The new maximum rate is almost a half-cent lower than the current rate of $0.399. Council is expected to approve the new maximum rate at a Sept. 15 meeting.

“We have to adopt by law by Sept. 27,” Keller Finance Director Aaron Rector said. “We’ve done a good job with tax mitigation and trying to lower the rate. This year, if we adopt as proposed, we would not have to ratify.”

“We have to adopt by law by Sept. 27,” Keller Finance Director Aaron Rector said. “We’ve done a good job with tax mitigation and trying to lower the rate. This year, if we adopt as proposed, we would not have to ratify.”To trigger a voter-approved rate election, council would have had to approve a maximum tax rate of at least $0.417588, Rector said.

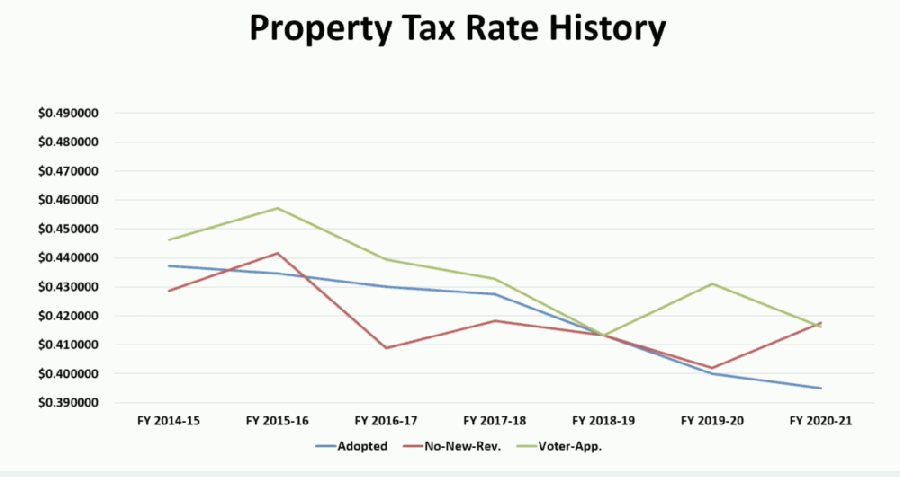

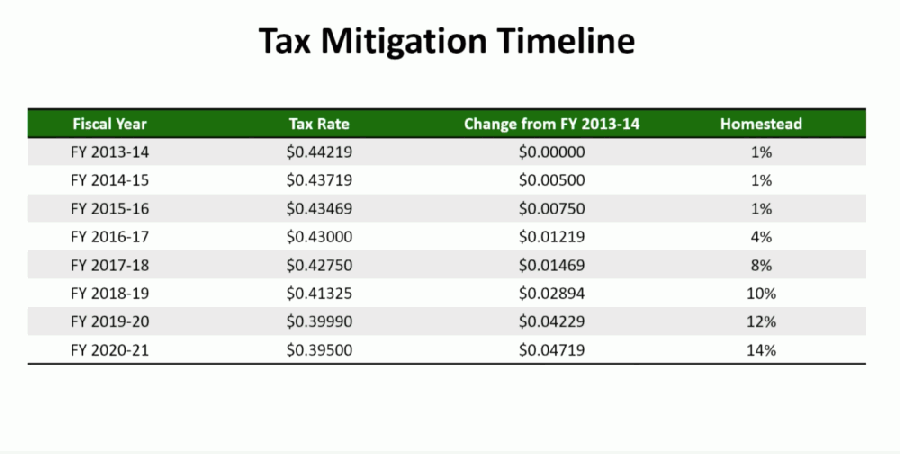

Instead, Keller residents will see a decrease to the tax rate for the eighth straight year, according to Mayor Pat McGrail. Since FY 2013-14, the property tax rate in Keller has decreased by nearly five cents from a high of $0.44219.

Earlier this year, Keller City Council also adopted a homestead exemption of 14%.

As a result, the average property tax bill is expected to decrease from $1,407 per year to $1,390 per year, Rector said.

“Looking at what occurred between 2014 and now, [there is] about a $300 reduction to the average tax bill,” Rector said.

If council adopts a maximum tax rate of $0.395 per $100 valuation, the maintenance and operations rate, which accounts for general fund activity, will account for $0.32419, a slight decrease from the previous year, he said.

Meanwhile, interest and sinking, or the rate for debt service, will account for $0.07081, which represents about a half-cent decrease from the current rate, Rector said.