High home prices, steep mortgage rates and limited supply are driving some potential homebuyers out of the market, said Clare Knapp, a housing economist for the Austin Board of Realtors. Texas also had the sixth-highest property tax rate—1.68%—in 2021, according to research from the Tax Foundation.

Home prices shot up during the height of the COVID-19 pandemic, Knapp added, as remote work policies allowed more people to move to Texas.

In 2019, the median home price in Texas was $241,358, according to data from the Texas Real Estate Research Center at Texas A&M University. Median home prices peaked around $340,000 in 2022 and dipped to about $335,000 in 2023.

What you need to know

The Dallas-Fort Worth metroplex area led the nation in population growth from 2020-23, the comptroller’s office reported Aug. 27. Over 462,000 people moved to the area in three years—nearly 233,000 of whom came from other states.

“[Texas is] issuing more building permits for single-family homes than any other state,” said Will Counihan, who leads the comptroller’s data analysis and transparency department, at an Aug. 27 event. “So it’s not that people aren’t trying to build [houses]. I think one of the big issues that we’ve found is that they're perhaps not building the right types of houses, specifically housing for low- and middle-income Texans.”

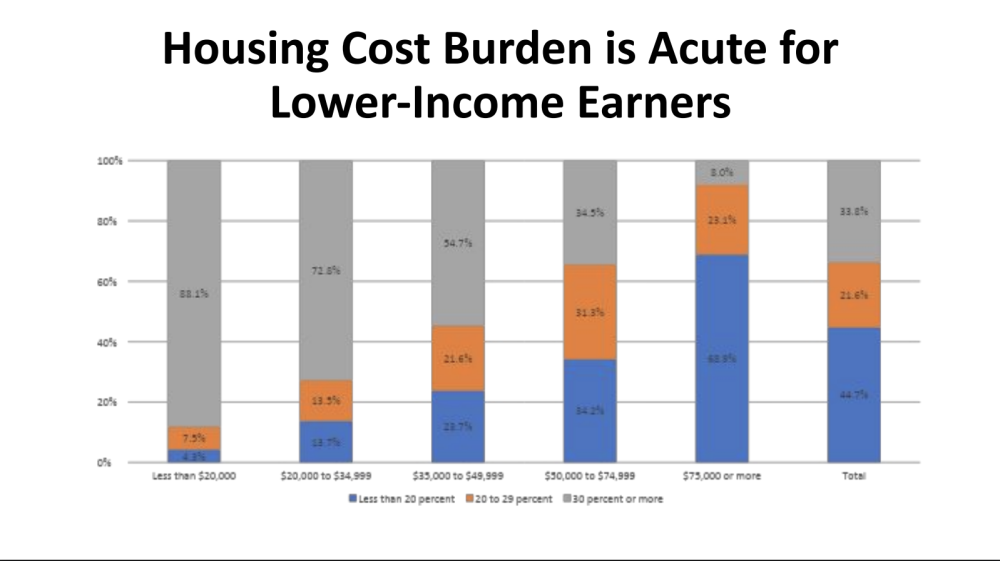

One third of Texas households are cost burdened, Counihan said, meaning they spend more than 30% of their salary on rent, a mortgage or other housing costs.

A Texan who wants to sell their current home and purchase a new one should make about $113,000 to qualify for a mortgage loan, compared to about $70,000 at the beginning of the pandemic, Knapp said. A first-time buyer should have an income of about $78,000 to qualify for a loan, up from $45,000 in early 2020.

“Needless to say, incomes have not increased that much,” Knapp said.

More details

Nationwide, housing affordability is at its lowest level since 1985, the National Association of Realtors reported.

“We're in a very unique place in Texas history, where we've got historic records of jobs,” said Nicole Nosek, the founder of Texans for Reasonable Solutions, an organization that aims to solve the housing shortage. “But on the other hand, if you don't have housing to accommodate all of the employees and all of the growth that we're attracting, what's going to happen is... the people on the lowest rung of the ladder and even the middle class get driven out to other states."

Texas should make it easier to build homes in commercial areas and reduce the minimum lot size for single-family residences, Nosek said.

In May, city of Austin officials voted to cut the city’s minimum lot size from 5,750 square feet to 1,800 square feet. The change was proposed by council member Leslie Pool as a strategy to permit more housing types and smaller homes than have traditionally been allowed in Austin.

Last year, Texas senators approved Senate Bill 1787, which would reduce cities’ minimum lot size requirements. The bill did not make it to the House floor.

Lt. Gov. Dan Patrick, who oversees the Senate, and House Speaker Dade Phelan each directed lawmakers to look into potential zoning changes ahead of the 2025 legislative session.

The comptroller’s report did not make specific recommendations to improve housing affordability, but noted that loosening zoning regulations, streamlining the permitting process and cutting property taxes could make a difference.

“There are some things that states and local governments can do to help with lowering prices and [raising] affordability,” Counihan said. “The biggest issue is that, really, states and local governments... don't build housing.”