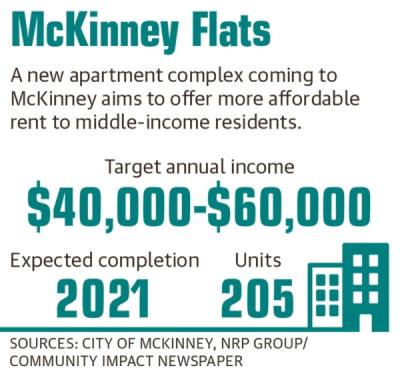

A new apartment complex called McKinney Flats is intended to fill that need by offering apartments with rent prices at least 30% lower than the market rate. It would target middle-income residents who struggle to afford housing in McKinney.

The project will be funded with the help of Low-Income Housing Tax Credits issued by the state and will be developed through a partnership between the city and a national multifamily development company called NRP Group.

The project is set to break ground in July and to be completed by fall 2021, according to the developer. McKinney Flats will be located just west of US 75

and north of SH 121 at the corner of Collin McKinney Parkway and Test Drive.

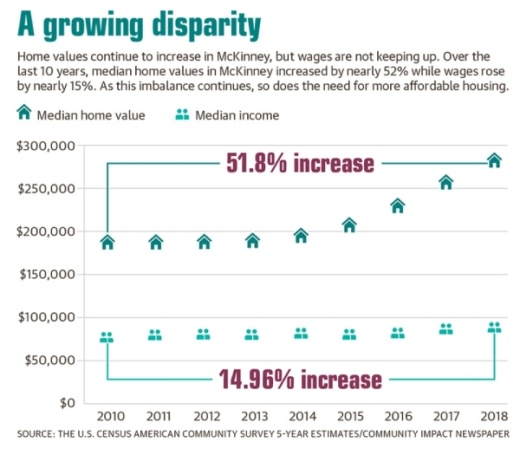

City leaders said this project is much-needed and that there is an affordable housing disparity because wages are not keeping pace with rising housing costs.

“Although employers are trying to be as competitive• as possible and raising their wages, we are finding ... entry-level workers in professional settings are also not able to find affordable housing [in McKinney],” said Lisa Hermes, McKinney Chamber of Commerce president.

Middle-income workers, such as teachers, nurses and public safety workers, struggle to afford renting in the area, according to the developer. This project aims to give them an option to live comfortably at a more affordable price, according to the developer.

“They are your average employee,” said Jason Arechiga, vice president of development at NRP Group. “They just don’t happen to make enough to afford a $2,000-a-month rent.”

‘A drop in the bucket’

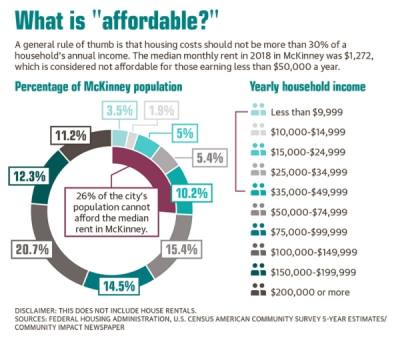

The median monthly rent in McKinney was $1,272 in 2018, according to U.S. Census American Community Survey five-year estimates. A local realtor puts that number closer to $1,800 when factoring in home rentals.

The target tenants of McKinney Flats will be people making between $40,000-$60,000 a year, or 50%-70% of the area’s median income, according to the developer. That median income is roughly $83,100, according to the city.

Talks about this kind of development first started in 2017, when McKinney City Council members expressed an interest in building a workforce housing complex in McKinney.

Council enlisted help from the McKinney Housing Finance Corp., a public nonprofit that acts as an arm of the city, to finance residential developments that provide decent housing at an affordable cost, said Janay Tieken, who oversees the corporation.

The corporation’s primary activity is issuing tax-exempt, single-family mortgage revenue bonds and bonds for affordable multifamily housing projects. This brings in revenue for the corporation to create and promote affordable housing opportunities in McKinney, said Tieken, who is also the McKinney Housing & Community Development Department manager.

NRP Group was selected as a codeveloper of the project, and through this partnership, the city will collect about $3 million, Tieken said.

“Rather than having another nonprofit come in and partner with a developer, ... council directed us to take the initiative ... so that we would have these funds that we can use for more affordable housing,” Tieken said.

Once complete, McKinney Flats will have 205 units, ranging from one- to four-bedroom apartments. The complex will have the potential to hold up to 500 residents.

A specific number is not available for how many people need this type of housing, but Tieken said she suspects it to be a significant amount.

“This is just a drop in the bucket,” she said.

To quantify this demand, the corporation is looking to launch a housing needs analysis in February.

“It will look at all of the housing within the city, not just the affordable housing,” Tieken said. “We want to ... make sure that we have the kind of housing available for all kinds of industries.”

Communities need all types of people, especially a workforce, Arechiga said.

“A city will get passed over from a lot of different corporations when they don’t have housing [or] the amenities for their employees,” he said.

For years, this has been a challenge for local businesses, Hermes said.

“They are having to recruit employees from surrounding communities, such as Princeton, Anna, Melissa, Sherman ... [or] even as far as Oklahoma in some cases, because we just don’t have the housing stock here for people to live ... in the community in which they work,” Hermes said.

McKinney Flats and projects like it will be a step in the right direction, Arechiga said, because rent rates are capped to a percentage of area median income and will be based on a percentage of that amount.

“McKinney has historically had a lot of their workforce in affordable housing and public housing on the east side [of US 75],” Arechiga said. “So this was a move to distribute it around because everyone deserves ... access to those kinds of amenities.”

The location’s close proximity to major roadways was another big decision factor when choosing where to build it, he said.

“Residents are going to be able to shoot right out and get anywhere in McKinney and anywhere in the greater area,” Arechiga said.

The location also drew concerns from nearby residents. Issues raised in relation to the project ranged from traffic congestion and potential increase in crime to the height of the facility and the possible impacts on home values.

These concerns came out during a Dec. 3 council meeting regarding the rezoning of the location from commercial to multifamily.

In response, the developer made some changes to the original plan, including reducing the four-story building to three stories and adding additional trees as a buffer between homes and the complex to help alleviate residents’ privacy concerns.

Council ultimately approved the rezoning by a 4-3 vote. At a later meeting, council also voted 4-3 to pass a resolution of no objection to the project, which the developer needed as part of its state application.

How tax credits work

NRP Group plans to offer these apartments at a below-market rate with the use of Low-Income Housing Tax Credits. NRP Group still has to go through the state application process, Arechiga said.

If awarded, these credits will come from a tax credit program signed into law by former U.S. President Ronald Regan in 1986. This program is meant to incentivize private developers to invest in affordable housing.

Before receiving credits, developers must go through a rigorous vetting process with the Texas Department of Housing and Community Affairs to make sure the buildings are up to par, Arechiga said.

“It’s held to a very high standard,” he said. “They vet your site, and then they decide if they can award you those credits. ... That helps us offer ... lower rents for a class A product.”

Each apartment will have high-end features, including granite countertops, vinyl plank flooring, masonry work and stone finishes, he said.

Residents will have access to amenities, such as a swimming pool, a fitness center and more, Arechiga said, as well as access to programs, including an after-school program for children.

NRP Group, which has developed about 40 affordable housing projects in Texas, expects McKinney Flats to be successful in serving a portion of McKinney’s workforce community, Arechiga said.