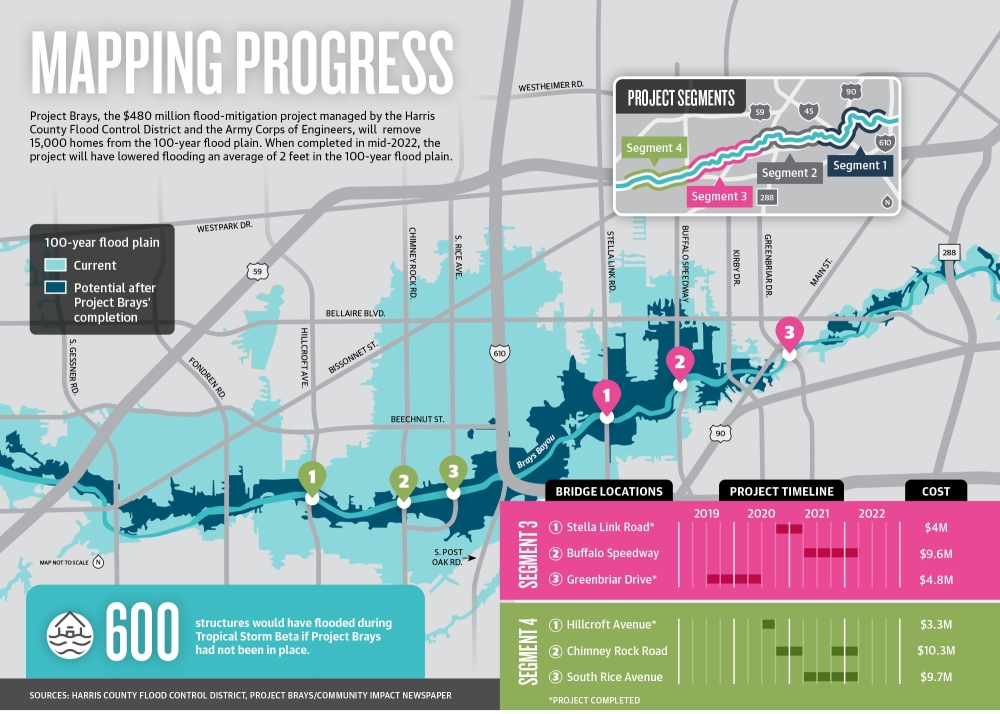

Projects designed to mitigate flooding include Project Brays, a $480 million flood-mitigation project headed by the Harris County Flood Control District and the Army Corps of Engineers. The entities are within a few months of completing some final bridge construction projects designed to aid increased stormwater flow in the Meyerland area and others that are located in the Brays Bayou Watershed, like Bellaire, during heavy storm events.

The project is designed to remove 15,000 homes from the 100-year flood plain—defined as an area that is expected to flood during a storm event that occurs roughly once every 100 years—across the 31 miles of Brays Bayou, HCFCD officials said. Project Brays will also eventually help reduce flood insurance rates for those residents when the HCFCD draws new flood insurance rate maps, which show flood risk premium zones and are slated to be turned over to the Federal Emergency Management Agency for review sometime in mid-2022, experts said.

“I think it will lower premiums because [Project] Brays is going to shrink the 100-year flood plain so that residents who are no longer in it or are farther away from the boundary should, by FEMA’s approach, have lower premiums,” said Sam Brody, a professor at the Texas A&M University at Galveston’s Center for Texas Beaches and Shores.

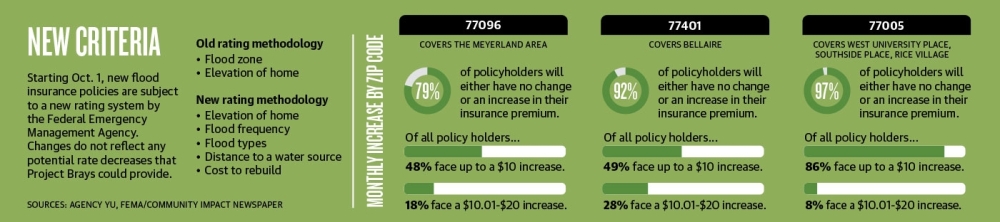

This comes as FEMA on Oct. 1 updated the methodology it used in its National Flood Insurance Program risk rating system for the first time since the 1970s. Called Risk Rating 2.0, the changes are meant to more accurately and equitably determine flood insurance premiums paid by residents.

Flood plain maps and the future

These official flood maps, which show a community’s different flood hazard areas, are changed periodically and can be changed through a variety of methods, including flood risk projects, map revisions and what are known as letters of map revision.

