Local experts attribute the rapid change to the housing market stabilizing—interest and mortgage rates have risen causing lower prices and increased inventory.

Mortgage rates more than doubled in December compared to December 2021 due to the Federal Reserve raising interest rates in an attempt to reign in price growth, experts said. In contrast, median home prices are declining.

“[Interest] rates have finally started to stabilize after a pretty rocky last about six months to a year,” said Jason Dishongh, Realtor and owner of Whiskey Oak Realty Group. “We saw rates increase faster than we’ve seen rates increase in a very long time, and so for the last three to four months, we started to see them stabilize a little bit more, which has helped stabilize the market as well.”

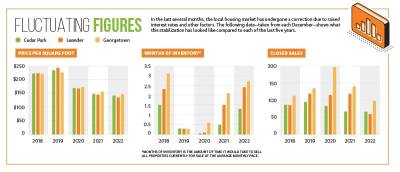

Houses are also sitting on the market for much longer compared to the beginning of 2022. Last year in January, homes sat on the market for an average of 33 days compared to 70 days in December. In Leander, homes were on the market for 21 days in January compared to 70 days in December.

In the coming months, the market is projected to stabilize with peak activity periods leading into the summer.

“The last six months with rates increasing, it was a definite slow down,” said Sheri McKim, branch manager at Benchmark Mortgage. “Now that values are starting to come down, it’s more of a buyer’s market. ... It’s definitely starting to pick back up, which it usually does in the spring.”

Rising rates

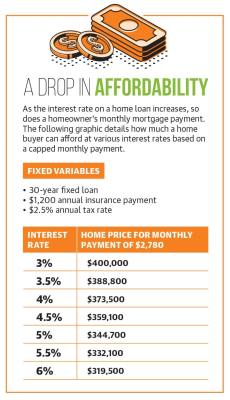

The average rate on a 30-year fixed home loan in December 2021 was 3.11%, according to data compiled by Freddie Mac, also known as the Federal Home Loan Mortgage Corp. By the end of 2022, it had reached 6.33% with the high point in November at 7.08%.

That jump in interest rates caused the potential homebuyer pool to shrink, Housing Works Research Manager Woody Rogers said.

During the pandemic, interest rates were at an all-time low, which encouraged more people to buy homes. Rogers said despite a downtick in prices of homes, increasing interest rates are causing more people to be priced out of the market.

“Now, because interest rates have gone up, it makes it kind of less realistic for a lot of potential homebuyers to be able to afford the mortgage products that are out there now,” he said.

As inflation continues to rise, mortgage rates are also back on the climb. Though the two factors are not directly correlated, experts said, interest rates oftentimes mirror inflation as the Federal Reserve tries to curb price growth.

These changing mortgage rates would cause the payment on a $450,000, 30-year home loan with average property taxes and insurance to increase by 29.7% from about $2,554 to $3,312, according to Freddie Mac data.

“One year [ago] would have been $800 less, so with the increase in rates, [homebuyers] are paying $800 more,” McKim said. “That’s a big difference.”

Thus, what prospective homebuyers could afford two years ago at a lower interest rate looks a lot different than what they could afford at a 6% rate.

Brandon and Chanel Winnis, who have been renting for a few years, are looking to buy a new home in Leander and build more equity. Increasing interest rates, however, have caused them to shift gears and alter their expectations.

"[Our expectations] definitely changed,” Brandon Winnis said. “The cost to borrow money has gone up, and that definitely impacts the type of home that you would be able to get into. It’s definitely influencing decisions, but we’re set on wanting to build equity.”

Dishongh said rates are still beginning to stabilize, and this is ushering in a new normal. Buyers are working on adjusting to the changing market.

“The rates are starting to normalize,” he said. “We’ve held steady at a 6% rate for several months now, so I think this is setting the new normal for us, and it’s taking time for people to get used to not seeing 2.5% for so long.”

