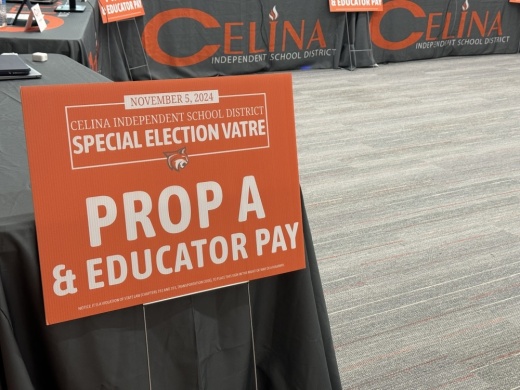

On the ballot

The voter approval tax rate election would establish a tax rate of $1.2358 per $100 valuation, if approved by voters. This is broken down between $0.7869 for maintenance and operations and $0.4489 for debt payments.

If the maintenance and operations tax rate increase is not approved by voters, then the district’s tax rate will still be $1.2358 per $100 valuation. This would be split between $0.7358 per $100 valuation for maintenance and operations. The tax rate for debt payments would be $0.50 per $100 valuation.

Ballots will also feature several federal and state races as well as county races, which include:

- Collin County Tax Assessor-Collector

- Denton County Sheriff

- Denton County Commissioner, Precinct 1

- Denton County Constable, Precinct 6

- Collin County Constable, Precinct 3

- Collin County Commissioner, Precinct 3

Election Day is Nov. 5 with voting locations open from 7 a.m.-7 p.m.

Registered voters living in Collin County can cast their ballot at any location countywide on Election Day. Registered voters living in Denton County can cast their ballot at their assigned voting site, which can be found by using the search tool here.