During a Sept. 20 meeting, Southlake City Council approved the FY 2022-23 budget in a 6-0 vote. The $117.2 million operating budget includes a $48.3 million general fund with a property tax rate of $0.36 per $100 valuation. The budget went into effect Oct. 1.

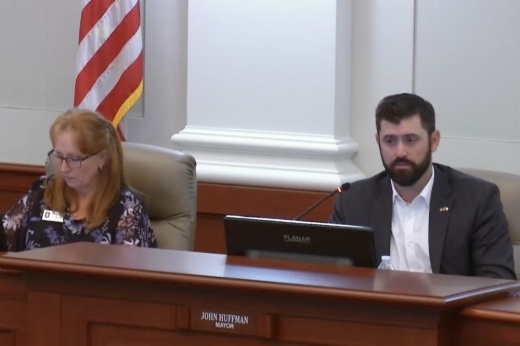

“To operate a city like Southlake, and to operate it in a fiscally responsible way, is absolutely no easy feat,” Mayor John Huffman said in the meeting, where Council Member Amy Torres-Leep was not present for the vote.

The general fund is supported by taxes, fees and other revenues, and it helps operate the city’s operations, such as police, parks and recreation, and other government departments, according to city documents. The FY 2022-23 general fund budget of $48.3 million is a 10% increase from the FY 2021-22 budget of $43.8 million.

The largest portion of the FY 2022-23 general fund supports the city’s public safety. Priorities for the FY 2022-23 budget include $11.2 million allocated for roads, $1.56 million for sidewalks and $550,000 for school safety, which will fund three additional school resource officers and one captain, the budget document stated.

Southlake received its certified property values July 25 from the Tarrant and Denton appraisal districts. Southlake Chief Financial Officer Sharen Jackson said taxable values have increased 10.3% from $8.22 billion to $9.064 billion. The city is expecting an increase of $328,551—or 1.2%—in property tax value in FY 2022-23.

The tax rate of $0.36 per $100 valuation is a decrease from the FY 2021-22 rate of $0.39 per $100 valuation. Since 2013, Jackson said the average Southlake home has increased 72% in assessed value.

“The decisions that we make today will impact us in the future,” Jackson said.