Lower prices, more inventory

Regarding home prices, Realtors have seen what is referred to as a market correction, or a rapid change in the price of a product. Dishongh said home prices were significantly higher, and now, the decreases are an adjustment from them being overpriced before.

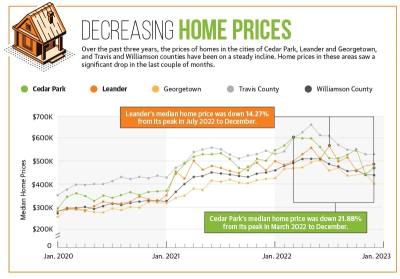

In Cedar Park, the peak median price for a house was $535,000 in 2021, and in 2022, the peak price was $604,800, according to ABoR data. Home prices dropped significantly in December to $472,500—a 21.9% decrease.

Median home prices in Leander followed a similar trend. In 2021, the peak median price for a home was $502,500 with a peak price of $567,455 in 2022. Prices fell 14.3% to $486,500 in December.

Though prices are leveling out, homes are still taking much longer to sell than before.

In December, homes in Cedar Park and Leander stayed on the market for 71 days—more than tripling compared to 22 days in December 2021.

With a less competitive, cooler market, potential homebuyers are gaining more of an interest.

“We are actually, beginning of 2023, starting to see buyers come back,” Dishongh said. “I’ve actually had a couple where there were multiple offers again.”

Offers are not every day like two years ago with major bidding wars taking place, he said, but it is different from recent activity with homes sitting on the market for three to six months at a time.

With more homes on the market, inventory has boomed in the Leander and Cedar Park area.

The cities had 1.9 months of inventory in December compared to 0.4 months in December 2021, according to the ABoR data. Because of the low mortgage rates and lack of inventory at the time, homes were quickly selling, experts said.

As an area has closer to six months’ worth of inventory, Dishongh said, the market shifts from a seller’s market to a buyer’s market. More homes are on the market with fewer offers and lower values, which helps increase activity.

Matthew Smith and Alycia Elkins-Smith settled in Cedar Park, but with their growing family, the couple is looking to buy another home in the city with more space. Because houses are sitting on the market longer, the Smiths can take more time to find their forever home.

We can take a night to think about it, [and] we don’t need to decide right this second, which is hard,” Elkins-Smith said.

McKim said there has been a slight boost in buyers since the beginning of the year.

“Buyers are definitely coming back,” she said. “Just from the beginning of the year, I’ve noticed a good uptick in activity and applications.”

Future of housing

Even with decreasing home prices, affordability will continue to be an issue in Central Texas, experts said. Since last year’s peak, home prices have dropped, but they are still considered high for many buyers.

“Unless you have a pretty big amount of cash available to you to put towards a down payment, that median sale price is really high for many buyers who would try to qualify,” Rogers said.

Dishongh said buyers are having to adjust their expectations of what their new home may look like.

“Before, maybe they were looking at a 2,500-square-foot home; now, they’re looking at a 2,000-square-foot home, because that price has gone up,” he said. “It’s really, from an agent’s standpoint, setting those expectations up front.”

Getting people to qualify for loans is more difficult in the current market, McKim said.

“If you’ve got someone who’s used to [paying] $2,000 a month, the problem is they can’t find a house that’s going to equate to that, because the values have jumped so drastically,” she said. “It’s a lot more difficult to qualify for some homebuyers.”

Buyers who are looking at homes in Austin will likely pay more money for a smaller house, whereas moving to a suburb, such as Leander, Cedar Park or Georgetown, will offer more space for less, experts said.

“Cedar Park and Leander are becoming their own sort of hub. ... [The cities] are doing a really good job of really creating what you need right here,” Dishongh said. “You can get everything right here, and you can get more house for your money that way.”

Experts said activity in the market should start to pick up in the summer, and prices will continue to even off throughout the year.

“If you’re looking to buy right now, the house that you’re buying today will be pretty close to the same price as what you will look at in the end of 2023,” Dishongh said. “You’re not going to see huge increases like we did, and you won’t see the big decreases that we did at the end of 2022.”