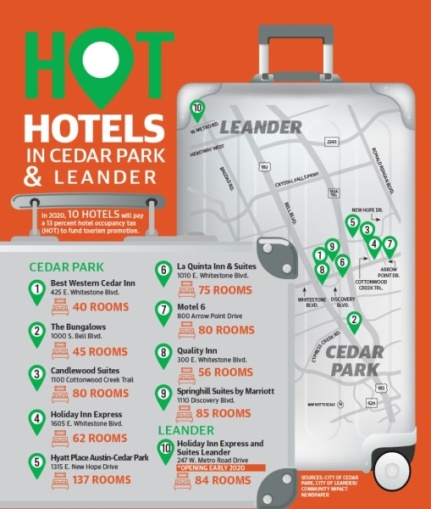

On Dec. 13, Community Impact Newspaper received Cedar Park’s hotel tax revenue for the fiscal year that ended Sept. 30. That total—$953,911—represents a 22.1% increase over the previous year and a nearly 300% increase over the first year the city collected HOT revenue in 2009. Nine hotels are in the city limits, according to Cedar Park spokesperson Fran •Irwin.

Leander, meanwhile, is set to receive tax revenue from the first hotel in its city limits. After originally planning to open in the fall, Holiday Inn Express and Suites, at 247 W. Metro Road in Leander, within a couple of months, according to Leander spokesperson Mike Neu.

State law allows local jurisdictions to tax rooms used for sleeping for less than 30 days, according to documents. Both Cedar Park and Leander levy a 7% hotel tax rate.

The state also levies a 6% hotel tax rate for a total of 13% in both cities. State law requires that hotel tax revenue be used to promote tourism.

Cedar Park’s tourism board began the current fiscal year with a beginning balance of $2,005,219, according to the city budget. For the current fiscal year, which ends Sept. 30, the city budget predicts hotel tax revenue will increase above the million-dollar mark to $1,130,564.

At its Dec. 5 meeting, Cedar Park City Council unanimously approved the allocation of $187,500—less than 20% of all HOT revenue the city collected the previous fiscal year—in grants to six projects (see Page 43) recommended by the tourism advisory board to receive grants from the city’s hotel occupancy tax revenue.

HOT revenue funds all aspects of local tourism promotion, Cedar Park spokesperson Jennie Huerta said, which explains the difference between the Dec. 5 grant total and the larger annual hotel tax revenue total.

Each HOT revenue recipient must sign an agreement that requires each entity to produce a final report on attendance, revenues and expenditures, and the city will pair that with local hotel occupancy rates “attributable to the project,” according to city documents. Leander has $486 in hotel tax funding from a now-closed bed and breakfast that once operated in Leander’s extraterritorial jurisdiction, or ETJ, according to Neu. Once the city reached a population of 35,000, state law forbade it from collecting hotel tax funds from its ETJs, Neu said.

Leander Mayor Troy Hill said he expects more hotels to set up shop in the city. The city created a tourism subcommittee in August to oversee future hotel tax revenue.

“We have more coming on the horizon,” he said. “We have had talks with two or three other hotels.”

Once Leander starts receiving hotel tax revenue, 75 percent will be directed to the tourism subcommittee that will fall under the purview of the Leander Chamber of Commerce, according to chamber President Bridget Brandt.

As the funds go up, the committee’s share will decrease, Brandt said. When revenue reaches from $250,000-$500,000, the percentage will drop to 60 percent. When it goes above $500,000, the percentage will drop further to 50 percent.

Brandt said Leander has already secured a tourism-related deal, even before the first hotel opens in the city.

“The Leander Wolfpack, our semipro football team, has people who are coming into town all the time,” she said. “With this hotel, we just initiated an agreement to be their official hotel.”

While Leander’s hotel tax revenue stream is just getting started, Cedar Park is in the process of revising its method for allocating hotel tax funds to local entities.

In 2019, entities applying for hotel tax revenue grants in Cedar Park had a three-week window—from April 24 to May 15—to download and complete an application to receive hotel tax revenue. Cedar Park Tourism Manager Saridon Stanton suggested accepting applications all year.

“This would allow Cedar Park to be more competitive in bringing events to the community and provide more opportunity for applicants to receive funding assistance,” she said.

Cedar Park’s Tourism Advisory Board will likely take up the application revision issue at its next meeting scheduled for Jan. 28, according to city officials.