What you need to know

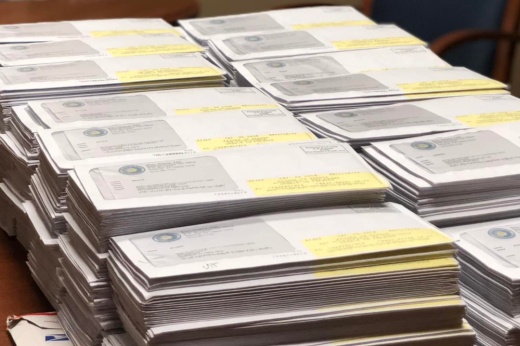

Ellen Owens, Bastrop County tax assessor-collector, said most bills should be in the mail by Nov. 15; however, property owners can view and pay their bills online at http://bastroptac.com.

Owens said payments are due upon receipt; however, payments are not considered late until midnight Feb. 1.

“I recommend anyone wanting to pay online do so before the last minute,” Owens said. “If there is a glitch, or if it processes even one minute late, then there will be penalties and interest charges.”

Owens explained that those eligible for split payments will get a coupon page with their bill—allowing them to divide their payments into fourths.

What else?

In addition to paying online, property owners can pay in person at one of four tax offices in the county—all of which now have drive-thru lanes.

Owens said the Bastrop location now has two drive-thru lanes to accommodate more customers.

Tax office locations include:

- Bastrop, at 211 Jackson St.

- Smithville, at 1624 NE Loop 230

- Elgin, at 1125 Dildy Drive

- Cedar Creek, at 5785 FM 535

Those with questions can contact the office by email at [email protected] or by phone at 512-581-7161.