“They constantly remind me we are nowhere near what the store would average normally during this time of year,” she said of the old sales records she obtained from the previous owner. “It’s been heartbreaking, to say the least.”

The storefront closed for nearly two months starting in mid-March, along with other stores across the state. Sales have decreased dramatically, even with an online shop, Ferrufino said.

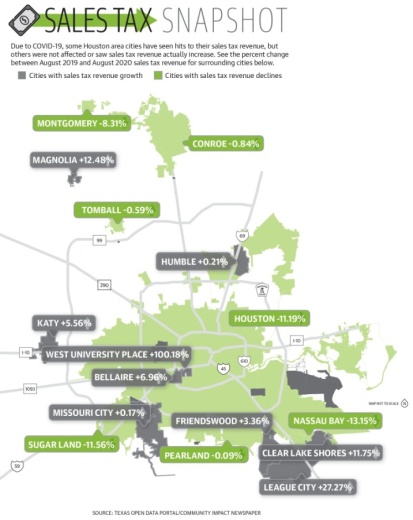

While sales tax revenue data shows both positive and negative regional trends in 2020, the financial impacts of the coronavirus pandemic have been felt by small-business owners across the Bay Area for more than six months. Experts and city officials said sales success during the approaching holiday season could be crucial for businesses looking to make up for lost time.

Business challenges

As League City continues to grow, its sales tax revenue has steadily increased year over year despite the setbacks of the pandemic. City officials said sales tax numbers have remained strong through COVID-19; this can be attributed in part to residents visiting the increasing number of local retail options as well as taking on home improvement projects.

“Unlike some of the communities that are more dependent on, say, regional or destination shopping, ...our sales tax is really locally generated,” City Manager John Baumgartner said.

During April, May and June, the city’s sales tax revenue was up 15% compared to the same months in 2019, according to state data. Residents preparing for hurricanes or the new school year may have contributed to the increased revenue. Another factor is the pandemic, which has forced people to stay home instead of traveling, said Angie Steelman, the city director of budgets and project management.

Ferrufino said she is “praying and banking” on a busy holiday season at The Salted Hippie to recover pandemic-induced losses. Aside from extreme weather and back-to-school seasons, Christmas time is another sales peak for the city, Steelman said.

“Each community has different factors that make their sales tax seasonal,” Steelman said, adding many businesses have shown resilience and flexibility as they find new ways to turn a profit. “We’ve seen businesses doing A-plus work figuring out how to survive in this new environment.”

Waiting game

Despite sales tax revenue showing positive growth, local restaurants have seen stagnation in profits even as dining rooms reopen at greater capacities, said Jim Molina, who manages Red River BBQ & Grill and Red River Cantina in League City.

“There really hasn’t been a lot of change since [the dining room opened back up],” he said. “The dining room still hasn’t gotten back to where it was. ... We’re kind of stuck in Groundhog Day.”

Overall sales look decent but not good, Molina said. With customers reluctant to return to the dining rooms, delivery and to-go sales have exploded, which have kept the eateries afloat along with the addition of a weekend to-go breakfast at the cantina, he said.

With sales down, local owners described having to give up much of their own incomes to keep their businesses running. The money coming in is enough to pay staff and keep up with business related bills but with little to no funds left over, said Ferrufino and Missy Edwards, who owns Fit4Mom Clear Lake.

Edwards’ group fitness business, located at 5150 FM 2351, Friendswood, took slightly longer to see revenue decline because of the sense of community developed among the mothers. However, the business has lost two thirds of its clientele in the last eight months, she said.

In Friendswood, sales tax revenue began decreasing year over year around March, rebounding by June and then decreasing slightly over the course of the summer.

“Trust that these small businesses in the area are doing everything possible, and even going beyond, to ensure that you have a safe, positive and fun environment when you walk into our

doors,” Ferrufino said. “It truly makes a difference when you support locally and support small.”

Expert insights

The most severe decreases in sales tax revenue may not have happened yet, and local governments need to brace for those, said James Thurmond, a former city manager and current graduate professor in public administration at the University of Houston.

The COVID-19 recession, which is considered to have started both domestically and globally in late February, is unlike any other economic downturn in recent history, Thurmond said: It could potentially be much longer lasting than a traditional recession.

“We haven’t hit the low point yet,” he said, adding local governments must spend money and create budgets wisely. “I would not be very positive right now. ... I would be cutting back.”

Sales tax revenue can make up significant portions of a city’s budget, which makes some cities very dependent on sales tax, he said. This is the case in Clear Lake Shores, where sales tax revenue makes up about 46% of the total fiscal year 2020-21 general fund; in both League City and Houston, about 25% of the FY 2020-21 general fund budgets comes from sales tax revenue. About 8% of the FY 2020-21 general fund in Nassau Bay is sales tax revenue, and the city is budgeting conservatively due to COVID-19, Nassau Bay City Manager Jason Reynolds said.

Many local governments—although not Clear Lake Shores—also collect property taxes, and these values take much longer to change than sales tax revenue does in the midst of an economic crisis, Thurmond said. If sales tax revenue decreases and property taxes remain relatively unchanged, for example, expenditures would need to be cut elsewhere in a budget, he said.

This adds another element of uncertainty to city planning, as does the fact the health of city governments depends heavily on the health of the region’s economy.

“Local government is only as strong as the local economy,” Thurmond said. “[If] they don’t have money coming in, they can’t provide some of the basic services they need to provide.”