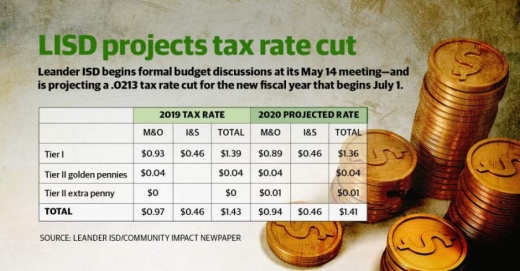

The LISD property tax rate for the current budget is $1.4375 per $100 valuation. District officials are projecting a lower tax rate of $1.4162—resulting in a $0.0213 tax rate decrease.

However, increases in property values may cause many LISD residents to pay more in property taxes despite the reduction in the tax rate.

The maintenance and operations, or M&O, tax bill is projected to drop from $0.93 to $0.8987. The interest and sinking debt, or I&S, tax bill is projected to remain the same at $0.4675.

LISD’s tax rate currently uses four “golden pennies,” or $0.04 of its tax rate that is shielded from the state’s recapture to equalize funding across school districts. The proposed budget calls for an additional golden penny that would increase the protected rate to $0.05.

Enacted in 1993, Texas’ recapture system mandates that districts with a value per student higher than $514,000 to contribute payments based on their taxable value, according to the Texas Education Agency. The money is collected by Texas’ education fund and redistributed to districts below that threshold.

Passed by the state Legislature in June 2019, House Bill 3 aims to equalize funding among school districts. Districts, however, are allowed a maximum of eight golden pennies, which are pennies within a school district’s M&O tax bill that are not part of the state recapture to equalize funding.

Staff will recommend that LISD trustees schedule a meeting and public hearing for June 18 in order to discuss and adopt the 2020-21 budget.

The May 14 meeting will begin at 6:15 p.m. Citizens wishing to comment must register online from 5:30-6 p.m. on the day of the meeting through this online document.