The $212 million budget includes pay increases for teachers and staff as well as adjustments for declining student enrollment through the general fund, debt service fund and child nutrition fund.

Revenues for the general fund are anticipated to be $211.3 million, while expenditures are set to equal $212.3 million. Recapture payments to the state are included as part of the expenditures. The district is anticipated to pay back $124.8 million in FY 2022-23, up from $102.6 million in FY 2021-22.

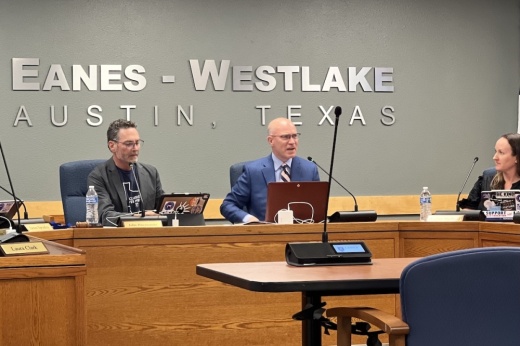

In May, the board of trustees unanimously approved a 5% midpoint raise for salaried staff and a 6% midpoint raise for hourly staff, which is reflected in the adopted budget. The Eanes Education Foundation contributed a $2.75 million grant to help fund instructional positions.

The total expenditures in the Child Nutrition fund are $4.6 million, while revenue is estimated at $4.4 million. An additional $100,000 in the budget was put aside to increase compensation for child nutrition and custodian positions, which the district has said it needs to fill.

The debt service fund is predicted to have a budgetary surplus of $5.6 million due to the district paying off certain bonds and working in previous years to refinance existing bonds.

The district’s budget assumes an enrollment of 7,875. As of June 6, the district is about 100 students short of the enrollment numbers used in the FY 2022-23 budget calculations, but the district anticipates that number to be around 50 students in the fall, Scott said. The per-pupil allotment for the district was $6,160 in FY 2021-22, and this is expected to remain the same for FY 2022-23, according to the district.

Although there is a $1 million deficit, EISD Chief Financial Officer Chris Scott said districts usually budget higher than they would normally spend to provide flexibility. This means the budget as presented nearly breaks even, he said. On top of this, the district has seen substantial growth in its tax base, which means a certain portion of taxes will lead to more funding than originally anticipated, he said.

This applies directly to the I&S, or interest and sinking, tax rate, which covers debt service for voter-approved bonds and is not subject to recapture by the state. For FY 2022-23, EISD’s tax base grew from a projected 9.1% to 21.4%, meaning the district is expected to see a 21.4% increase in its I&S funding.

District officials have proposed a maintenance and operations, or M&O, tax rate of $0.8846 per $100 valuation, compared to $0.9408 in FY 2021-22. This fund covers the general budget and is subject to recapture. The tax rates for FY 2022-23 cannot be adopted until the fall; however, the M&O rate is Scott’s best estimate at this time of what the tax rate may be, he said.

A more detailed look at the budget for FY 2022-23 and previous years is available on the district's website.