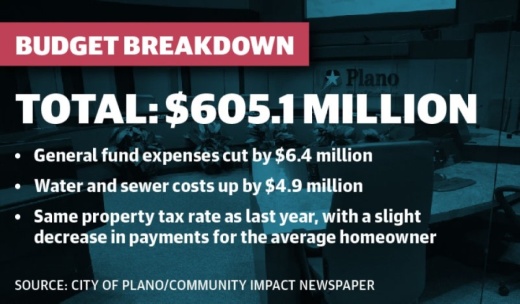

Totaling $605.1 million, the budget faced economic challenges due to the coronavirus pandemic, including losses in sales taxes, permit and licensing fees, and hotel and motel taxes, all of which are major revenue sources for the city. Staff reacted with a budget contingency plan in March and took a proactive approach to prepare for projected losses through FY 2020-21, according to City Manager Mark Israelson.

This contingency plan included a re-estimate of the FY 2019-20 $601.4 budget, a hiring freeze for most positions and a 5% cut to all fund expenses. By doing this and pausing any salary increases, Plano was able to retain its workforce, Mayor Harry LaRosiliere said. It also helped identify $13 million in savings from the FY 2019-20 budget, according to Israelson.

The city plans to continue with its contingency plan into the new budget year, with the exception of hiring some public safety positions, until there is more certainty about the long-term impacts of the coronavirus pandemic, Israelson said.

“We are cautious and conservative in our approach, and we maintain a contingency plan,” LaRosiliere said. “I will continue to have concerns as long as there is uncertainty that lies before us for both sales tax and property taxes, which are our two largest sources of revenue.”

Even with a $6.4 million reduction, close to half of the city’s $327 million general fund expenses are dedicated to public safety. Another 15% is devoted to programs and services provided by the libraries, parks and recreation, and public works. All of these programs were funded at nearly the same levels as the previous fiscal year.

“Obviously, COVID-19 has had a significant impact on how service is delivered, but the services that are being delivered are still the same,” Israelson said.

A delayed impact

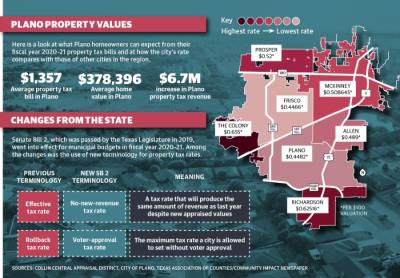

In the 30 years Budget Director Karen Rhodes-Whitley has worked with the city of Plano, she said, the property tax rate has increased only twice: once to incentivize economic development in fiscal year 2006-07 and once more following the economic recession of ’08.

For FY 2020-21, the city approved the same tax rate as the year before: $0.4482 per $100 of assessed property value. But because of Senate Bill 2, which changed how cities calculate their property tax rates, the same rate is considered a 2.97% increase compared with what is now called the no-new-revenue tax rate—a term created under SB 2, according to Rhodes-Whitley.

City officials estimated that the annual tax bill for the owner of an average-priced home will decrease by $4 in FY 2020-21. The city expects to see a $6.7 million increase in total property tax revenue, with close to half of that increase coming from new property added to the tax roll in Plano.

Property values will be reevaluated in January, and the city is anticipating a negative impact due to the pandemic, Israelson said. Those unknowns make maintaining a contingency plan the best option, he said.

Watching for recovery

Sales tax revenue in Plano has also taken a considerable hit over the last six months. In March, the city collected just over 20% more revenue than in the same month the year prior, according to the Texas State Comptroller’s Office. In June and July, the city saw decreases of roughly 14% and 17%, respectively, as compared to those same months last year.

Plano has made a slight comeback since then, with monthly allocations fluctuating within 2% in August and September as compared to the same months a year ago. These numbers are encouraging, Israelson said, but do not guarantee an economic resurgence.

“We’re grateful for the recovery that’s already happened but hopeful that there is even more growth within the economy and within the business sector,” he said.

In FY 2019-20, the city expected to receive $86.1 million in sales tax revenue but found that it came in $4 million lower. In FY 2020-21, collections are projected to total $84.9 million, which represents close to a quarter of the city’s general fund revenue.

Costly expenses

One of the largest increases Plano expects in FY 2020-21 is in the water and sewer fund, where expenses rose by close to $5 million year-over-year. These costs are part of the city’s enterprise fund and are paid largely by residents based on individual usage.

Last fiscal year was the first time in city history that water and sewer costs outpaced those of public safety. The combined fund now totals roughly $7 million more than planned expenditures for public safety in FY 2020-21.

“If you’re looking at the other expenditures, [for] most of the other funds, ... there’s about a million-dollar increase, but the one that has the most impact is our water and sewer fund,” Israelson said. “And that’s due to wastewater costs from the North Texas Municipal Water District.”

In late September, the water district adopted a budget that kept the wholesale water rate the same as the year prior. This is the first time the district has not increased that rate since FY 2006-07, Interim NTMWD Director Rodney Rhoades said in a recent news release. The city has contributed funds to minimize the impact of the water rate increases to residents in previous years and will continue to do so this year, Israelson said.

However, the water district did increase wastewater treatment rates for two interceptors used by Plano by $0.13 per thousand gallons. Residents will see that increase reflected in their bills.

The city of Plano, along with several other cities, has been involved in settlement negotiations as part of a rate dispute with the water district for more than a year. Settlement discussions are confidential at this point, according to Israelson, and the budget is based on rates recently set by the water district.