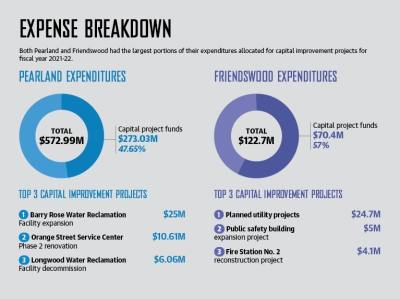

New budgets for fiscal year 2021-22 were approved for Pearland and Friendswood in September. Although the cities differ in population size and fiscal resources, both cities saw their budgets follow similar trends, including focusing at least 47% of their respective budgets on capital improvement projects.

Planned Pearland projects include the Barry Rose Water Reclamation Facility expansion and the Orange Street Service Center renovation, while Friendswood is planning to reconstruct Fire Station No. 2 and expand its public safety building for FY 2021-22, which lasts from Oct. 1 to Sept. 30, 2022, for both cities.

“Pearland is a growing place—everything from our scale of police services and personnel to the growing of a full-time professional fire department,” Pearland City Manager Clay Pearson said. “It should be no surprise, and it only goes to serve that the general fund expenditures are going to grow along with that.”

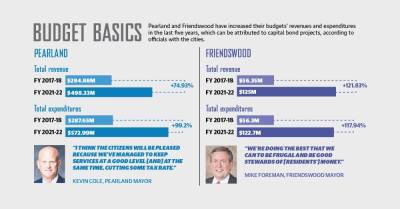

Additionally, both cities project their overall revenues to increase this year. The cities’ planned expenditures also increased more than 99% in the last five years.

Pearland City Council adopted a FY 2021-22 budget on Sept. 27 with $572.99 million in expenditures—a 99% increase from the $287.65 million

FY 2017-18 budget. Similarly, Friendswood has seen its budget increase in the last five years from $56.3 million in expenditures in FY 2017-18 to $122.7 million in FY 2021-22.

“Our revenue sources and expenditures category pretty much remain the same from year to year,” Friendswood Director of Administrative Services Katina Hampton said. “A significant difference for this year ... [is] we’re going to be using quite a bit of our reserves, if you’ll call them that.”

Friendswood will be using money issued from previous bond elections, she added.

Capital projects

Both Pearland and Friendswood saw their total populations increase in the last decade, according to the U.S. Census Bureau’s 2020 decennial data. Pearland’s population jumped from 91,252 residents in 2010 to 125,828 in 2020, while Friendswood’s population rose from 35,805 residents in 2010 to 41,213 in 2020, data showed.

Growing populations come with the need for more capital projects, such as planned utility projects. Friendswood budgeted $70.4 million, or 57% of the budget, for capital upgrades this year.

“There’s always things that are in the works,” Friendswood City Manager Morad Kabiri said. “Once we get done with all the capital projects that the voters approved in 2019, there’ll be other projects. ... There will never be a time when we finish one thing and we can say, ‘Great, we’ll be done for the next 20 years.’”

Three of the biggest Friendswood projects this year will be expanding the public safety building, reconstructing Fire Station No. 2 and planned utility projects, Hampton said.

The public safety building project will be an 9,000-square-foot expansion to the facility that will include additions for the fire marshal’s office, the municipal court and the police department with associated offices, restrooms and locker rooms, according to city documents.

“The public safety building has been around for a while now but never really built out,” Friendswood Mayor Mike Foreman said. “This gives us the ability to complete the construction of that and have all the space that our police, fire marshal, municipal court need to do their jobs.”

Fire Station No. 2 is among the oldest buildings still standing in Friendswood, Foreman said. He added it is time to build a new one and is excited to see it come to fruition.

Meanwhile, Pearland budgeted $273.03 million, or 47.65% of the budget expenditures, for capital projects. Projects to be funded in FY 2021-22 include the Hwy. 288 frontage road construction between Magnolia Parkway and Broadway Street in addition to other drainage and water projects, Pearson said.