FEMA sent a version of one of these letters of map revision to the officials completing Project Brays, saying if the flood-mitigation project is constructed as proposed, it would satisfy the agency’s NFIP criteria and would warrant a change to a flood insurance rate map.

HCFCD Engineering Division Manager Imelda Diaz said Project Brays—which started excavation work on the main channel in 2004 and is slated for a mid-2022 completion—consists of over 75 projects, including channel-widening improvements along 31 miles of Brays Bayou that were completed earlier in 2021. In addition, five stormwater detention basins have been completed.

The final piece, which includes bridge demolition and reconstruction across Brays Bayou to make way for higher bridges that allow for greater flow, is entering its final phase with a total of eight bridges under construction. Two bridges are being raised in the Greater Meyerland area: one on South Rice Avenue and one on Chimney Rock Road. Both bridges are to be completed by late winter 2021 to early spring 2022, Diaz said.

The project could bring flood insurance rate relief to residents such as longtime Meyerland resident Julia Long. Long said she and her husband were facing a flood insurance premium of up to $11,000 a year should she not demolish, elevate or sell their home.

“It turns into this whole equation where you ask yourself whether you leave your house on the ground but pay a bunch in flood insurance, elevate and pay a lot to elevate, or build new and pay a lot in property tax,” Long said.

That sense of trepidation came as Long and her husband were debating staying or leaving their Meyerland neighborhood after their home flooded three times over the last several years.

Still, despite the looming increase, the Longs managed to finish elevating their home in 2019 and have reaped the benefit of dramatically lowered flood insurance premiums, she said.

However, Project Brays has already brought relief to some homes that previously flooded. For example, Brays Bayou stayed within its banks during Tropical Storm Beta in September 2020, and modeling determined that approximately 600 structures would have flooded if Project Brays had not been in place, according to the HCFCD.

When completed, Project Brays is expected to reduce flooding by 2 feet in the flood plain and will provide a 100-year level of protection along the main stem of Brays Bayou upstream and downstream of Beltway 8.

“They’re telling us that it will lower the flood level by 2 feet,” Martin said. “If that’s the case, then our old house, which got 11 inches, should not flood again ever. So I think if they lower the flood level by about 2 feet, I think that’d be tremendous.”

Bellaire, positioned inside the Brays Bayou Watershed, is also expected to see benefits, with a conditional letter of map revision from FEMA showing that Project Brays could potentially remove a large portion of the city from the 100-year flood plain. As a result, improvements to Brays Bayou mean an improvement to Bellaire’s stormwater drainage system, said Mike Leech, Bellaire’s public works director.

“Brays Bayou is a big key to how our system performs,” he said.

Closer to the bayou, in Meyerland, the benefit to the area is not just a reduction in flooding, but also a greater confidence in living in the area, said Jonathan Elton, Section 3 director for the Meyerland Community Improvement Association.

“I think the biggest impact is a feeling of greater ease that the risks of flooding in the area have significantly decreased,” Elton said.

Question of fairness

This is because the number of variables used to calculate premiums has increased in the new system from two to at least five. Variables include a property’s elevation within a particular type of flood zone, flood frequency, the type of flooding and distance to a water source.

The purpose, according to FEMA, is “to deliver rates that are actuarily sound, equitable, easier to understand and better reflect a property’s flood risk.”

However, decreases in flood insurance premiums are not shared across the board. Locally, how premiums are affected can vary wildly, according to both FEMA and an analysis of locally compiled data by Community Impact Newspaper.

For example, in ZIP code 77096, which includes the Meyerland area, out of 6,249 policies tracked by FEMA, 79%, or 4,960 policies, may see a first-year increase anywhere from $0 to more than $100 per month. For context, the majority of those—2,986—may see up to a $10 increase, while 1,152 policies may see an $11-$20 increase.

FEMA’s Risk Rating 2.0, while easier to get a flood insurance rate than its predecessor, may not necessarily be fairer, said Leash Yu, an insurance agent at Agency Yu, which handles risk management out of its West University-area office.

“On the fairness piece, it really depends on where you live,” Yu said. “I do think that the community, especially in West [University Place], in Woodland Heights [and] in a lot of Memorial, also got impacted rather heavily. I think most of those areas that don’t flood and that are unfairly impacted by 300% increases can justify their frustrations.”

Agency Yu’s data, which considers 110 insurance quotes from its client list across communities such as West University Place, Bellaire, Braes Heights, Meyerland, River Oaks, Briarforest and Memorial, calculated an average annual increase in flood insurance premiums of $457, a 128% increase. The data used for the calculation included eight quotes from West University Place, nine quotes from Bellaire and seven quotes from the Meyerland area.

Meyerland policies are expected to see a 130% increase, but other communities, such as Bellaire and West University Place, could see 165% and 188% increases, respectively, according to Yu’s data.