The business was forced to close its doors when the city began implementing social distancing protocols. But the restaurant and brewery continued operating by shifting to a tailgate approach, allowing locals to pick up food in the parking lot.

Sean Saunders, Lockwood’s vice president of operations, said while it was not a perfect approach, the shift allowed the company to retain employees while providing a community experience.

“This provided an outlet for us and locals to still have a taste of something normal in a safe environment,” Saunders said.

With business remaining steady thanks to the brewery accelerating its distribution, Saunders said Lockwood was lucky in that the business did not have to lay any workers off. Saunders said he’s always adapting to customers’ needs as the restaurant continues to see a return of guests in person.

“We continue to strive for a guest-friendly experience to accommodate everyone, and that includes making things as clean and safe as possible,” Saunders said.

That return to in-person shopping is something Texas-based commercial real estate firm Weitzman said is happening throughout the Dallas-Fort Worth metroplex.

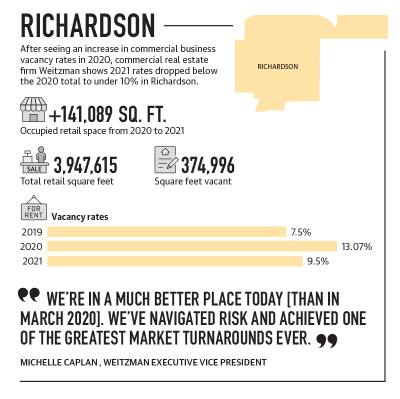

“We’re in a much better place today [than in March 2020],” Weitzman Executive Vice President Michelle Caplan said during the firm’s annual forecast in January. “Everyone from retailers to landlords to shoppers have all faced enormous challenges with innovation and ingenuity. We’ve navigated risk and achieved one of the greatest market turnarounds ever.”

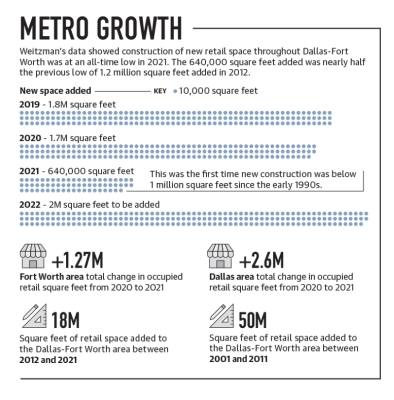

As part of its report, Weitzman noted construction of new retail space in the region was at an all-time low in 2021, with just 640,000 square feet of new space added. That was nearly half the previous record low of 1.2 million square feet built in 2012, according to Matthew Rosenfeld, Weitzman executive vice president and director of DFW brokerage. However, increased demand for retail space and rising occupancy rates are expected to help turn things around in 2022, according to the forecast.

“Based on what’s in the pipeline, we expect construction to total approximately 2 million square feet [in 2022],” Caplan said. “That’s more than double the 2021 total, but it remains on the conservative side.”

The Weitzman forecast also found retail occupancy was at 93.5% throughout the region at the end of 2021. That rate was the third highest total the firm has recorded for DFW, just below its previously recorded highs of nearly 94% in 2019 and almost 95% in 1981.

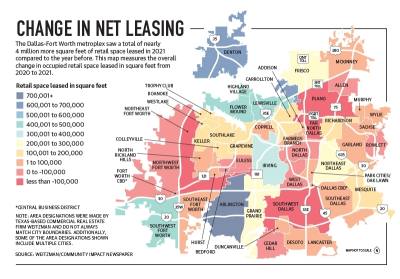

“This is [a] complete reversal from 2020, when pandemic-related closures resulted in vacancy jumping by more than 4 million square feet,” Rosenfeld said at the January event. “Now our numbers [going into 2022] look remarkably like those of prepandemic 2019—one of the best years ever for our retail market.”

Adapting in Richardson

Unlike other nearby cities, Richardson is roughly 96% developed, according to city officials. Manasseh Durkin, chair of the board of directors for the Richardson Chamber of Commerce, said this lack of buildable land as well as recent shopping trends will cause stores to shift toward smaller retail locations.

“The consumer is now OK with going smaller into what I call micro-retail,” Durkin said. “It used to be an instant gratification thing where I’d want to walk in [a store] and leave with a product. Now, Amazon and the big players have solved that for the most part where [any product] can come in two days.”

The convenience of online shopping has shifted what needs to be provided in stores, with many industries, including health care and housing, now incorporating online elements, Durkin said.

“The way we’ve shopped has shifted,” Durkin said. “When I saw my neighbors in their 80s having Uber Eats delivered to their house, you know the world has changed. The big box stores have been a dying thing for a while, and I think the novelty of that mix of everything is gone.”

That change is also happening with restaurants, such as Velvet Taco and Piada Italian Street Food, Caplan said, with those two eateries modifying some of their existing restaurants to include digital drive-thru windows that allow customers to pick up online orders with minimal contact.

A shift toward flexible work space is also being incorporated into the design of new apartments and townhomes, according to Matt Enzler, a senior managing director with multifamily development company Trammell Crow Residential. The company has built multifamily developments in Richardson and throughout the metroplex.

“We’re adding more home office-type options, whether it’s a full dedicated study or if it’s just adding a spot for a [personal] workspace,” Enzler said. “Then, outside the unit, we’ve added, for all of our new developments, more workspace. You don’t necessarily want to live and work in the same spot 24 hours a day.”

‘Tech and mortar’

Rosenfeld said grocery stores throughout the region have led the way in using digital tools to help physical retailers meet changing customer needs, an approach Weitzman refers to as “tech and mortar.”

“Without a doubt, COVID[-19] has transformed grocery shoppers’ behavior, and brick-and-mortar locations [that] are offering delivery and curbside pickup [are] benefiting,” Rosenfeld said.

The region is seeing expansions from grocers, such as Kroger, Sprouts and H-E-B, according to the Weitzman forecast. H-E-B has announced plans to open new stores in Plano and Frisco in 2022 and McKinney in 2023.

The demand for Walmart’s pickup and delivery services has led the company to increase its order fulfillment capacity by 40% over the last two years, according to Lauren Willis, the retailer’s communications director for Texas.

To help meet customers’ new shopping patterns, Walmart is adding market fulfillment centers to many existing stores, including the former supercenter near Richardson at 13739 N. Central Expressway. These centers will help meet the demand for Walmart’s contactless pickup and delivery services in those cities and throughout the metroplex.

Looking ahead

While businesses continue to focus their efforts on online shopping, Durkin said he believes the industry is going to have a shift back to brick and mortar, but mostly for solving the problem of returning items.

“If people want a pair of boots or whatever clothing you want, they’re going to need to walk into a little tiny retail store and try it on,” Durkin said. “If they like it, they will [order it online], and it’s going to come to their house in an Amazon delivery in two days. That’s the future of retail.”

Location data analytics firm Placer.ai tracks consumer foot traffic for retail and real estate companies using mobile device data. CEO and co-founder Noam Ben-Zvi said he believes shopping centers are “here to stay.”

“Even when people [were] stuck at home, they still managed to somehow spend a lot of money offline,” Ben-Zvi said during the Weitzman forecast livestream in January. “People don’t want to sit at home and buy everything.”

Even with a return to in-person shopping and dining, Saunders said businesses should still plan to expect the unexpected.