With the rise in population comes the need to improve infrastructure, Pearland Chief Financial Officer Amy Johnson said in an email—a sentiment the city manager expressed as well.

“The city has gotten very aggressive, and again, [capital improvements] commensurate with our growth,” Pearson said.

In Pearland, the biggest capital projects under revenue bonds 2022 are renovations to the Orange Street Service Center, which is where most of the public works employees are housed and where city equipment and supplies are stored; the Barry Rose Water Reclamation Facility expansion; and the Longwood Water Reclamation Facility decommission.

The Orange Street Service Center will be budgeted for $10.61 million, Barry Rose Water Reclamation Facility expansion for $25 million and the Longwood Water Reclamation Facility decommission for

$6.06 million for FY 2021-22, according to the city’s proposed budget book.

“As a growing city, in Pearland, we routinely have quite a bit of capital improvement programs from roads to water and sewer,” Pearland Mayor Kevin Cole said. “As always with a growing citizenry, you [have] got to continue to work on your infrastructure and make sure it can handle the population.”

Property tax rundown

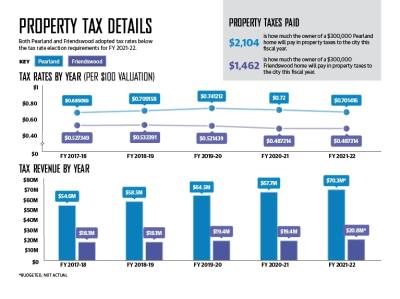

Along with their respective budgets, both cities adopted property tax rates for the upcoming year. Pearland adopted a lower tax rate than the year before, while Friendswood adopted a flat tax rate, meaning it stayed the same as the previous year.

Pearland City Council voted Sept. 27 to set the tax rate at $0.701416 per $100 property valuation, a rate that is under the no-new-revenue tax rate, which is a tax rate that would produce the same amount of tax revenue if applied to the same properties taxed in both years. Pearland expects to collect about

$70.29 million in property tax revenue alone, according to the budget.

Overall, Pearland expects to collect $498.33 million in revenue this fiscal year compared to about $284.88 million five years ago and $344.83 million last year, according to budget documents.

“The recommended [total property tax] rate is the lowest since 2018 and directly addresses the City Council’s initiative to decrease the ratio committed to debt service over operations and maintenance,” Johnson said.

The main expenses are personnel costs, which is typical for a city’s budget, Johnson added. A total of about 20% to 30% of property tax bills goes to the city, Pearson said.

“I think the citizens will be pleased because we’ve managed to keep services at a good level [and], at the same time, cutting some tax rate,” Cole said. “So in keeping with some of the appraisals that have been up, some of our tax rate relief is in keeping with what some of those rates are.”

As for Friendswood, the city adopted a tax rate of $0.487314 per $100 valuation on Sept. 13, which was the same rate the city had for FY 2020-21. While the property tax rate is above the no-new-revenue tax rate of $0.452977, city officials attributed that to bond projects that had been previously approved by voters.

In FY 2017-18, the city’s total revenue was at

$56.35 million. For FY 2021-22, Friendswood anticipates the total revenue to be $125 million.

Friendswood residents approved three different propositions that totaled $52.1 million as a part of a November 2019 bond election, Kabiri said.

For last year’s budget, Friendswood City Council failed to pass a tax rate of $0.497314 per $100 valuation, which would have been $0.01 higher than the no-new-revenue tax rate. City Council wanted a lower rate to not add an undue burden to its taxpayers during the COVID-19 pandemic, Kabiri said.

However, the city has accumulated $1 million more debt service since last year, so it adopted a tax rate higher than the no-new-revenue tax rate for FY 2021-22 to offset the debt, Kabiri said.

“It’s pretty much the money coming in has to equal the money going out, and we [have] got to include paying for our debt as a part of the money going out,” Foreman said.